Store of Value or Utility

Common narrative is that Bitcoin is the bona fide store of value. An alternative to gold and in just 10 short years, supporters claim that the coin will flip gold to be the world’s preferable shield against inflation and economic crises stemming due to poor monetary choices.

However, if developing trends is anything to go by, Ethereum is well placed to be not only a utility coin but a broad, diverse store of value, better than Bitcoin.

Presently, Ethereum is evolving. It is shifting away from the Proof-of-Work consensus style to a more efficient Proof-of-Stake system which will be more secure, scalable and fast. That’s exactly why there is a lot of anticipation within the investment community.

A Scalable Ethereum Will Attract Enterprises

A scalable Ethereum means enterprises will easily settle on the network over competitors as the network is decentralized, secure and active on the developer front.

As a matter of fact, Ethereum developer activity is higher than Bitcoin, and has been ramped up in recent times as the community prepares for Dec 4, 2019 Istanbul hard fork.

If enterprises launch their services on the network by activating different smart contracts, it means there will be more activity and diversity as owners of ETH can not only lend their coins to developing DeFi applications, but the resulting demand could thrust prices out of the current lull.

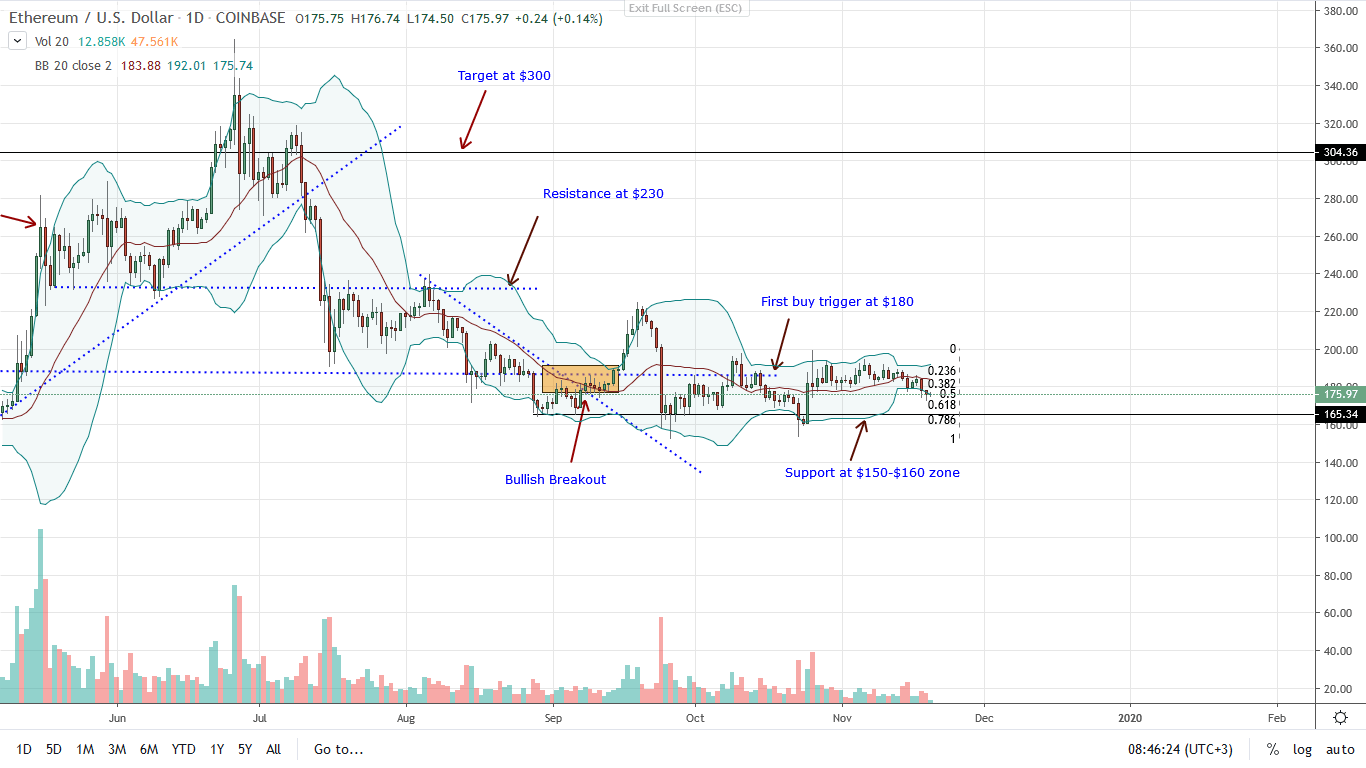

ETH/USD Price Analysis

At the time of writing, ETH is on a downtrend, posting a 5.25 percent loss in the last week versus the USD.

Nonetheless, it is up against BTC and the uptrend seems exhausted. Looking at the chart, there is a double bar bear reversal pattern which was confirmed yesterday.

Additionally, not only are bear pressing lower but candlesticks are actually banding along the lower BB. That means the sell momentum is strong and prices are likely to fall going forward.

Even so, support is expected at the $150 to $160 support zone. Note that despite the sharp liquidation, sellers are yet to reverse gains of Oct 25-26.

From an effort versus result point of view, buyers still have a chance more so if there is a reaction at the 61.8% Fibonacci retracement line anchored on Oct 25-26 trade range. In that case, odds are ETH will reverse this week’s losses as bulls aim at the psychological $200 resistance mark.

On the reverse side, losses below $150 could spark a dump that would spur a price slide towards $130 and even $100.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.