Ethereum (ETH) has moved back to around $3,884, and some market participants continue to discuss a possible move toward $10,000. Analysts also note that outcomes remain uncertain and depend on broader market conditions. Alongside ETH, Digitap ($TAP) has been promoted by the project as a banking-focused crypto product, though any future price performance is speculative.

Digitap describes itself as an “omnibank” and has publicly discussed an integration with Visa. The project says its token sale has raised about $1.2 million so far. Some commentary has suggested the token could appreciate after it becomes tradable on exchanges, but post-listing prices are unpredictable and may not reflect token-sale pricing.

Ethereum Price Outlook — The Fusaka Upgrade and the $10K Scenario

Ethereum is preparing for its next network upgrade. The Fusaka upgrade is set for December 3, 2025, according to public discussions. Market observers expect that the changes could affect fees and transaction throughput. Developers have discussed raising the block gas limit from 45 million to 150 million, which would increase the number of transactions per block if implemented as proposed.

Sentiment around ETH has also been influenced by fund flows. A post on X cited $184 million in outflows from ETH ETFs on the same day core developers were discussing Ethereum’s roadmap, with BlackRock accounting for a large share of the reported outflows.

ETH ETF Outflows | Source: @TedPillows on X

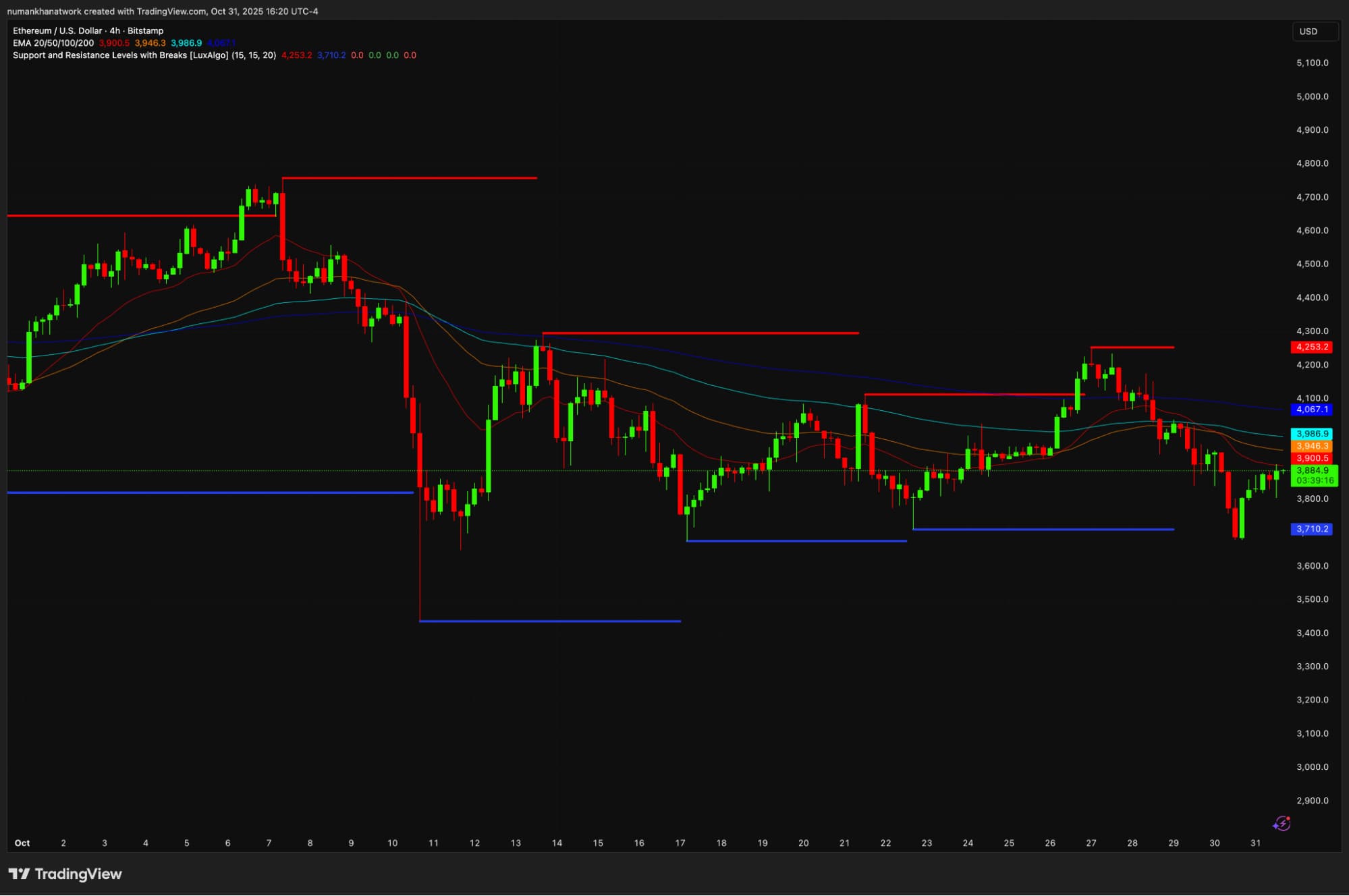

On the charts, ETH trades at $3,884. It is below its 50-day EMA ($3,949) and 200-day EMA ($4,069), which some traders interpret as a sign that momentum is not clearly established.

