The crypto market has shown signs of renewed activity, with Ethereum (ETH) among the assets drawing attention. At the time of writing, ETH was trading around $2,943 after rising from a recent monthly low near $2,565, reflecting shifting short-term sentiment. Separately, on-chain and venue-reported activity has highlighted large leveraged positions linked to ETH (for example, a reported $44.5 million long on HyperLiquid), though such positioning can change quickly and does not indicate future performance. There have also been reports of regulatory developments affecting crypto applications and prediction markets, including Polymarket, which some market participants view as relevant to the broader Ethereum ecosystem.

Some market commentators have also discussed the possibility of a future Ethereum ETF and how that could affect demand, but outcomes remain uncertain. Against this backdrop, attention often shifts to smaller, higher-volatility tokens and early-stage fundraising efforts. Two projects mentioned frequently in marketing and community channels are the utility-focused Based Eggman token sale and the meme-focused Maxi Doge token sale.

Why some Ethereum holders are watching Based Eggman

When ETH trends upward, some investors and traders look for higher-volatility tokens in related ecosystems, though those assets can also fall sharply. Based Eggman is marketed as a project built on Base, Coinbase’s Layer-2 network that settles to Ethereum. Supporters argue that activity on Ethereum and Base could bring more attention to projects on that network, but this is not guaranteed.

Based Eggman ($GGs) is presented by the team as more than a typical meme token, positioning itself as a broader Web3 product for creators and gamers. According to project materials, it is associated with:

A utility-focused ecosystem: the team describes plans for a retro gaming hub, a “HODL Furnace” concept for gamified staking, and creator monetization tools. Whether these features launch as described, and whether they drive token demand, is uncertain.

Network positioning: being native to Base may mean lower transaction costs relative to Ethereum mainnet. Any claims about adoption or user onboarding depend on broader market conditions and execution.

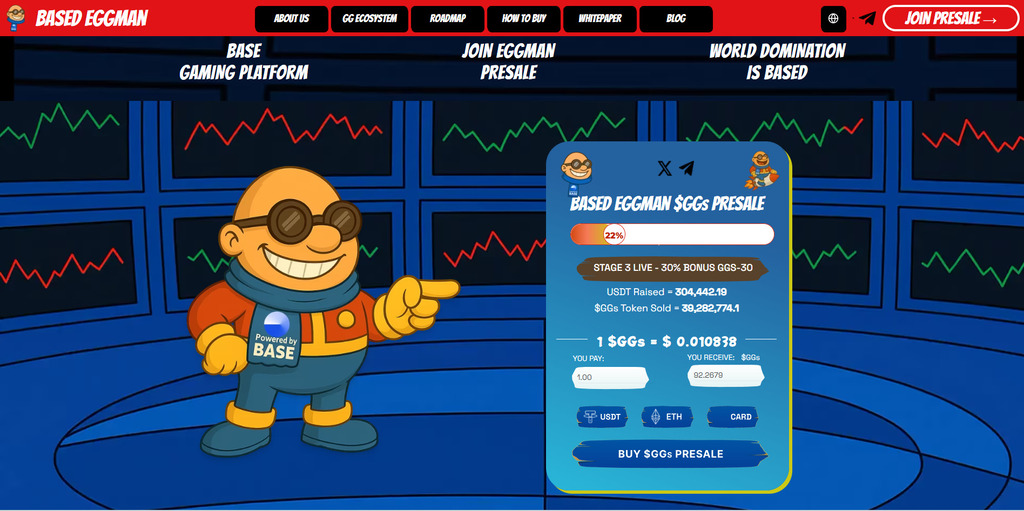

Token-sale activity: the project has promoted multi-stage fundraising. Stage-based sales and marketing can increase attention, but they are not evidence of long-term value or eventual exchange liquidity.

Project-reported token sale and roadmap items (for context)

Based Eggman’s team describes a staged token sale and has published a roadmap with planned milestones. The specifics, including timing and delivery, are subject to change.

- Project website (for reference): https://www.basedeggman.com/

- Sale stages: The project describes multiple stages with different pricing. Stage-based pricing is a marketing structure and does not indicate future market price.

- Marketing incentives: The team has referenced time-limited promotions in its materials; readers should treat incentives and bonuses as marketing and assess terms carefully.

- Roadmap communications: The project has indicated it will share additional updates about later stages and development milestones.

The project has also referenced potential milestones such as staking functionality, exchange listings, and game releases. These items should be viewed as plans rather than confirmations, and any token rewards or yields described by the project are not guaranteed and may carry additional risks.

