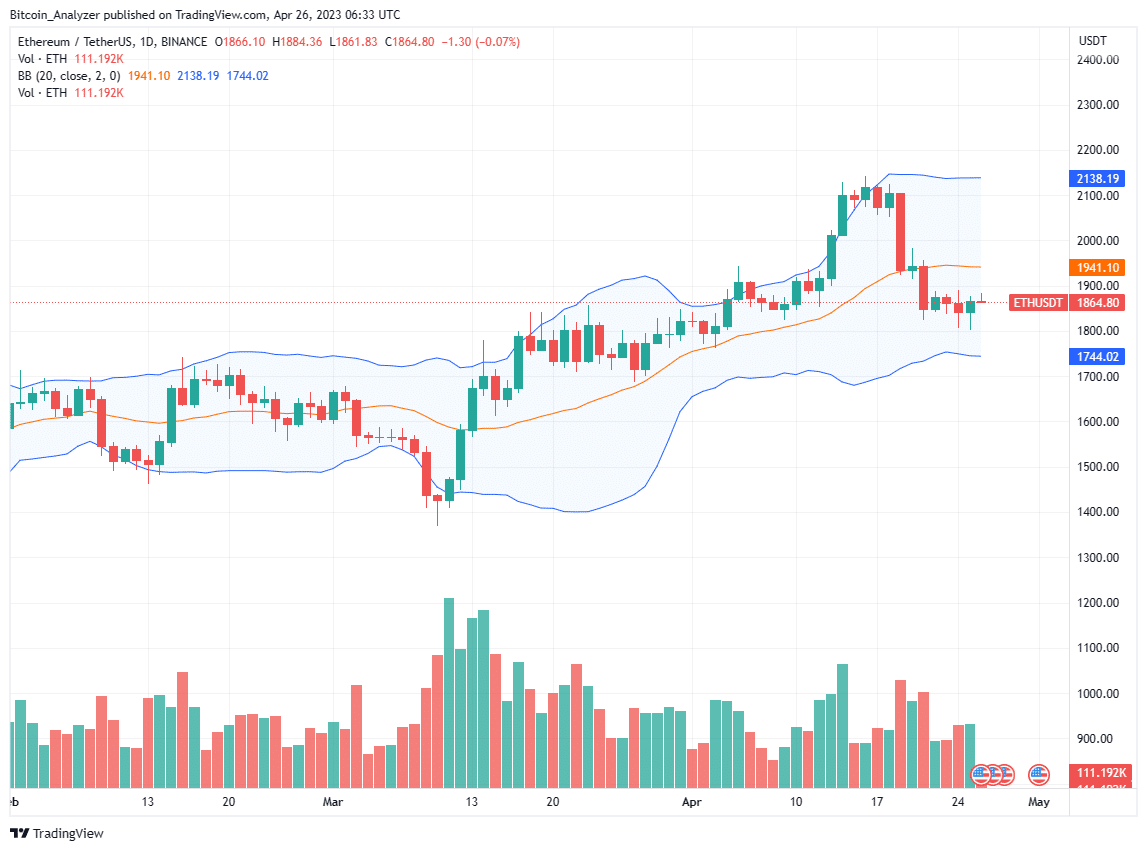

Ethereum (ETH) prices are consolidating in a range with caps at around $1,950 and $1,800 when writing on April 26.

Even though Ethereum (ETH) is down 13% from recent peaks of $2,100 set in April 2023, the general trend remains bullish from a top-down preview.

As it is, bears have yet to confirm losses from April 19. However, ETH bulls have also failed to push above the middle BB, and completely reversing losses of April 21 means sellers have the upper hand from an effort-versus-result perspective in the short term.

Based on this, traders might look for entries to short on every attempt below $1,950, with even clearer opportunities once there are losses below $1,800.

The Shanghai Upgrade Boost

The Shanghai Upgrade was massive for Ethereum. The network has now become a proof-of-stake platform, with stakers free to unstake their coins. Moreover, the network is enhanced and can perform at a higher level. For this reason, ETH bulls are optimistic.

Their confidence is cemented with news that more institutions are staking their ETH rewards.

This development pushed the number of staked ETH to new weekly highs. Records from Dune Analytics show that 571,950 ETH were staked in the last week alone.

A notable observation is that institutions are behind the recent staking drive, a vote of confidence for the pioneer smart contracting platform.

With more stakers, Ethereum becomes more decentralized and secure.

Ethereum Price Analysis

ETH is bullish, reading from the formation in the daily chart. Even though buyers must flow back and drive prices more convincingly above crucial resistance levels, the uptrend from mid-March remains.

The primary support is at $1,800, while resistance is at the April 21 high of $1,950 in an overly bearish formation where ETH remains in a bear breakout following losses on April 19.

The current bearish preview is also valid from an effort-versus-result perspective. Note that prices are still oscillating within the April 21 bear range, a positive for sellers.

Traders can wait for a conclusive break above $1,950 before loading on dips with targets at $2,100.

This is because they know that losses below $1,800, at the back of expanding volumes, may trigger a sell-off forcing ETH back to $1,700 and $1,500 in the days ahead.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Ethereum News.