TL;DR

- Gold-backed tokens such as Tether Gold and PAX Gold have gained over 30% so far this year, emerging as a refuge amid the Israel-Iran conflict.

- Meanwhile, Bitcoin and Ethereum suffer sharp declines.

- The growing demand for stable assets boosts the appeal of crypto assets tied to tangible commodities, solidifying their role in today’s volatile environment.

The price of gold and its digital equivalents surged following renewed conflict in the Middle East. Israel’s recent military strike on Iranian targets triggered a swift reaction in global markets, prompting a wave of capital flows into assets perceived as safer, such as physical gold and blockchain-based gold tokens.

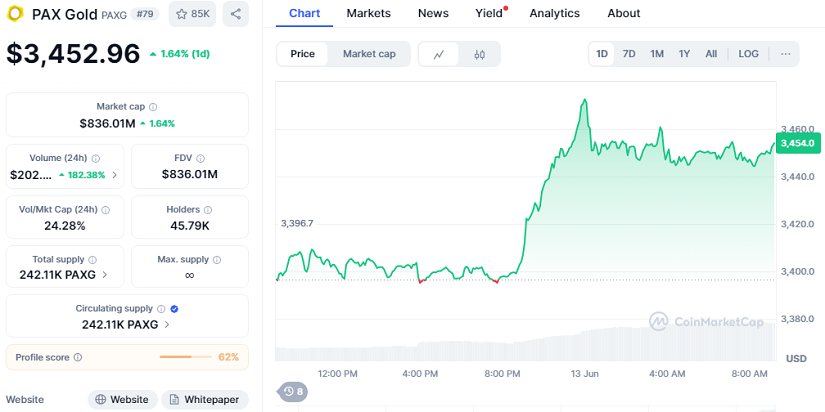

Currently, PAX Gold trades at $3,452.96, showing a 24-hour gain of +1.64%, with a market capitalization of $836.01 million. Meanwhile, Tether Gold is priced at $3,430.01, up +1.44% on the day, with a market cap of $845.58 million. Both assets are significantly outperforming Bitcoin and Ethereum in year-to-date performance, establishing themselves as some of the top crypto investments of 2025.

Gold-Backed Tokens Strengthen As Digital Safe Havens

Unlike other volatile assets, gold-backed tokens combine the solidity of a commodity with the efficiency of blockchain technology. So far in 2025, PAX Gold has gained over 31.4%, while Tether Gold has appreciated more than 30.9%. These returns make them two of the most profitable crypto options available this year.

Meanwhile, Bitcoin dropped to $102,953, losing steam after nearing a new all-time high. Ethereum experienced an even steeper decline. The selling pressure was reflected in metrics like negative net taker volume on Binance and a Taker Buy/Sell Ratio below one. Over $450 million in liquidations occurred as panic gripped the market. Some analysts believe that continued geopolitical instability could drive more investors toward backed assets in the coming weeks. Retail investors, too, are increasingly considering these tokens for portfolio diversification and risk reduction.

Solid Crypto Investing Amid Geopolitical Uncertainty

The performance of gold-backed tokens shows how financial innovation can merge with traditional assets to deliver real-world value. In times of global stress, these instruments help protect purchasing power while preserving the liquidity and autonomy that define digital currencies.

Furthermore, rising institutional adoption signals that the market is recognizing these assets for more than just speculation. Both traditional investors and crypto natives are seeing them as reliable, programmable, and accessible tools for capital protection. Their cross-platform compatibility is also creating new opportunities within the broader DeFi landscape.