Indeed, the crypto market is a bid. Traders are energized, and every low, appears to be another entry point. Ethereum traders have not been left if open interest statistics from Skew leads. Open Interest is simply the sum of all the longs and shorts contracts in the Ethereum futures market.

At the moment, that number is over $600 million and positive sloping, revealing demand, and the likelihood of further gains in days ahead.

Going forward, positive developments in the smart contracting market is a net positive for ETH. A recent report from DappRadar, a dapp analytics platform, showed that there are more users in Ethereum, more than double those in Tron.

DEXs Launching from Ethereum

From Jan 2019-20, the number of daily unique active wallets in the platform rose as EOSIO’s shrunk perhaps because of the slowing effects of a EOSID airdrop. The effect forced dapps out but like Ethereum, EOS snapped back since it is popular for DEXs.

In Ethereum, the number of exchanges and DeFi rose, but with the former growing at a faster rate than DeFi daps. This is promising because just recently, the total value of ETH in USD terms exceeded $1 billion.

Quorum—ConsenSys Merger?

As Ethereum developers get to work and the higher echelons plan for a possible merger between JP Morgan’s Quorum and ConsenSys, led by Joseph Lubin, it will only continue to fan buyers who are now aiming at $300.

Quorum is open source and its source code free. It was derived from Ethereum, and according to people familiar with this plan, the aim is to maintain the Quorum brand, and keep the technology as it is: open source.

ETH/USD Price Analysis

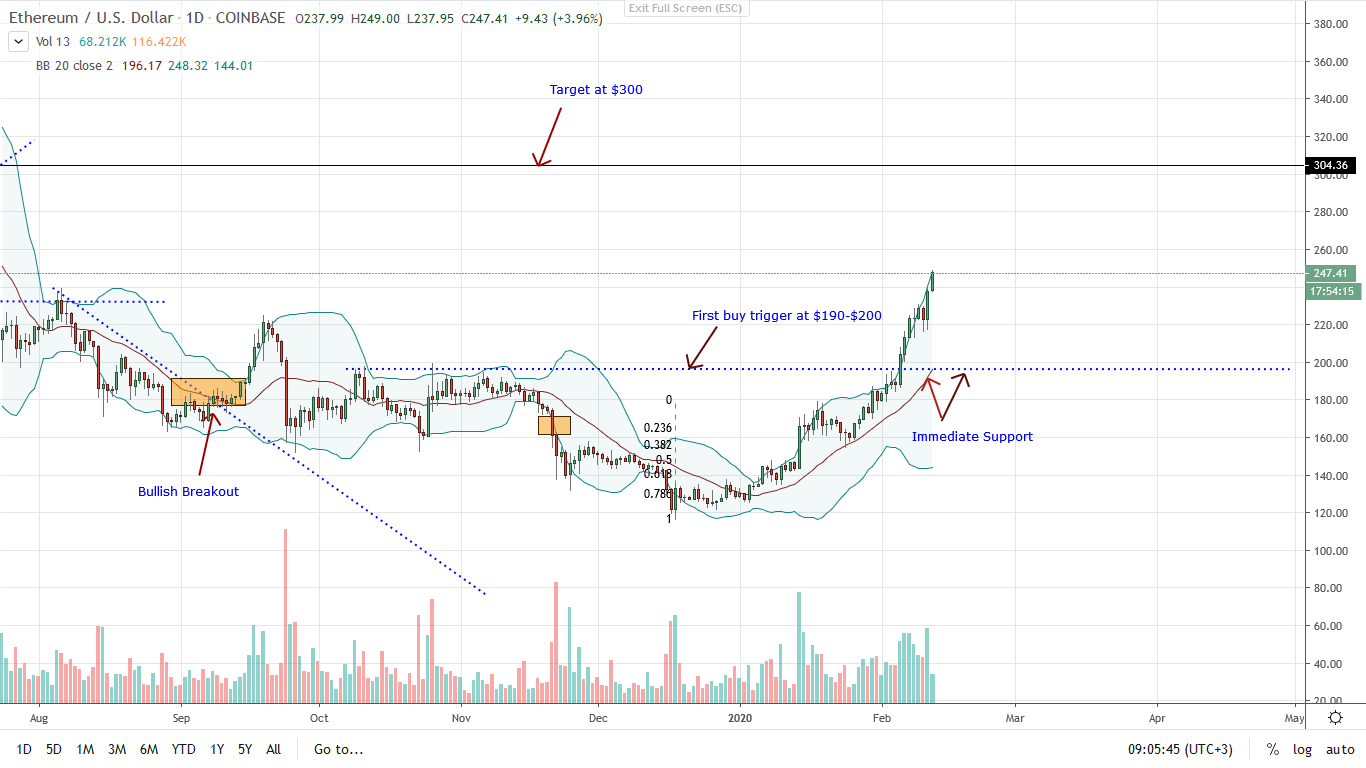

ETH price is up an impressive 30% in the last trading week. At the back of this upswing is an uptick in trading volumes stemming from a decisive close above the psychological $200 mark. From the chart, there is no doubt that buyers are in control.

Not only did yesterday’s price action re-asserted buyers’ dominance, but the divergence away from the middle BB, the 20-day moving average, is a classic mark of strength.

Since the market is bullish, with yesterday bullish bar conspicuous, traders can search for entries in lower time frames and aim for $300, a round number, a significant level that could be the anchor for the next wave of higher highs.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.