TL;DR

- Ethereum holds above the $3,000 level, reinforcing it as a critical technical support despite short-term weakness.

- Wyckoff-based analysis and on-chain metrics point to ongoing accumulation, not distribution, with large holders increasing exposure.

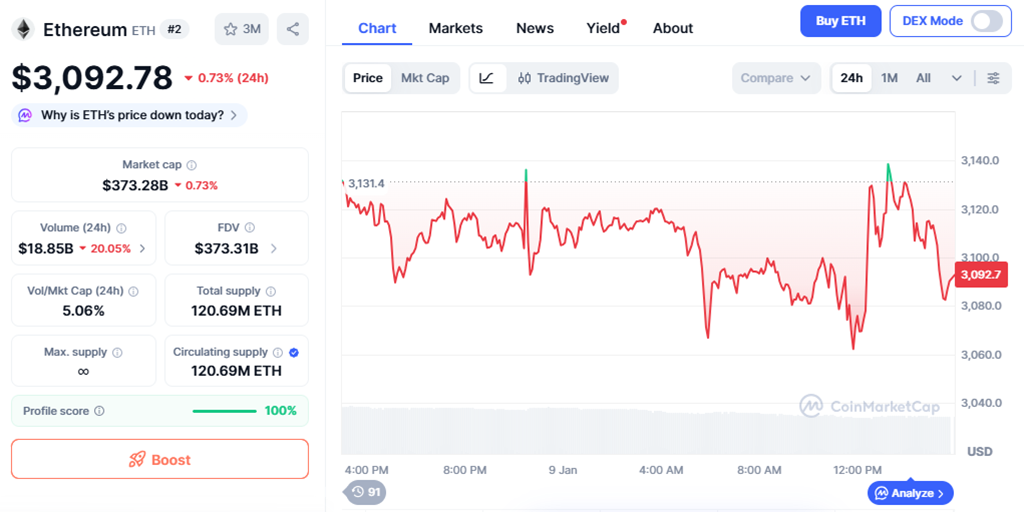

- With ETH trading near $3,092 and a market capitalization of $373.28 billion, analysts remain focused on conditions that could enable a broader upside move.

Ethereum continues to trade above the $3,000 threshold, a level that has acted as a structural anchor in recent weeks. Even with short-term weakness, market data suggests positioning remains constructive rather than defensive.

INSIGHTS:

Ethereum whale balances are trending up

even as price hesitates.This isn’t momentum chasing.

This is strategic positioning.Distribution happens at tops.

Accumulation happens before moves.Follow the smart money. pic.twitter.com/s4NTgJ3iKm

— Merlijn The Trader (@MerlijnTrader) January 9, 2026

Ethereum Holds Structure Around Key Technical Levels

Ethereum trades near $3,092 at the time of writing, posting a 0.73% decline over the last twenty-four hours. Despite the dip, the broader structure remains intact, with price holding above a zone many analysts consider technically relevant. The asset’s market capitalization of $373.28 billion highlights its continued weight within the digital asset market.

Long-term chart analysis based on Wyckoff principles places Ethereum in the later stages of an accumulation range. Under this framework, price behavior near $3,000 reflects sustained demand rather than reactive buying. Analysts note that a confirmed move above the $3,800 to $4,000 area would indicate a transition into a stronger phase, consistent with historical structure shifts.

Comparisons with previous cycles show that Ethereum’s consolidation periods have lengthened, while volatility has gradually declined. In past cycles, similar conditions preceded directional moves once resistance levels turned into support. Observers see the current setup as aligned with those historical patterns.

Ethereum On-Chain Signals And Whale Behavior

On-chain data adds further context. Wallets holding 10,000 to 100,000 ETH have increased their balances since early 2025, reversing a multi-year trend of declining large-holder exposure. This accumulation has continued while price remained range-bound, pointing to strategic positioning rather than short-term speculation.

Exchange balance data supports this view. According to CryptoQuant, ETH held on centralized exchanges has dropped below 16.5 million units. Lower exchange supply generally reduces immediate selling pressure and has historically aligned with periods of stabilization or gradual expansion.

From a shorter-term perspective, traders remain focused on resistance near $3,360, which defines the upper boundary of the current range. As long as Ethereum holds above $3,000, analysts describe pullbacks as part of a controlled structure, not signs of trend deterioration.

Ethereum’s ability to defend the $3,000 level, combined with steady whale accumulation and declining exchange balances, keeps analysts focused on higher price zones.