Latest Ethereum [ETH] News

The smart contracting space is on a treadmill. New technology keeps cropping up while at the same time, emerging competitors are stepping up, promising speed, scalability and security and basically all features that Ethereum presents. Of the many entrants, Cardano, though in development but an alternative smart contracting platform designed from the ground up under the guidance of Charles Hoskinson—who leads the engineering and quality team thanks to his experience in Ethereum; promise to offer a stiff competition.

Although it is work in progress and in the second phase of a five-step development concluding with Voltaire, the team promise to give a run for its money not only in smart contract abilities but in the rate at which it is innovating and rolling out new tech—in sidechains based on PoS architecture.

Besides by adopting proof-of-stake which Ethereum is planning to migrate in Serenity or in Ethereum 2.0, many pundits as well as investors may find the platform energy conservative and therefore attractive.

Perhaps to keep up, Vitalik is assuring the community that several teams are working towards achievement of what Ethereum 2.0 promises—that is speed, scalability and above all shift from proof-of-work to stake which Vitalik is apparently so keen on. He says different teams are working towards this goal and to that end there won’t be delays.

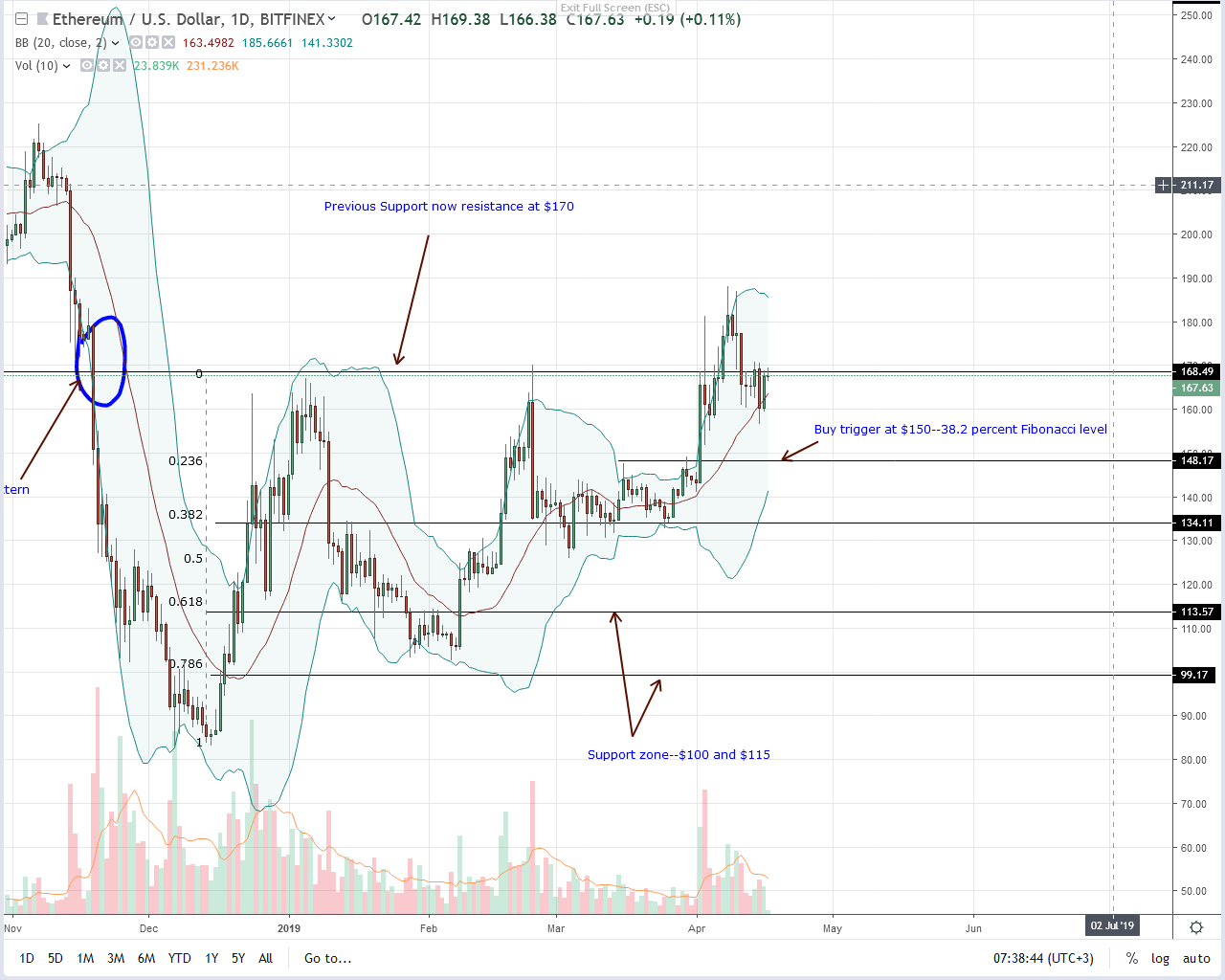

ETH/USD Price Analysis

Once this happen and the close above is at the back of above average volumes exceeding recent averages of 252k or even those of Apr-2 of 575k, then risk-averse, conservative traders can load up on every dip with first target at $250 or higher.

Thus far that is yet to print but we are positive that increasing BTC prices would have a positive effect on ETH thanks to its correlation improving sentiment. As far as candlestick arrangement is concerned, risk-off, aggressive type of traders can load up on every dip with first target at $170 since an analysis price action from an effort versus result point of view, bulls are in control.

Chart courtesy of TradingView—BitFinex

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.