TL;DR

- An Ethereum ICO participant moved 150,000 ETH worth approximately $646 million to a staking address after being inactive for more than three years.

- The addresses involved had not conducted any ETH-related transactions since February 2022.

- This movement highlights renewed interest from long-term ICO-era holders amid growing bullish sentiment for Ethereum and broader crypto markets.

An Ethereum whale that took part in the 2014 ICO (Initial Coin Offering) reemerged this week by moving a staggering 150,000 ETH into a staking address. According to on-chain data reported by EmberCN, three ICO-era addresses combined for this massive transfer on Thursday evening Eastern Time. Prior to this activity, the addresses had remained dormant since February 2022 and were completely inactive in ether-related transactions.

Dormant Ethereum Investors Make Bold Moves

Several Ethereum ICO participants have resurfaced in recent months, reflecting growing optimism and renewed confidence around ETH’s performance. In August, a different ICO-era address moved around $19 million in ETH to Kraken and offloaded an additional 1,060 ETH over subsequent days. Last month, another ICO participant transferred 2,300 ETH to the same platform, signaling that long-term holders may be reallocating assets strategically, seeking better staking rewards and potential future gains.

Staking Gains Momentum Among Long-Term Holders

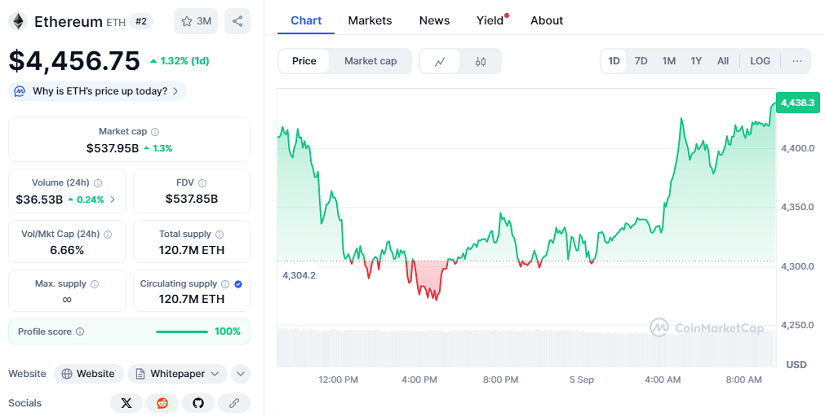

Ethereum’s ICO, conducted from July 22 to September 2, 2014, raised approximately $18.3 million by selling more than 60 million ETH at an average price of $0.31 per token. This week’s 150,000 ETH transfer equates to over $646 million at the current price of $4,456.75 per ETH, with a 24-hour performance gain of 1.32%, a market capitalization of $537.95 billion, and a 24-hour trading volume of $36.53 billion, up 0.24%, demonstrating continued strong liquidity and interest.

The move suggests that long-term holders may be increasingly embracing Ethereum’s staking opportunities as the network continues to strengthen and expand. Analysts note that such significant deposits from dormant ICO-era addresses can provide confidence to retail investors and help reinforce bullish sentiment across the ecosystem, potentially attracting more institutional attention.

Ethereum traded slightly higher in recent sessions, continuing its gradual upward trend while Bitcoin climbed 0.7% to $111,519. The strategic redeployment of ICO-era holdings into staking may also indicate that major holders anticipate further network growth, adoption, and enhanced staking yields.

With the reactivation of dormant addresses and substantial staking activity, Ethereum continues to showcase its appeal not only to new investors but also to early participants who remain deeply committed to the network’s long-term potential, security, and technological innovation.