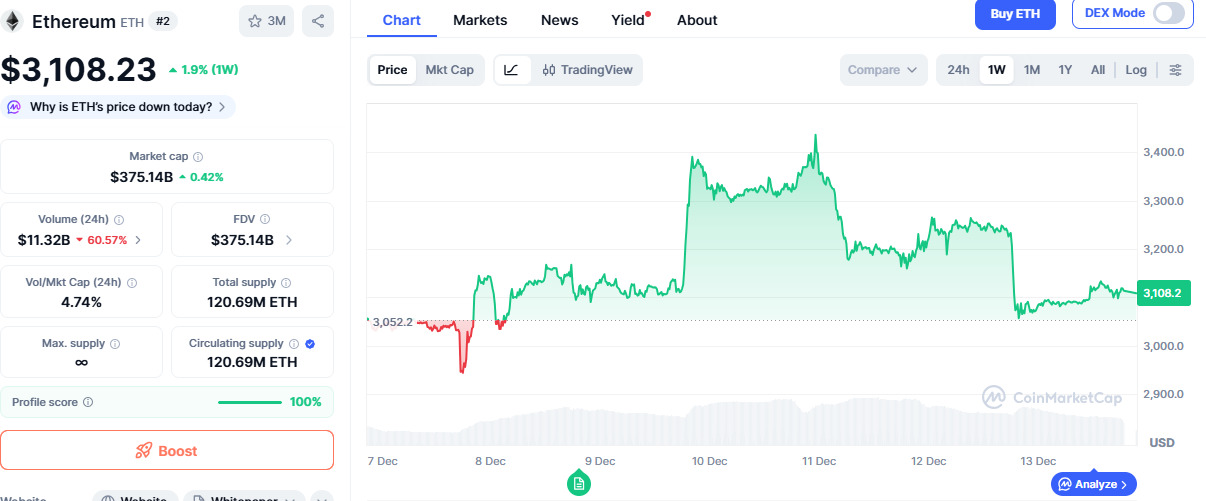

Ethereum (ETH) defended the $3,000 level repeatedly during a recent market sell-off. Despite the Fusaka upgrade, the market reaction remained muted. Price action has been cautious, with volumes remaining thin and many market participants watching for the next catalyst.

The growing uncertainty has made some users shift their focus toward platforms positioned around day-to-day utility. Digitap ($TAP) is presented by the project as an “omni-bank” ecosystem that aims to combine crypto, fiat, and payments within a single product stack.

Project materials also describe an ongoing token sale, including time-based marketing promotions. Readers should treat these details as project-reported and non-predictive.

ETH at $3K: Solid Foundation but Limited Short-Term Visibility

The Fusaka upgrade is described by Ethereum communications as an effort to improve network efficiency and performance. Market prices, however, are influenced by broader narratives and liquidity conditions as well as technical changes.

At around $3,000, Ethereum is a comparatively mature asset, and near-term price moves may depend on incremental adoption and macro conditions rather than a single upgrade.

For retail participants, risk and volatility remain relevant considerations, particularly in periods of lower liquidity.

$TAP and ETH: Different Use Cases and Risk Profiles

Ethereum at $3,000 is often discussed as a more established cryptoasset, with activity spanning DeFi, infrastructure, and application development. Any expectations about returns are speculative and depend on market conditions.

Digitap, by contrast, is described by the project as a payments-oriented product that aims to make crypto usable for everyday transactions. That positioning differs from Ethereum’s role as a base-layer network, and it comes with different execution and market risks.

According to the project, Digitap is building an “omni-bank” ecosystem integrating crypto wallets, fiat accounts, payments, and settlement. As with any early-stage product, readers may want to verify what is live today versus what remains on a roadmap.

Digitap’s Reported Product Scope and Token Sale Context

Digitap describes its offering as including crypto payments, cross-border transfers, wallets, and merchant-oriented tools. The project states that some functionality is available while the token is being sold through an early-stage fundraising process.

Project materials also reference virtual cards, banking-style features, and planned exchange availability. These are project claims and may change over time.

More broadly, the project’s thesis is that a single app can bridge digital assets and traditional payment rails. Whether that thesis translates into adoption depends on regulatory, technical, and commercial execution.

Some commentary around $TAP frames it as an “alternative” to holding large-cap assets during uncertain periods; that framing is opinion-based and should not be read as a prediction.

Utility Narrative Versus Speculation

Parts of the crypto market have increasingly emphasized utility and real-world integrations, alongside speculative trading. Digitap positions itself within that utility narrative, citing payments and consumer-facing features.

The project also states that token demand is intended to be linked to in-app usage. Any such linkage is dependent on user growth, transaction activity, and token design, and it does not guarantee price outcomes.

Digitap further says it incorporates a buyback-and-burn mechanism funded by platform revenues. If implemented as described, such mechanisms can affect token supply dynamics, but they are not a guarantee of demand or price appreciation.

Ethereum also has supply dynamics linked to network usage, but they operate differently and are influenced by broader network activity and market conditions.

User Controls and Payment Claims

Digitap states it focuses on user controls such as onboarding options and privacy-related settings, alongside global payment access. The practical impact of these features depends on jurisdiction, compliance requirements, and product implementation.

The project also references integrations with card and payment networks. Readers should consult the project’s documentation for specifics and availability by region.

Ethereum’s scale and adoption remain distinct from early-stage projects. Comparisons between them should account for differences in maturity, liquidity, and risk.

Digitap is described as early-stage while offering a broader “financial stack.” As with similar projects, the key question for observers is whether usage can grow sustainably and within regulatory constraints.

Payments Infrastructure as a 2026 Theme (Speculative)

Looking ahead, some market narratives focus on payments, remittances, and banking-style infrastructure as potential areas of growth. That remains speculative and subject to regulation and competitive pressures.

Digitap positions its product as an attempt to address inefficiencies in cross-border payments and consumer finance. Ethereum may continue to serve as a widely used infrastructure layer, while consumer-facing apps compete on usability and distribution.

Project-Reported Funding and Token Sale Figures

Digitap says it has surpassed $2.3 million in early funding. This figure is project-reported and has not been independently verified in this article.

According to the project, the token sale price is $0.0371 and more than 143 million $TAP tokens have been purchased. The project also describes this price as a 73.5% discount relative to a stated launch price of $0.14. These figures are marketing claims and do not indicate future market value.

Holiday Promotions (Project Marketing)

Digitap has promoted a holiday-themed campaign that, according to the project, includes rewards and bonuses for participants. Such incentives are marketing tools and do not change the underlying risks of token purchases.

The project describes the campaign as offering multiple reward types (such as account upgrades and token bonuses). Availability, eligibility, and terms are determined by the project.

Summary

Ethereum holding around $3,000 after the Fusaka upgrade may be interpreted by some as a sign of continued interest in the network, though it does not imply a particular future price path. Digitap, meanwhile, is being marketed as a payments-focused “omni-bank” product with an associated token sale and token mechanics described by the project.

Project links (for reference)

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about an early-stage token sale and project marketing materials. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.