Ethereum is firm when writing, adding four percent in the last trading day but stable in the past week.

At this pace, conservative traders can wait for a bull confirmation above $2k before loading the dips and expecting more expansion in the days ahead.

Still, since buyers have the upper hand, traders can watch out for whether the breakout above the current consolidation, a bull flag, is with high participation.

If that’s the case, the short-term trend will likely be more rapid as buyers add to their longs; swinging on to the rapid gains of the past two weeks.

Microsoft Building A Non-Custodial Wallet, Is ETH A Security?

While Ethereum underperforms Bitcoin, there are new developments from a fundamental level. Microsoft, the technology giant, is testing an inbuilt non-custodial wallet.

Although the wallet is in private testing, it will support ETH and ethereum tokens, including non-fungible tokens (NFTs).

The tech company is looking to gather feedback, and when and how they will launch the wallet to the public remains to be seen. Still, that Microsoft supports Ethereum is a massive step for the ecosystem.

Meanwhile,prosecutors choose to target ETH in their filing, accusing KuCoin of facilitating the trading of unregistered securities, is a relief for XRP, a lawyer claims.

It is a coordinated long game play to get a default judgment and a potential ruling w/ language that KuCoin was selling #ETH as an unregistered security. Why have the investigator purchase #ETH specifically when there were hundreds of other tokens to choose from? https://t.co/lcanLjOtVt

— John E Deaton (@JohnEDeaton1) March 16, 2023

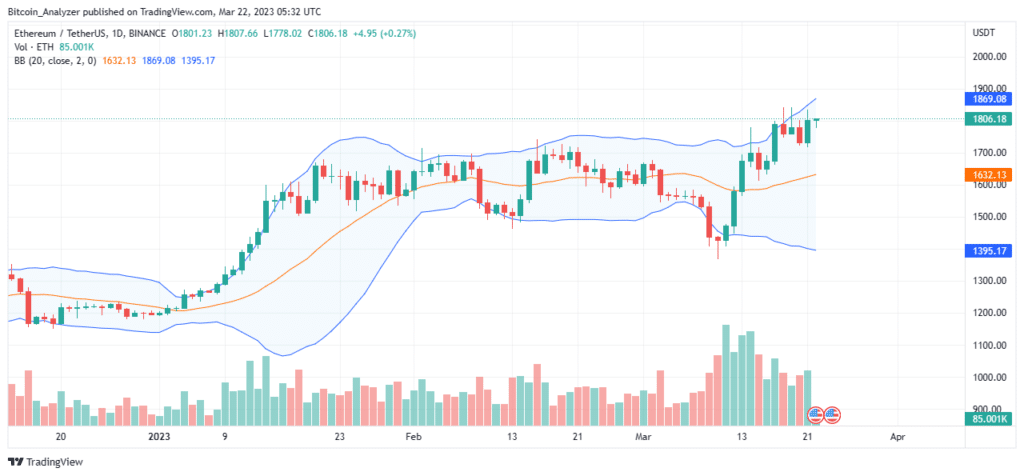

Ethereum Price Analysis

Even though there were instances of price contraction, the failure of bears to follow through reaffirms the strength of bulls.

Notably, the rejection from yesterday was at February’s highs, confirming that the uptrend is solid and the retest has been completed.

Therefore, per candlestick arrangement and alignment with the primary trend in the daily chart, the first level of resistance remains at $1.85k, marking this week’s highs.

As prices peel away from the bull flag and beyond the recent consolidation, the break higher should ideally be with rising volumes.

This move will cement buyers of March 13 and 17, setting the foundation for a possible rally towards $2k in short to medium term.

This preview will be nullified if ETH tanks below $1.7k and $1.65k in the next few sessions.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.