TL;DR

- Brett Harrison, former president of FTX US, is launching Architect Financial Technologies to bring perpetual futures contracts to traditional assets like stocks, commodities, and foreign currencies.

- The startup has regulatory approval in Bermuda and plans to operate a 24/7 exchange that accepts both fiat and US dollar-backed stablecoins.

- Architect is currently in its Series-A funding round, having already raised $17 million from major investors, including Coinbase Ventures, Circle Ventures, and the SALT Fund.

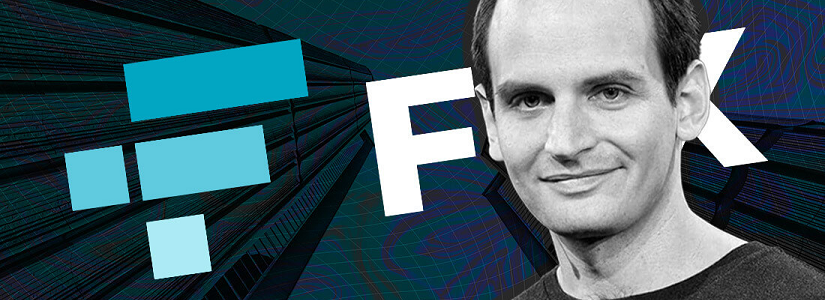

Brett Harrison, who previously served as president of FTX US, is introducing a bold new venture aimed at merging key elements of the cryptocurrency trading model with traditional financial markets. His software startup, Architect Financial Technologies, intends to offer perpetual futures contracts—non-expiring agreements commonly used in crypto markets—for assets such as single stocks, stock indexes, metals, energy, and foreign currencies, with the goal of enhancing market efficiency and providing additional trading tools for professional and retail investors alike.

Perpetual Futures Come to Traditional Assets

While perpetual contracts have fueled trading volumes and price volatility in the crypto sector, Harrison plans to bring this same flexibility to traditional asset classes. Architect’s exchange, AX, will operate continuously, giving investors global access at all hours. Both regular fiat and US dollar-backed stablecoins can serve as collateral, allowing transactions even when standard banking channels are unavailable. The platform operates under Bermuda regulatory approval through Architect Bermuda Ltd., ensuring compliance while maintaining innovation and offering unique risk management features for traders globally.

Backing From Major Investors and Industry Leaders

Architect is currently in its Series-A funding round, having already secured $17 million from prominent backers including Coinbase Ventures, Circle Ventures, and the SALT Fund. Harrison draws on extensive experience in high-frequency trading and crypto exchange operations, having previously worked at Citadel Securities, Jane Street Group, and FTX US.

The firm’s roadmap includes expanding perpetual contracts into emerging asset classes such as rare earth metals, renewable energy, and data center compute costs—sectors expected to grow alongside AI and cloud computing technologies, providing new avenues for innovative investment strategies in both established and emerging markets.

With U.S. regulators still limiting perpetual futures domestically, Harrison sees an opportunity for innovation offshore that could later influence U.S. markets. The timing aligns with ongoing regulatory discussions, including planned long-dated perpetual futures for Bitcoin and Ether at Cboe Global Markets pending approval. Harrison emphasizes that Architect is poised to provide traders with constant access, diverse collateral options, and sophisticated financial strategies previously limited to crypto markets.