Ethereum (ETH) remains bullish when writing, adding roughly 50% from mid-March 2023. After pricking above $2,000 for the first time in months, buyers failed to push the coin further above $2.1k.

While the slowdown could suggest slowing upside momentum, the retracement hasn’t been rapid. Moreover, prices are still trending above $2,000, a net positive for traders.

Still, optimistic but conservative traders can wait for a convincing confirmation before loading the dips.

In the current formation, there could be more opportunities above $2,100; a high representing last week’s resistance. This would provide the impetus for another sharp expansion, lifting prices higher and confirming the strong wave higher of the better part of the last trading month.

Post-Shanghai Effects

The Shanghai Upgrade of last week turned out to be a boon for bulls. Even though traders expected selling pressure days after the upgrade, prices are steady.

The USD value of staked ETH exceeds that of pre-Shanghai. This can be attributed to expanding ETH prices.

However, it can also mean more stakers and validators are vouching for the network since they can withdraw their funds anytime.

Major US players, especially exchanges like Kraken, have withdrawn their stake and rewards due to applicable regulations prohibiting the service.

Essentially, Shanghai will boost ETH’s liquidity and, most importantly, improve the network’s decentralization levels.

The more there will be validators, even via liquidity staking providers like Lido Finance and Rocket Pool, the more decentralized and secure Ethereum becomes.

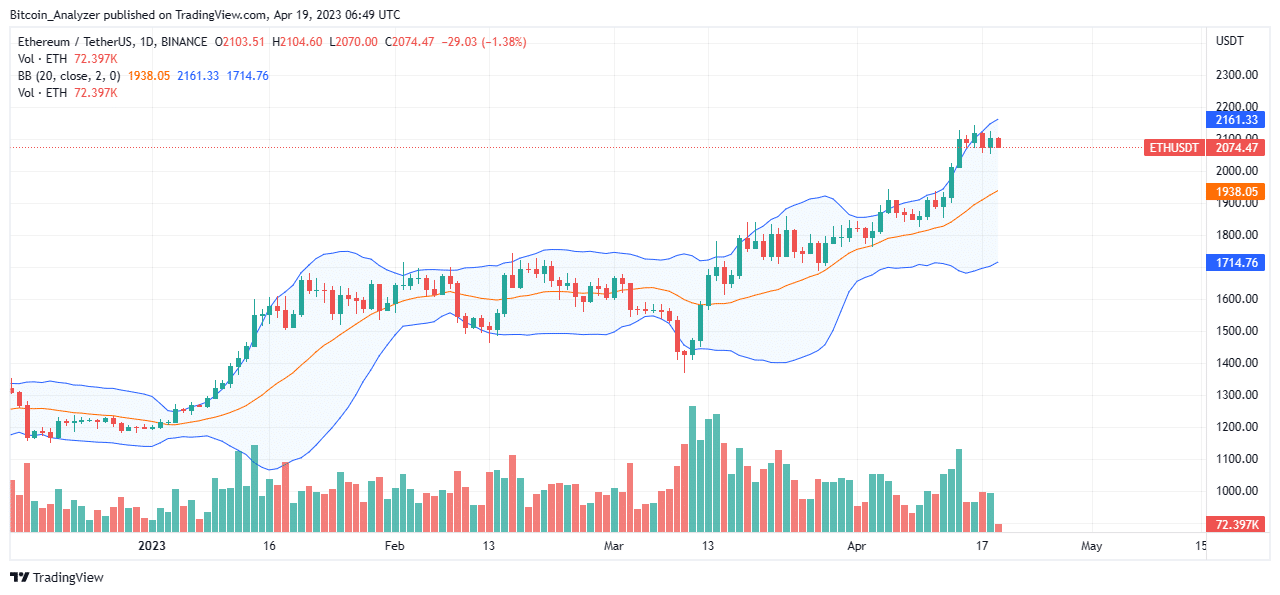

Ethereum Price Analysis

The bullish bar from April 14 shapes the current formation. Which is bullish, the engulfing bar also has decent volumes.

Subsequent bars have been ranging but with lower participation levels. It means buyers have the upper hand from an effort versus result perspective. It comes even despite the contraction of prices from H1 2023 highs on April 17.

Resistance lies at $2,140, while support is at $2,000. As long as prices are within this range, traders can look to double down on dips, expecting more expansion.

Conservative traders can wait for a high volume break above $2,140 before setting eyes on $2,400 in the near term.

Conversely, losses below $2,000 may force a re-calibration back to $1,850 in a welcomed retest.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Ethereum News.