TL;DR

- Ethereum is experiencing a surge in short positions, with Wall Street investors significantly increasing their bets against the cryptocurrency.

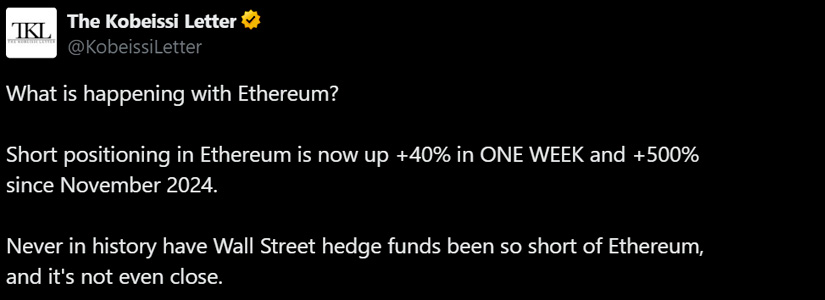

- Analysts from the Kobeissi Letter report a dramatic rise in Ethereum short positions, up 40% in one week and 500% since November 2024.

- While macroeconomic factors and regulatory scrutiny contribute to bearish sentiment, some analysts believe Ethereum could see a short squeeze due to its strong fundamentals.

Hedge funds are increasing their short positions in Ethereum at an unprecedented pace. This surge has raised concerns about potential challenges ahead for the world’s second-largest cryptocurrency by market capitalization, prompting speculation about whether it signals deeper issues or other underlying factors at work.

Surge in Short Positions

Renowned analysts from the Kobeissi Letter have highlighted a dramatic increase in short positions against Ethereum. According to their data, short positioning in Ethereum has surged by 40% in just one week and has skyrocketed by 500% since November 2024.

Sharing their insights on X, the analysts noted that this level of shorting by Wall Street hedge funds is unprecedented. The increase in shorting activity has caught the attention of the crypto community, sparking debates about the future of Ethereum’s price.

Macroeconomic and Regulatory Factors

The macroeconomic environment has been turbulent, with rising inflation and interest rates causing jitters in the financial markets. These conditions have led investors to adopt a risk-off approach, increasing their short positions in volatile assets like cryptocurrencies.

Additionally, regulatory scrutiny on the crypto market has intensified, with several countries implementing stricter regulations. This has added to the uncertainty surrounding Ethereum’s future, prompting investors to hedge their bets by shorting the asset.

Potential for a Short Squeeze

Despite the bearish sentiment, some analysts believe that Ethereum could be primed for a massive short squeeze. A short squeeze occurs when a heavily shorted asset experiences a sharp price increase, forcing short sellers to cover their positions, which in turn drives the price even higher.

Ethereum’s strong fundamentals, including its upcoming network upgrades and growing adoption in the DeFi and NFT sectors, could act as catalysts for such a squeeze.

End of Altseason?

Returning to the current market scenario, Ethereum (ETH) prices are experiencing a significant decline, having dropped 17% over the past two weeks. The cryptocurrency recently hit an intraday low of $2,540, with a slight recovery bringing it up to $2,650 at the time of writing.

Despite this downturn, traders and analysts have observed consistent chart patterns, highlighting that February has traditionally been a bullish month for ETH.