TL;DR

- An Ethereum whale reactivated their wallet after seven years and transferred 2,000 ETH to Kraken, raising concerns about potential mass sell-offs in an already weakened market.

- ETH dropped more than 50% in the first quarter of 2025; after hitting $1,400 on Black Monday, it managed a slight rebound, but daily volume plunged by nearly 59%.

- The investor still holds an unrealized gain of $12.3 million, but their return suggests a possible partial liquidation.

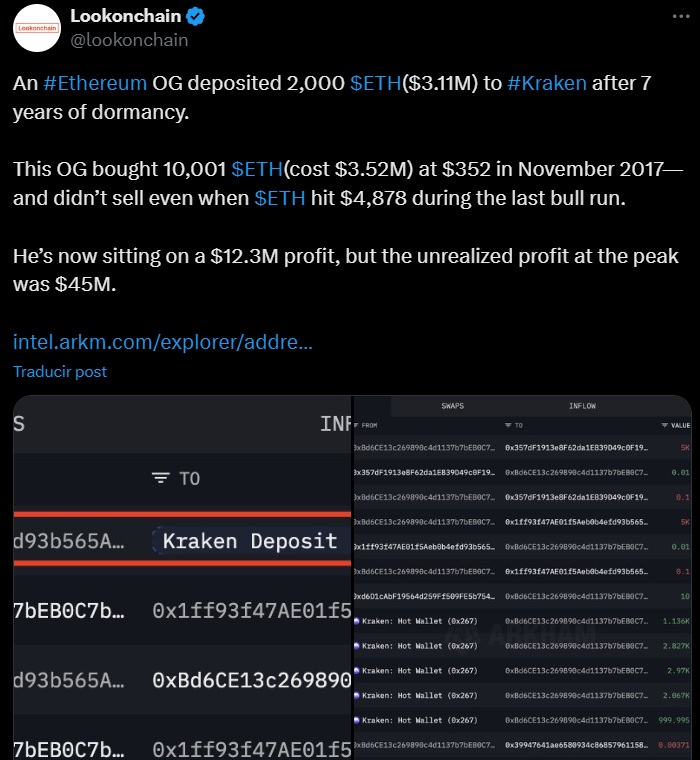

Ethereum has once again drawn market attention following the return of a whale who had been inactive for seven years. This investor, who purchased 10,001 ETH in 2017 at $352 each, recently transferred 2,000 ETH to the Kraken exchange. The transaction, then valued at over $3 million, triggered alarm bells due to the potential for increased selling pressure in an already unstable market.

In the first quarter of 2025, Ethereum lost more than half of its value. The most recent drop occurred on so-called Black Monday, when its price fell to $1,400. However, it managed a partial recovery in the following hours, reaching levels near $1,530. It is currently down 2.26% on the day. Its volume has plummeted, falling nearly 59%.

Ethereum Had a Quarter to Forget

The investor who reactivated the wallet still holds an unrealized profit of approximately $12.3 million. Although this gain had exceeded $45 million during ETH’s all-time high in 2021, no sales were made at that time. The new movement raises questions about a possible partial liquidation amid the current bearish outlook.

The fund transfer was detected by Lookonchain, a platform specializing in blockchain analytics. The transaction not only reignited concerns over large-scale sell-offs, but also revealed that some whales are willing to act after long periods of inactivity.

Will ETH Keep Falling?

Meanwhile, macroeconomic tensions continue to pressure the crypto market. Tariffs driven by the Trump administration have increased volatility, and several analysts suggest Ethereum’s price could remain range-bound if these conditions persist. Meanwhile, Peter Schiff, a frequent critic of the sector, forecasted another drop for ETH, possibly below $1,000.

Against this backdrop, whale activity and macroeconomic signals will play a key role in Ethereum’s performance over the coming months. The risk of further declines remains.