TL;DR

- The SEC has extended its review of the Invesco Galaxy Ethereum ETF staking proposal to September 25, highlighting ongoing caution toward crypto innovation.

- If approved, this would mark the first US spot Ethereum ETF to include staking rewards, potentially boosting yields for investors.

- The crypto sector remains optimistic, seeing this as a step toward wider institutional adoption of blockchain-native income streams.

The U.S. Securities and Exchange Commission (SEC) has once again postponed its decision on whether to allow staking within the proposed Invesco Galaxy Ethereum ETF, setting a new review deadline for September 25. This extension adds more weeks of uncertainty for applicants and crypto advocates pushing for broader integration of blockchain-native mechanisms into traditional finance.

Originally filed by the Cboe BZX Exchange on June 9 and revised on June 23, the proposal aims to let the ETF not only hold Ethereum but also participate in the network’s proof-of-stake consensus. Doing so would enable the fund to earn staking rewards directly, providing additional returns beyond just price appreciation. So far, no approved US crypto ETF includes this feature.

SEC officials pointed to the need for deeper analysis of how staking rewards interact with existing securities laws and investor protection frameworks. Recent filings suggest the regulator wants more clarity on how custodians would handle staked assets and how staking rewards might be treated for tax and accounting purposes.

While some see these repeated delays as frustrating, others argue they reflect the complex nature of merging decentralized finance features with traditional exchange-traded funds. A green light from the SEC could encourage more institutional players to explore crypto’s income-generating potential, strengthening Ethereum’s position as the leading proof-of-stake network.

Institutional Interest Continues To Grow

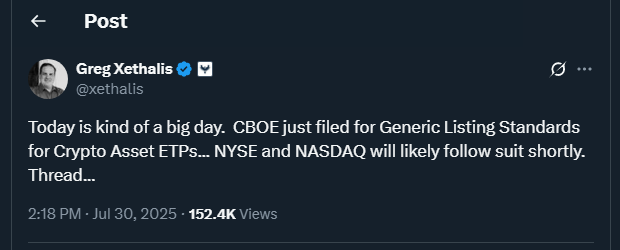

Despite regulatory hesitation, demand for crypto exposure through regulated products keeps expanding. Earlier this year, multiple spot Ethereum ETFs without staking rights gained SEC approval after lengthy deliberation. Adding staking to the mix could make these products more competitive against holding ETH directly on-chain.

Major firms like Grayscale and Bitwise are also waiting on similar decisions for their own staking-enabled ETF proposals. Industry experts believe a positive ruling would send a signal that the US is willing to adapt traditional frameworks to accommodate blockchain innovations that generate real yield.

Crypto Industry Remains Patient And Confident

For now, the extra time until September gives issuers and regulators room to resolve outstanding questions without derailing momentum. With Ethereum’s network upgrades making staking more accessible and efficient, more investment products are likely to pursue this path once clear rules are in place.