ETH Monthly Price Chart (4H) | Source: TradingView

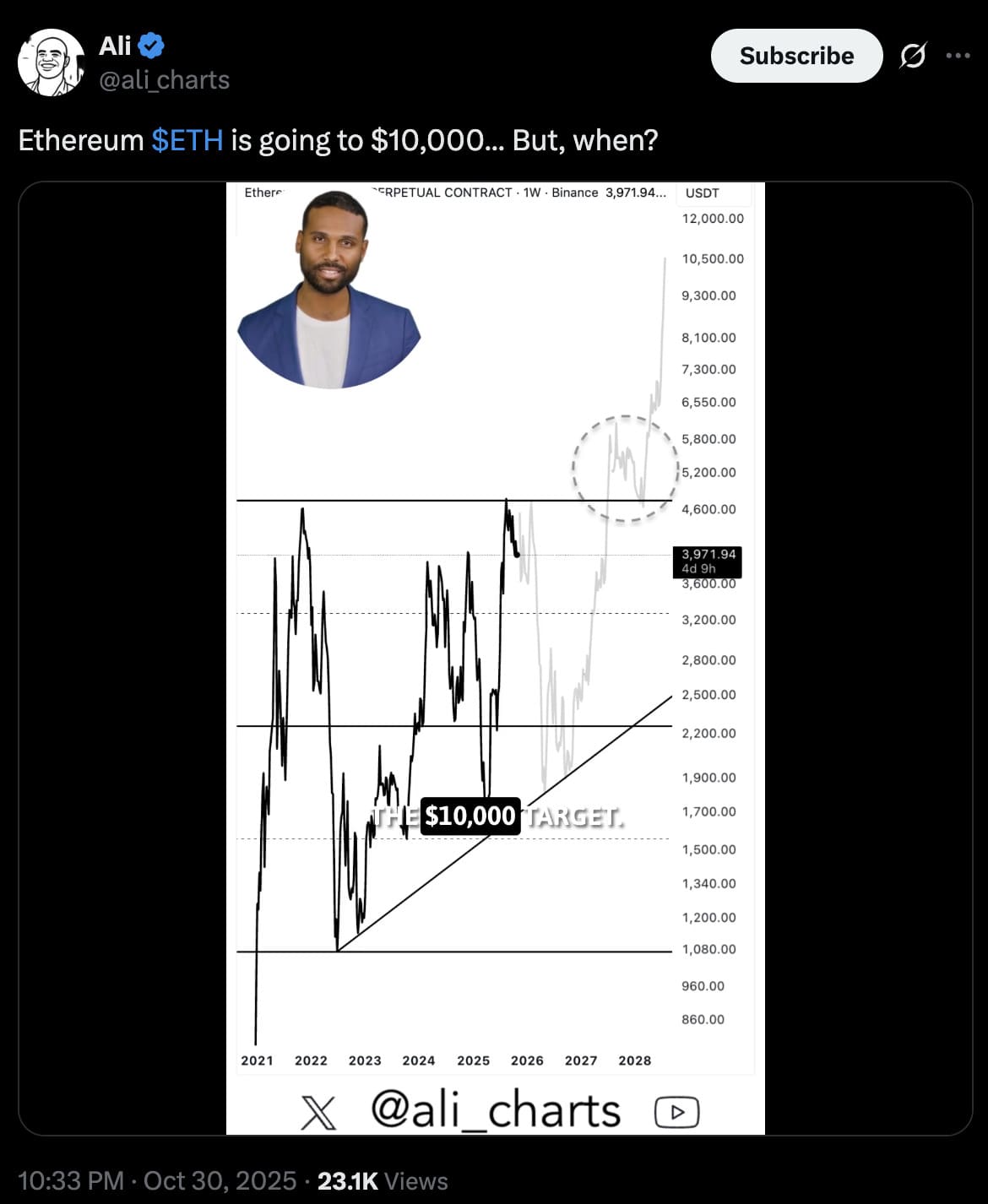

The $10,000 level is a frequently discussed milestone in market commentary. Analyst Ali Martinez has suggested Ethereum could revisit lower levels (such as $2,000) before any move higher, highlighting that price paths can be volatile and non-linear.

