TL;DR

- Ethereum is experiencing renewed whale activity as high-profile trader Arthur Hayes and a 2014 ICO-era wallet become active.

- Hayes rotated 1,480 ETH ($4.7 million) along with other crypto assets in a series of moves over two days.

- Meanwhile, the dormant wallet, which had held ETH for 10 years, transferred 200 ETH ($626,000), marking its first activity since the 2014 ICO. These actions coincide with short-term market volatility, highlighting Ethereum’s liquidity and trading patterns.

Ethereum markets are seeing significant whale activity, with notable movements from high-profile trader Arthur Hayes and a decade-old ICO wallet. Blockchain data shows millions of dollars in ETH and other tokens changing hands, prompting renewed focus on market liquidity and short-term price dynamics. Analysts note that such movements can influence trader sentiment and encourage more active participation in Ethereum markets.

Hayes Executes Strategic ETH Rotations

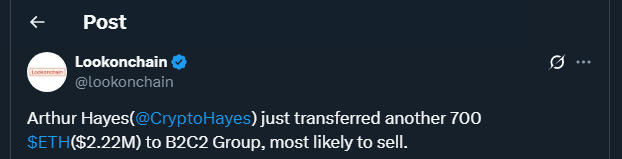

Arthur Hayes, former CEO of BitMEX, has actively rotated his portfolio, selling 1,480 ETH ($4.7 million) across two days. Additional offloads included 2.4 million ENA ($651,000), 640,000 LDO ($480,000), 1,630 AAVE ($289,000), and 28,670 UNI ($209,000). On-chain data indicates that Hayes transferred 700 ETH ($2.22 million) to liquidity provider B2C2 Group, interpreted by analysts as preparation for further sales.

Earlier moves included 520 ETH ($1.66 million) and 2.62 million ENA ($733,000) sold just hours before the 700 ETH transfer. Lookonchain highlights that Hayes’ prior ETH exits often precede repurchases at higher prices, reflecting active portfolio management rather than purely speculative selling. These patterns suggest that experienced investors are continuously monitoring market conditions and taking advantage of short-term volatility.

Long-Dormant ICO Wallet Breaks Silence

A wallet from Ethereum’s 2014 ICO era moved 200 ETH ($626,000), marking its first transaction in over a decade. This wallet originally acquired 1,000 ETH for $310, a position now valued at roughly $3.13 million, representing a return of approximately 10,097x.

The activity coincided with a 1.22% ETH price drop, which fell to $3,194.25 after reaching an intraday high of $3,238. The pullback briefly dipped below $3,070 before stabilizing, showing how historic holders can influence short-term market movements. Analysts note that movements from long-dormant wallets can attract attention from both institutional and retail traders, adding a layer of complexity to Ethereum’s trading environment.

Market Implications and Outlook

These whale movements demonstrate the influence of concentrated ETH holders on market liquidity and volatility. While the short-term impact included modest price fluctuations, the pattern reflects seasoned investors’ active asset management.