Latest Ethereum [ETH] News

Perhaps there is a storm brewing, maybe not. However, what is clear is that there is development and movement beneath the price covers. Many are no doubt, fixated by price and as they track movement, Ethereum developers are hard at work. It was only weeks ago when Ethereum’s founder, Vitalik Buterin did assure the blockchain world that the holy grail in Ethereum 2.0 is right on course and won’t delay even for a day.

In the perfect world of Ethereum 2.0, there are no clogs, and the network is not only fast, secure but scalable. Besides, Ethereum would be leveraging a proof-of-stake consensus model phasing out what has been termed as a limiting but battled tested proof-of-work model that also tags decentralization controls.

We have seen this with ProgPOW where the argument is to tame attempts of centralization brought by ASICs and good news is, proposers are on the forefront meaning the community is in sync with their views. Nonetheless, what the future of Ethereum as a dominant platform is clear.

Should developers stick to their development path then holders will be the biggest beneficiaries thanks to EIP 1234, adoption lead by Samsung support and in days ahead, a freeze where ETH coins will be scarce allowing the laws of supply and demand to kick in as equilibrium is struck.

ETH/USD Price Analysis

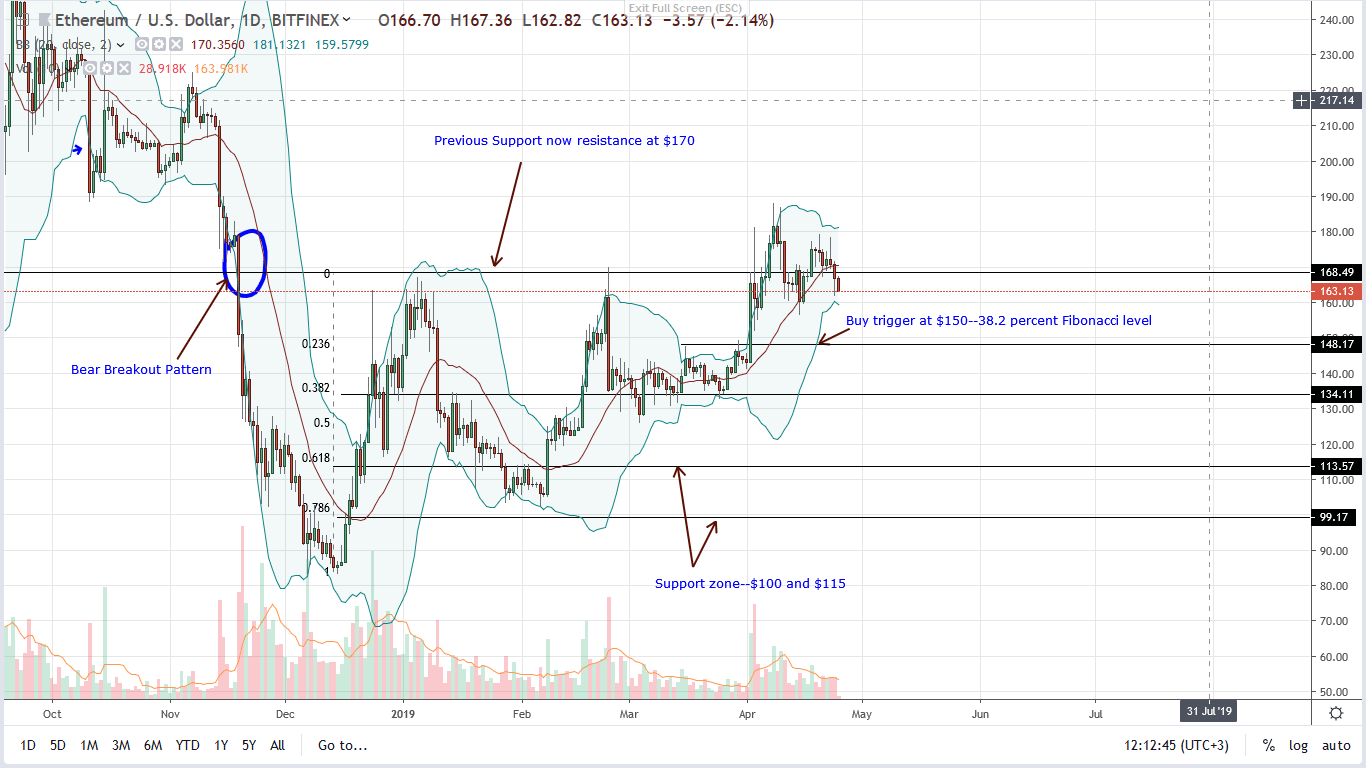

Price wise and Ethereum [ETH] is under pressure, sliding 1.2 percent in the last week and trending below $170, a key resistance level. Like in our previous ETH/USD trade plans, $170 is previous support now resistance and bears of Q4 2018 pounded this level. Once it gave up, prices went to a free fall, sinking to $70 before rebounding late last year.

Therefore, from an effort versus result, cause versus effect point of view, it is imperative that buyers build enough momentum to reverse last years losses. If not, and prices find a ceiling at $170 as gains of Apr-2 are reversed, then we shall have another retest and in a typical breakout pattern, the next wave would most likely drive back prices to $135 or $100.

All the same, this depends on whether Apr-2 gains will be reversed with accompanying bear bar printing high volumes above averages of 183k or 575k of Apr-2. In the meantime, traders should watch how prices react at $150 and later $135. If these levels hold and prices rebound, then risk off traders can load up with targets at $200 and later $250. On the flip side, any meltdown would see Ethereum [ETH] retest $135 and $100 as aforementioned.

Chart courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.