TL;DR

- Bitcoin has reached a record $850 billion in realized capitalization, indicating strong value accumulation within its network.

- Capital inflows into Bitcoin have significantly increased since the 2022 bear market bottom, with nearly $500 billion more in investment.

- Despite high BTC prices, demand patterns suggest large entities are leading the cycle, without the usual retail investor euphoria.

Bitcoin is demonstrating unprecedented market strength, according to Glassnode, one of the leading cryptocurrency analytics firms. In its weekly report, the company reveals that Bitcoin’s realized capitalization has reached an impressive $850 billion for the first time. This increase reflects a record amount of value stored within the Bitcoin network, potentially signaling that the current bull cycle could extend beyond 2025, possibly well into the next few years, driven by sustained institutional adoption and strategic market movements.

Bitcoin’s Capital Inflow Doubles Since the 2022 Bottom

Capital inflows into Bitcoin since the bottom of the 2022 bear market have been remarkable. According to Glassnode, Bitcoin has attracted around $500 billion in capital inflows since November 2022, pushing its realized capitalization to new historical highs. This metric reflects the accumulated value within the network, based on the price at which each coin last moved on the blockchain. When compared to the $400 billion low reached in 2022, it’s clear that Bitcoin has absorbed a substantial capital influx, showcasing its growing appeal among institutional and retail investors alike.

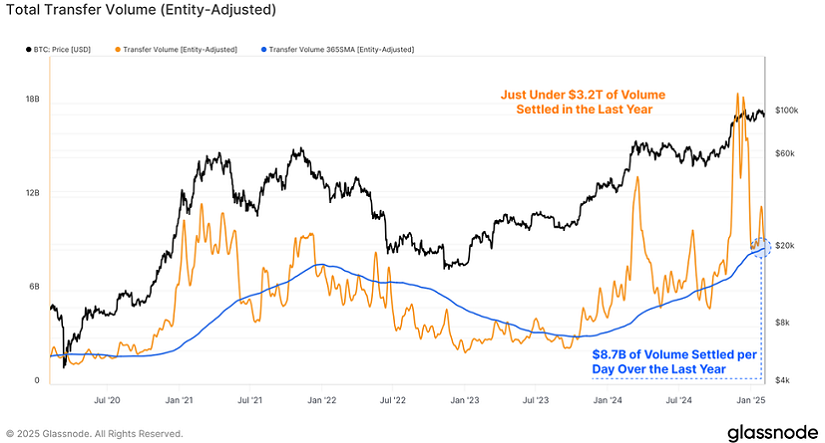

The firm also highlights that, despite these impressive numbers, daily transaction volume has remained stable, hovering around $9 billion, suggesting that Bitcoin continues to be a useful and valuable tool. In total, the Bitcoin network has settled over $3 trillion in transactions in the past year, further reinforcing the utility of the cryptocurrency beyond its market value, and emphasizing its expanding role in the global financial ecosystem.

However, Glassnode also notes that the current bull market is “atypical”. Historically, Bitcoin price peaks have occurred about a year after reaching a high in the number of coins with three months or less of movement. But this time, BTC’s price is rising without the retail market showing the usual level of FOMO (fear of missing out). This pattern suggests that larger entities, such as institutions and big investors, are leading the demand for BTC, marking a difference from previous cycles dominated by smaller retail investors.

Glassnode’s analysis reflects a shift in investment patterns, which could indicate Bitcoin’s consolidation as an institutional asset and a trend toward greater adoption by larger players.