Ethereum is up roughly 13% at spot rates week-to-date, rapidly expanding following the United States banking system crisis.

The trend observed is similar to that in Bitcoin.

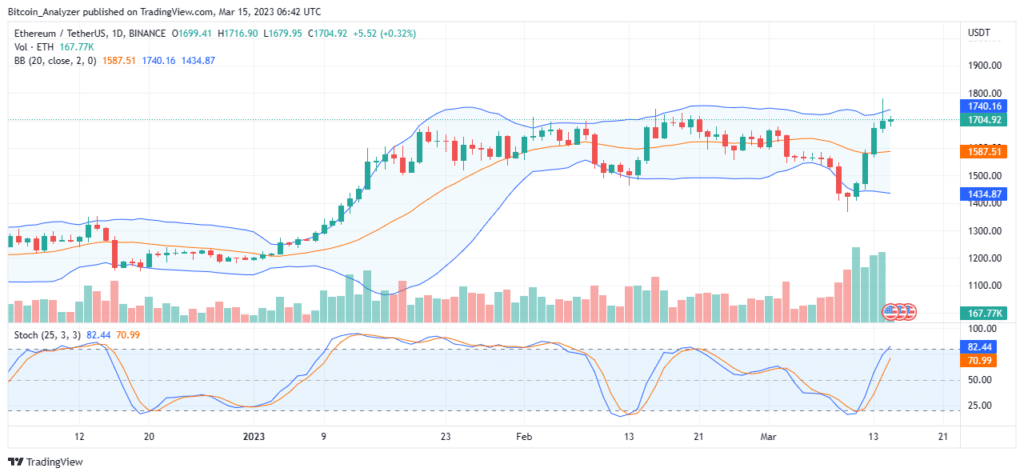

ETH is trending at February highs when writing. Still, buyers need to push the coin above this reaction line in coming sessions.

Notice that though the uptrend remains and gains from the weekend have been confirmed, prices are relatively lower.

After yesterday’s pullback, there is an inverted hammer, suggesting rejection of higher prices.

Binance Buys Various Coins, Including ETH

Amid renewed confidence in ETH, developers are actively working towards the Shanghai upgrade. Yesterday, it was deployed on the Goerli testnet.

This is critical, ensuring that the upgrade functions as intended before being rolled out in the mainnet in the days ahead. From a fundamental point, this is bullish.

News that Binance converted its recovery fund to, among other coins, Bitcoin and Ethereum, has revived demand.

The $1 billion was set aside by the exchange after FTX and Alameda Research collapsed to assist potent projects facing a liquidity crunch.

People a bit unnerved with recent stablecoin developments will feel so much more reassured. Industry recovery initiative in full force 🤝✌️. #BNB #BRGArmy #Binance

— DB CRYPTO COOPER.bit☕ (@CryptoViv) March 13, 2023

Now, a part of this has been injected to boost ETH’s liquidity.

Changpeng Zhao said the decision was advised by the recent changes in stablecoin and banks.

The New York Department of Financial Services (NYDFS) has already banned the issuance of BUSD, a stablecoin under the Binance brand issued by Paxos.

Ethereum Price Analysis

Subsequently, following this bounce, traders remain bullish. However, despite gains, bulls must close above February highs at around $1,670 as mentioned earlier.

This will be in the validation of the recent uptrend, confirming the gains of March 14. It will also be an assurance, reversing the NY session loss yesterday that saw ETH recoil, dropping from Q1 2023 highs of $1,780.

ETH bulls are in charge at spot rates and the uptrend set in motion from mid-December could be confirmed should there be gains sustaining prices above the February high. The leg up from over the weekend is already with rising volumes, a net positive.

As it is, confirmation of recent gains above $1,780 may see ETH roar to $2k or better in the days ahead.

Technical charts courtesy of Trading View Disclaimer: Opinions expressed are not investment advice. Do your research.