A federal grand jury in the District of Oregon has indicted the Russian creators of the alleged $340 million “global Ponzi” scheme Forsage, according to a statement released by the US Department of Justice on February 22.

Vladimir Okhotnikov, Olena Oblamska, Mikhail Sergeev, and Sergey Maslakov, the four accused, have been legally charged with playing significant roles in the pyramid or Ponzi scheme that deceived millions of unsuspecting investors.

The indictment results from a “rigorous investigation” that took months to piece together the systematic theft of hundreds of millions of dollars, according to U.S. Attorney Natalie Wight for the District of Oregon in her remarks on the case.

She added,

“Bringing charges against foreign actors who used new technology to commit fraud in an emerging financial market is a complicated endeavour only possible with the full and complete coordination of multiple law enforcement agencies.”

Forsage Founders Could Face a 20-Year Jail Term

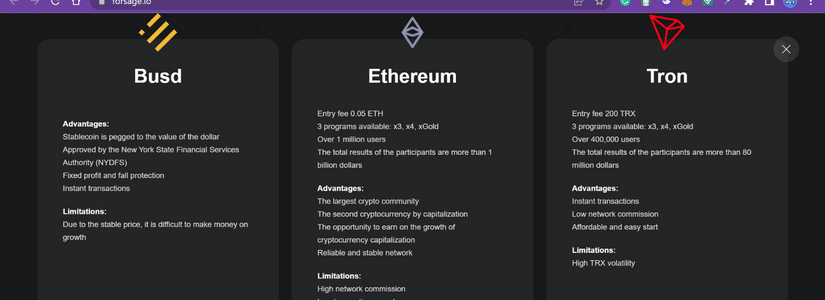

The statement stressed that Forsage depended on smart contracts that were “consistent with a Ponzi scheme” on the Ethereum, Binance Smart Chain, and Tron networks.

As per reports, as soon as an investor made a Forsage investment by acquiring a “slot” in a Forsage smart contract, the smart contract immediately distributed the investor’s funds to other Forsage investors, ensuring that earlier investors were compensated with funds from subsequent investors.

The indictment additionally claims that the defendants misrepresented Forsage to the public by portraying the investment opportunity as legitimate, risk-free, and lucrative on its website and through other social media channels.

Blockchain analytics, however, purportedly showed that over 50% of investors never received a single dividend, and 80% of “investors” received less than they had invested.

The team also allegedly misled Forsage investors by claiming that “100% of the income goes directly and transparently to the members of the project with zero risk.”

Meanwhile, they noted the defendants programmed at least one of Forsage’s accounts, known as the “xGold” smart contract, in such a way that investors’ assets were diverted out of the Forsage investment network and into cryptocurrency accounts under the founders’ control.

If convicted, they would face a maximum penalty of 20 years in prison, as they are each charged with conspiracy to commit wire fraud.

This indictment comes after the US Securities and Exchange Commission accused 11 individuals connected to Forsage of fraud in August.

Two of the defendants, Ellis and Theissen, consented to settle the accusations and be permanently restrained from violating the accused provisions as of that time, the SEC stated, without admitting or disputing the allegations.