Ethereum is again facing heightened volatility after a strong first half of the year. Traders are watching whether ETH can hold around the $4,000 area, while recent shifts in trading volume are being interpreted by some market participants as a sign of changing near-term momentum.

Meanwhile, some market participants are monitoring newer real-world asset (RWA) initiatives such as Avalon X (AVLX). Project materials describe it as being linked to Grupo Avalon’s real estate developments in the Dominican Republic.

As with other RWA-related tokens, any link between a token and off-chain assets, potential “perks,” or long-term value depends on the project’s structure, disclosures, and execution, and may not translate into predictable outcomes.

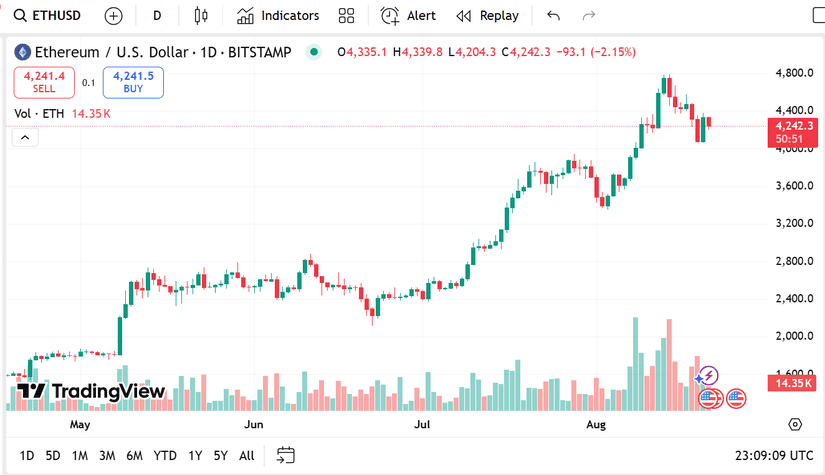

Ethereum Price Data: Testing the $4,000 Level

ETH has recently traded near the $4,000 area. CoinMarketCap data showed ETH trading around $4,790 at the time of writing, alongside reported increases in market capitalization and 24-hour trading volume. Price and liquidity can change quickly, and short-term moves do not necessarily indicate a sustained trend.

Source: Tradingview/Ethereum

Some technical analysts view $4,000 as a notable area, where a rebound or further decline could influence market sentiment into Q3. Technical analysis is inherently uncertain and may not predict future performance.

Avalon X: Blockchain Meets Real Estate

Avalon X (AVLX) is presented by its promoters as an RWA-focused tokenization effort tied to real estate. The project references the global real estate market (often cited in industry estimates in the hundreds of trillions of dollars) as part of its broader context, and says it is backed by Grupo Avalon, which it describes as a Dominican Republic real estate developer with:

- $103 million in completed sales

- $548 million worth of projects in completed, ongoing, and upcoming developments

- $385 million worth of new projects in development, pushing total project value to close to $1 billion

According to project materials, Avalon X aims to enable fractional exposure to real estate-related initiatives using the AVLX token. The project also describes AVLX as a utility token and mentions features such as staking and tiered benefits, which may include marketing-style incentives (for example, discounts or resort-related offers). These features and any associated terms are project-reported and should be reviewed in the project’s own documentation.

Token sale details and marketing incentives

The project states that AVLX is being offered through an early-stage token sale with staged pricing (including a reported Stage 1 price of $0.005). The project has also promoted incentive-based campaigns, including a giveaway and raffle, as part of its marketing.

The project has additionally referenced projections for growth in the broader tokenization sector by 2030. Such projections are speculative, may vary widely by source, and do not imply that any specific token will achieve a particular outcome.

RWAs as a broader market theme

Ethereum remains a primary venue for smart-contract activity and on-chain finance, while RWAs have become a separate theme that some participants are following across multiple blockchains. RWA tokens can carry additional risks, including legal, operational, and disclosure issues around off-chain assets and how (or whether) token holders obtain enforceable rights.

Avalon X is one example being discussed in this context, but any assessment depends on independently verifiable information about the underlying assets, governance, tokenholder rights, and compliance posture.

Project links (for reference)

Website: https://avalonx.io/

X: https://x.com/AvalonXOfficial

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice. As with any initiative within the crypto ecosystem, readers should do their own research and carefully consider the risks involved.