TL;DR

- The Ethereum community is debating changes in monetary policy to curb the expansion of staking.

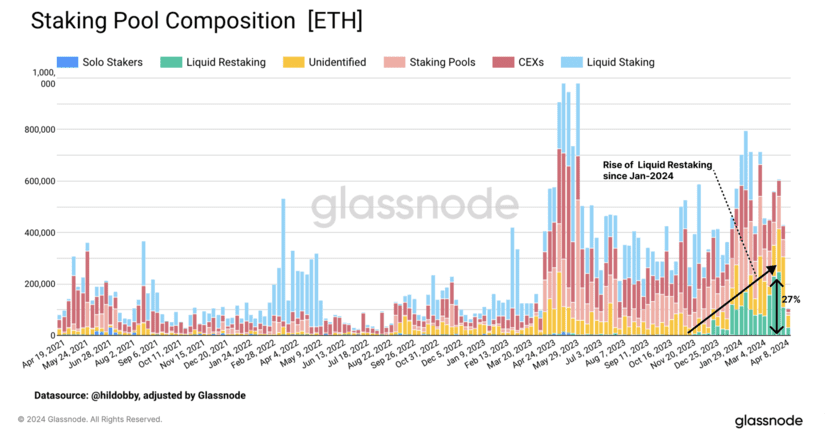

- The increase in staking demand has led to 26% of the total ETH supply participating in Proof-of-Stake.

- The rapid expansion of staking raises concerns about diluting ETH’s function as money. Proposals emerged to limit annual ETH issuance to mitigate the impact.

The Ethereum community is intensely debating potential changes in ETH’s monetary policy, mainly addressing proposals aimed at slowing the rapid expansion of the staking pool. This is due to the growing interest in protocols like Liquid Staking and Restaking, which offer new yield opportunities.

The increase in staking demand hasn’t gone unnoticed, with around 26% of the total Ethereum supply currently participating in the Proof-of-Stake process. This surge has been primarily driven by the emergence of innovations such as Liquid Staking, Restaking, and Liquid Restaking, providing users with additional yield opportunities.

However, the rapid expansion of the staking pool is raising doubts and concerns within the community. Some fear that widespread use of staking derivatives could dilute Ethereum’s function as a form of money and disrupt the balance of power in the network.

EigenLayer protocol introduced the concept of Restaking last year, allowing users to deposit their staked ETH or Liquid Staking tokens into smart contracts to earn additional yields. This innovative tool has significantly contributed to the increase in staking demand on ETH.

Is Ethereum Losing Its Essence?

Ethereum researchers have sounded the alarm and expressed concern about the accelerated growth of the staking rate and its potential impact on inflation. As more ETH is allocated to staking pools, inflation affects a decreasing number of ETH holders who do not participate in staking, potentially undermining Ethereum’s function as a monetary asset.

In response to community concerns, the Ethereum Foundation has proposed limiting annual ETH issuance to reduce incentives for new participants to enter the staking pool and slow growth rates. However, the proposals have sparked more discussions than solutions. Many argue that changes in monetary policy are unnecessary at this time.

The Ethereum community is at a crucial juncture and must address the evolution of its monetary policy and the impact of staking growth on the network. The community will continue to evaluate different proposals and seek a balance between staking expansion and preserving the integrity and functionality of ETH as a decentralized financial platform. We will closely monitor the outcome of the conflict.