TL;DR

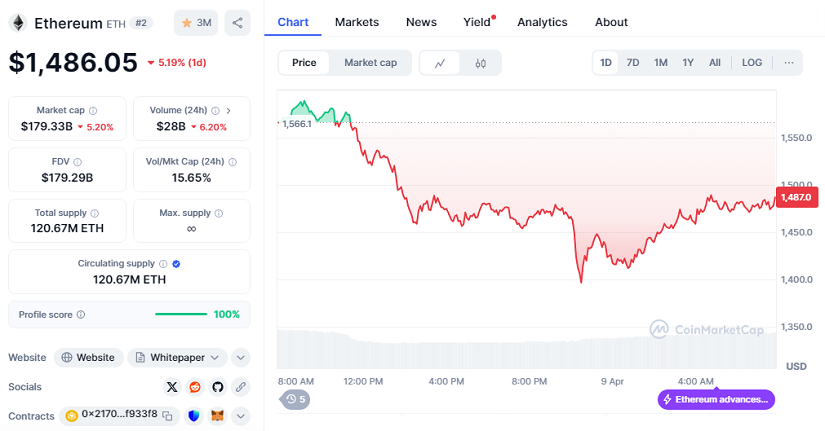

- Ethereum’s price dropped to $1,486.05, hitting its lowest level since March 2023 after a sharp 5.19% decline in the last 24 hours.

- Renewed trade tensions triggered by Donald Trump’s push for 104% tariffs on Chinese goods are fueling strong bearish pressure in the crypto market.

- Institutional and whale sell-offs, including a wallet linked to Trump, sparked over $125 million in ETH liquidations.

The crypto market has once again come under heavy macroeconomic pressure, and this time, Ethereum took the biggest hit. The second-largest cryptocurrency by market capitalization fell 5.19% in the last 24 hours, now trading at $1,486.05 with a market cap of $179.33 billion. This significant drop comes amid renewed U.S.–China trade tensions reignited by President Donald Trump’s aggressive protectionist rhetoric.

Markets turned volatile after the announcement of sweeping 104% tariffs on a wide range of Chinese products, sparking fears among investors. Ethereum, which had already shown weakness throughout 2025, broke key support levels and is now dangerously close to entering a critical zone. Meanwhile, Bitcoin also slid by over 3%, underlining the broader impact of these political headwinds across the digital asset market.

Institutional Sell-Off Adds Pressure On ETH

The recent liquidation of 5,471 ETH by a wallet allegedly tied to Trump’s DeFi venture, World Liberty Financial, has intensified investor concerns. That single transaction, worth over $8 million, was followed by a whale unloading 10,000 ETH, valued at approximately $15.7 million, after holding the position for more than 900 days.

The result has been a liquidity shock that undermined market confidence, particularly as these high-volume players seem to be reducing their exposure to ETH. Analysts have already flagged the $1,200 level as the next critical support, warning that failure to hold could trigger another steep sell-off. If current conditions persist, Ethereum could see further downside movement, testing investor sentiment even more.

Pro-Crypto Outlook: Opportunity Amid Chaos

Despite the grim sentiment, many in the crypto community view this correction as a potential setup for future gains. Historically, moments of peak fear and capitulation have preceded major rebounds in the crypto space. Ethereum’s strength as a smart contract platform, combined with its upcoming technological upgrades, may act as a recovery catalyst once the turbulence fades.

For long-term investors, current prices could represent a strategic entry point—assuming one maintains a clear and informed perspective on the disruptive potential of blockchain technology. As always, the key is patience, conviction, and the ability to see beyond short-term panic.