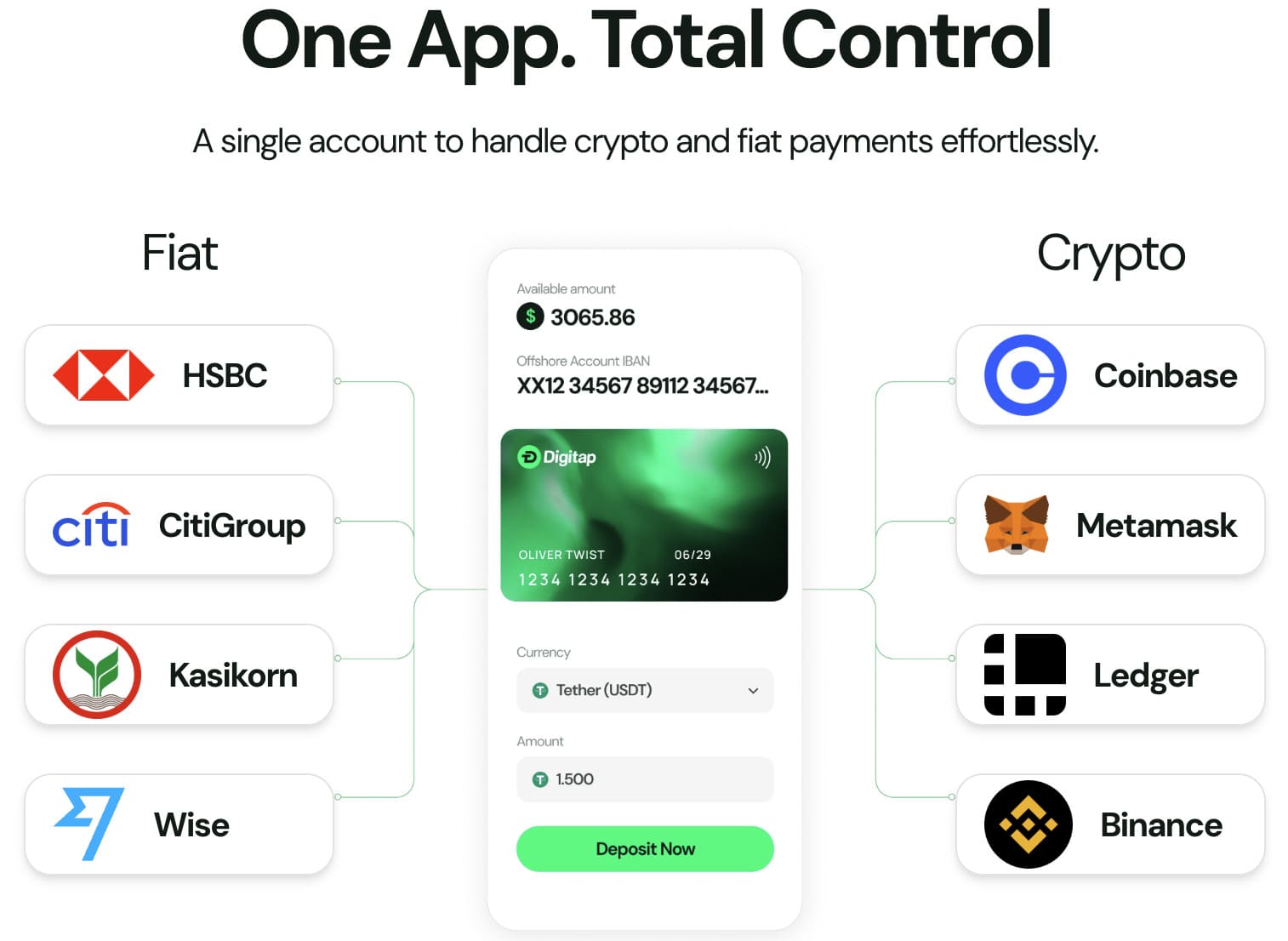

Separate from ETH, Digitap has been discussed in some circles as a banking-app narrative tied to a token sale. The project points to its Visa-related plans and its stated product roadmap, but adoption and token-market outcomes remain uncertain.

How Digitap’s Omni-Banking App Addresses Cross-Border Money Transfers

Cross-border transfers can still be slow and expensive in traditional finance, often involving intermediaries and processing delays. Many crypto products have aimed to reduce friction, but connecting crypto services to everyday payments remains a challenge. Digitap says its omni-banking services are designed to address that gap.

According to the project, its app supports transferring, swapping, and spending both crypto and fiat in one interface.

Digitap also says its Visa integration would allow users to pay or withdraw funds using crypto or fiat from the same card, subject to service availability and applicable rules.

Digitap states that its app is already live. The project also references third-party audit reports published by Coinsult and SolidProof. Readers should review the scope and methodology of any audits directly, as audit reports do not eliminate technical, market, or operational risk.

Some market commentary has contrasted Ethereum price targets with Digitap’s early-stage token-sale narrative. These comparisons may be limited, given the differing maturity, scale, liquidity, and risk profiles of the assets.

Market Commentary on Digitap as Its Token Sale Progresses

Digitap’s token sale has attracted attention in parts of the crypto market. The project has highlighted product milestones such as a Visa-related announcement and an Android app release as drivers of interest.