- GGs staking: The team has described a staking mechanism; outcomes depend on contract design, emissions, and participation, and may change over time.

- DEX/CEX listings: The project has said it intends to pursue listings. Listing decisions are ultimately made by exchanges and are not assured.

- Gaming and rewards features: The team has described a play-to-earn style game and rewards systems. Such mechanics can change, and their sustainability depends on user adoption and token economics.

Public “price predictions” for newly launched tokens are inherently speculative. Readers should treat any third-party or community estimates as non-predictive and consider liquidity, supply schedules, and execution risk.

Ethereum outlook: scenarios remain uncertain

Ethereum’s recent move has been linked by some observers to macro sentiment, expectations around a possible spot Ethereum ETF, and ongoing changes in Ethereum’s supply dynamics (including fee burns and staking). Even when these factors are present, market outcomes can diverge sharply from narratives, and prices can be highly volatile.

- Forward-looking price ranges: Some commentators publish scenario ranges for ETH in late 2025 or early 2026, but such estimates are speculative and should not be treated as forecasts.

- Risk considerations: ETF-related expectations, staking dynamics, and burn mechanics may be offset by macro conditions, regulatory shifts, or changes in network activity.

- Smaller tokens and early-stage sales typically carry higher risks than large-cap assets, including liquidity risk, smart-contract risk, and project execution risk.

Maxi Doge token sale: meme-driven positioning

Maxi Doge is marketed as a meme-focused project that aims to benefit from retail interest in meme tokens during bullish periods. Project marketing has referenced an anticipated token sale launch in 2026; timing and delivery depend on the team and market conditions.

Comparisons between new meme tokens and established assets such as Dogecoin often focus on market capitalization and perceived upside. However, small-cap tokens can move sharply in both directions and may face limited liquidity, high slippage, and rapid sentiment shifts.

Dogecoin: As a long-established asset with a large market capitalization, its price dynamics tend to differ from newly launched tokens.

Maxi Doge: As an early-stage project, its valuation and trading conditions (if it lists) could be highly volatile. Marketing materials may discuss outsized upside, but such outcomes are uncertain and not typical.

Any allocation to early-stage meme tokens is generally speculative and may not be appropriate for many readers, particularly given the possibility of total loss.

Conclusion: what to watch into 2026

Why Base-based projects are being discussed

Base, developed by Coinbase, has grown as an Ethereum Layer-2 network. If activity in the Ethereum ecosystem continues, Layer-2s like Base may also see increased usage; however, network growth does not automatically translate into value for every token deployed on that network.

In the current market, some readers may see early-stage token sales as a way to gain exposure to new projects, while others will prefer established assets due to liquidity and longer track records. Based Eggman and Maxi Doge are two examples being promoted within this theme, but both carry elevated execution, liquidity, and smart-contract risks.

Frequently Asked Questions

If outlooks for ETH are positive, why do some people look at smaller tokens?

Some market participants seek higher-volatility assets in hopes of larger gains, but that approach also increases the likelihood of large losses. Smaller tokens and early-stage sales can have limited liquidity and less historical data, making outcomes more unpredictable than for established assets.

What is the rationale behind following Base projects during an ETH rally?

The argument is that increased Ethereum activity can spill over to Layer-2 networks used for lower-cost transactions. Even if Base usage rises, individual projects still depend on execution, product adoption, and token design.

How should readers think about “upside” comparisons between new meme tokens and Dogecoin?

Market-cap comparisons are sometimes used to frame hypothetical scenarios, but they can be misleading without considering liquidity, circulating supply, unlock schedules, and demand sustainability. New meme tokens can be far more volatile than established assets and may not develop deep markets.

Should someone choose Based Eggman or Maxi Doge?

This article does not make recommendations. Readers considering early-stage token sales may want to review the project documentation, token distribution, smart-contract audits (if available), and the practical risk of losing their entire allocation.

Why do some projects target a bull-market window for a token sale?

Teams sometimes time launches around periods of elevated retail interest, which can increase attention but can also increase volatility and the risk of rapid drawdowns. Launch timing is a marketing and strategy choice and is not a measure of project quality.

How could a potential Ethereum ETF matter for smaller projects?

If an ETF leads to broader interest in Ethereum, that could indirectly affect activity across related networks and applications. Any knock-on effects for specific tokens are uncertain and would still depend on product-market fit, execution, and liquidity.

More Information on Based Eggman Here:

Website: https://basedeggman.com/

X (Twitter): https://x.com/Based_Eggman

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.