TL;DR

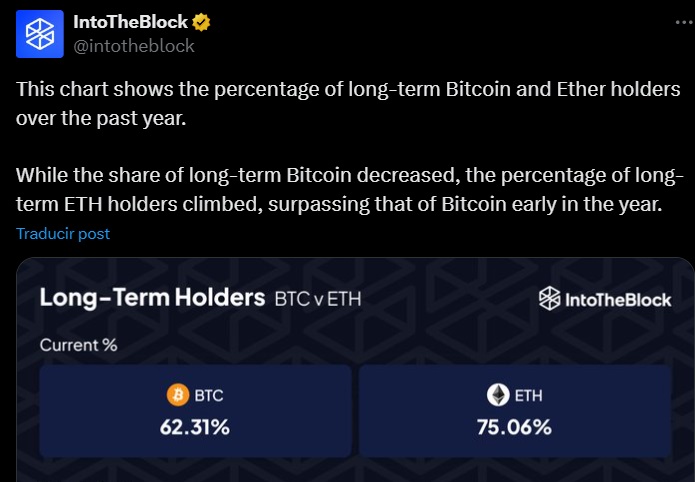

- The proportion of long-term Ethereum holders increased from 59% to 75% in 2024, highlighting growing confidence compared to Bitcoin.

- The proportion of long-term Bitcoin holders dropped from 70% to 62%, impacted by sales during periods of market volatility and euphoria.

- Ethereum attracted more institutional interest, doubling net inflows into ETFs in December.

The behavior of long-term investors in the crypto market revealed new trends in 2024. Ethereum solidified itself as the preferred asset over Bitcoin.

The proportion of long-term Ether (ETH) holders—those who hold their tokens for more than a year—showed a consistent increase throughout the year, rising from 59% in January to 75% in December. This growth is the result of strengthened confidence in ETH as 2025 approaches.

In contrast, Bitcoin (BTC) experienced a decline in the proportion of its long-term holders. During the same period, this metric fell from 70% to 62%. This may be linked to sales triggered by market volatility. For instance, in December, Bitcoin saw significant price fluctuations, reaching an all-time high of $106,000 before falling to $93,000 in just two weeks. The adjustment was partially attributed to some investors deciding to liquidate positions during a period of heightened market euphoria.

Ethereum: Optimism for Regulatory Changes in 2025

Despite the slight correction, analysts like Ger Van Lagen remain highly optimistic about Bitcoin, suggesting that BTC could surpass $200,000 in the near future. However, Ethereum has garnered greater attention due to its stability in holders’ behavior and its growing integration into financial products such as exchange-traded funds (ETFs). In December, net inflows into ETH ETFs doubled, reaching $2.1 billion.

Experts also believe that 2025 could be a pivotal year for Ethereum due to regulatory and technological factors. These include the possible incorporation of staking into ETH ETFs, regulatory changes led by the Commodity Futures Trading Commission (CFTC), and a restructuring of the Securities and Exchange Commission (SEC)’s approach. These dynamics suggest a shift in investor preferences within the crypto market