Project materials describe the sale as being in “Stage 4,” with a listed token price of $0.0268 at the time of writing. Token-sale pricing may not correspond to future secondary-market pricing once trading begins.

Digitap reports raising nearly $1.2 million and selling more than 82 million tokens so far. Market capitalization is not established until an asset is actively traded and widely priced, and early figures may change as new information becomes available.

Digitap’s materials also describe planned stage-based price changes, including a move to $0.0297. Timelines and terms can change, and any future market impact is uncertain.

The project has discussed potential exchange listings in early 2026, though listing timelines are not guaranteed and depend on third parties and market conditions.

Ethereum and Digitap: Two Different Narratives Drawing Attention

Some analysts have discussed scenarios where Ethereum reaches $10,000 in 2026, although forecasts vary widely and are not certain. At the same time, Digitap has received attention for its banking-app positioning, based largely on the project’s announcements and the themes it emphasizes.

Digitap says its product is built around a Visa-enabled card and an app that supports both crypto and fiat functionality. Whether the product achieves meaningful adoption, and how $TAP trades after any listing, will depend on execution, regulation, competition, and market conditions. The token sale is ongoing with staged pricing, according to the project.

For reference, the project publishes details on its website and social channels:

Project website (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. Crypto assets can be volatile, and token sales and exchange listings involve risk.