Amidst mayhem in the crypto markets, ETH climbed back above $3K, a move some market participants read as a sign that risk appetite may be stabilizing. The rebound has also renewed interest in smaller projects that claim to offer working products, although these carry different liquidity and execution risks than large-cap assets.

In that context, some traders are looking beyond established tokens and toward early-stage fundraising and token-sale models. These markets can be less transparent than exchange-traded markets, and outcomes depend heavily on product delivery, market conditions, and regulatory factors.

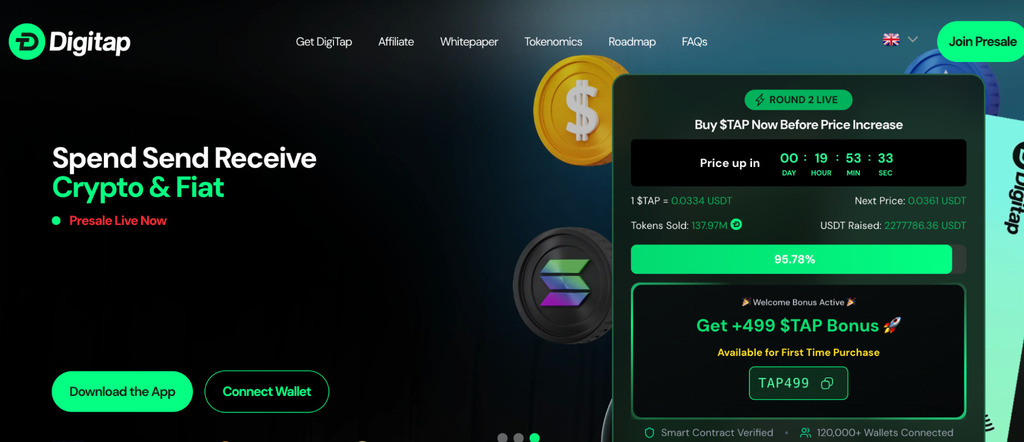

One project drawing attention is Digitap ($TAP). The project describes itself as an “omni-bank” product with an app for payments and crypto/fiat functionality on iOS and Android.

What ETH’s Bounce Canand Can’tSignal

When ETH crosses a major psychological marker like $3K, market sentiment often improves. Some traders interpret it as a sign that macro pressure may be easing and that liquidity could return. However, short-term rebounds can reverse quickly, particularly during periods of heightened volatility. From a broader perspective, ETH can remain sensitive to macroeconomic developments (such as interest rates) and broader market moves, including Bitcoin.

Early-stage tokens sold through project-run sales can behave differently from exchange-traded assets because pricing is often set by sale mechanics rather than continuous market discovery. That does not make them “independent” of the market, and they can still be exposed to sharp drawdowns, delays, or changes in terms once trading begins.

As a result, comparisons between large-cap rallies and early-stage token sales are not straightforward. Large caps tend to have deeper liquidity and wider coverage, while early-stage projects may have higher uncertainty around execution, access, and future trading conditions.

What Digitap Says It Offers

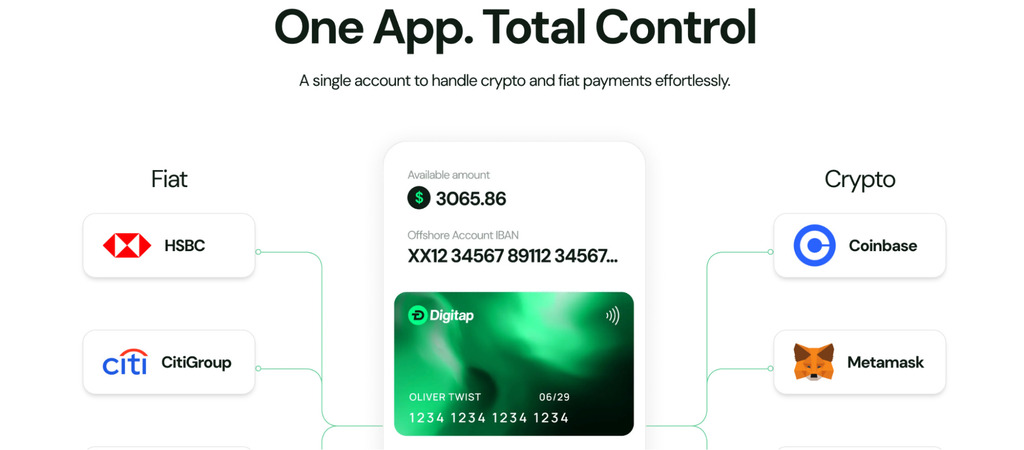

Digitap positions itself as a payments-focused crypto product with a mobile app. According to project materials, its platform includes a wallet and exchange features, global IBAN support, and a Visa-compatible card intended for spending and transfers.

The project is also running a token sale for $TAP. As with any token sale, prospective participants typically evaluate product availability, fee structures, custody and counterparty risks, and whether the offering is accessible in their jurisdiction.

The project also describes token-related mechanics such as supply reductions (“burns”) and a staking program. Any stated yields, buybacks, burns, or reward rates should be treated as project-reported and subject to change, and they are not a guarantee of returns.

More broadly, payments-oriented crypto apps compete on reliability, compliance, fees, and user experience. For readers evaluating such projects, the practical questions tend to be whether the product works as described, what limits apply (including identity requirements that can vary by country), and what risks come with holding or staking the associated token.

What to Watch in a Recovering Market

In periods when sentiment improves, attention often shifts toward projects that claim to have a product in market rather than just a roadmap. At the same time, early-stage tokens can carry concentrated risk: limited disclosure, changing terms, and uncertain liquidity when trading starts.

If a project is centered on payments and card functionality, additional considerations can include availability by region, identity and compliance requirements, fees, custody arrangements, and the operational resilience of any partners involved. Readers should review the project’s official documentation and terms before making decisions.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.