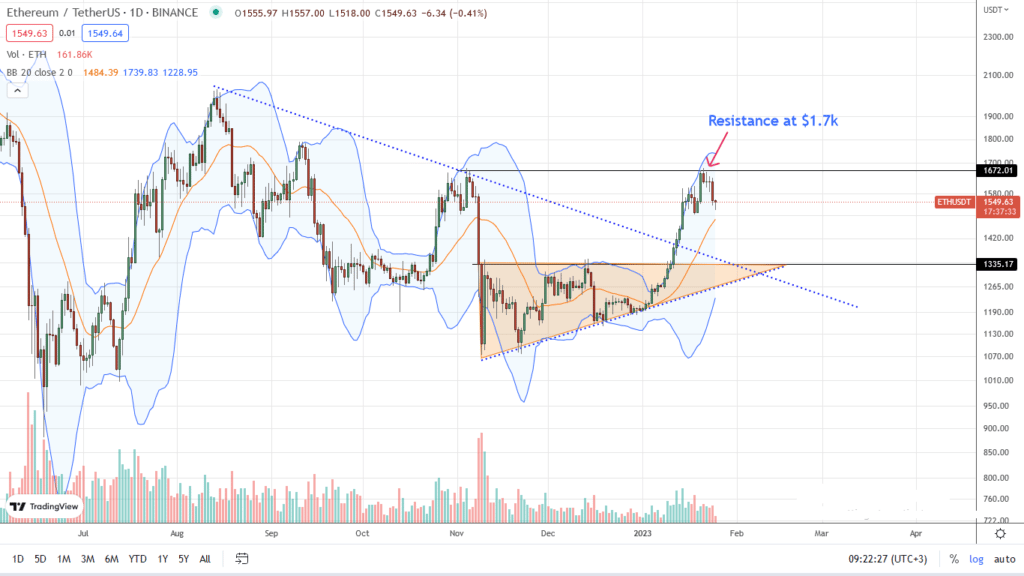

Ethereum prices have been trickling lower in the past four trading days. Even so, the uptrend remains valid. Subsequently, traders might find entries to double down on every low inside the January 20 bullish engulfing bar.

A notable, encouraging development is that trading volumes are relatively low amid this drop. Nonetheless, prices are above the $1.5k and $1.35k support levels. As it is, ETH bulls are in control, provided prices are within the January 20 bull bar, validating the uptrend from an effort versus result perspective.

Any upswing that may lift ETH above $1.7k and last week’s highs may be the beginning of the next leg up. In that event, ETH may rally toward $2k.

SHANGHAI UPDATE

Overall, there are encouraging formations in Ethereum that may shape its valuation in Q1 2023 and beyond.

Specifically, the platform remains the most active smart contracting network. Blocks are full. Moreover, many projects are looking to launch on the network or link through secure bridges.

However, in the near term, traders are looking at the Shanghai Upgrade. According to Ethereum developers, the upgrade tags several improvements touching its virtual machine.

Besides, there will be enhancements on smart contracts that would affect its control flow and, thus, fees on layer-2 platforms.

Protocols like Arbitrum and Optimism stand to draw immense benefits. However, on the ETH price side, unlocking coins staked since late 2020 might influence the near-term trajectory.

ETHEREUM PRICE ANALYSIS

There are a series of lower lows, as visible in the daily chart. Even though bulls are confident of what lies ahead, they must keep prices above $1.5k. This level flashes with the bullish engulfing bar of January 20.

Since the contraction from the upper BB points to slowing momentum and a bull flag, there must be a decisive breakout in either direction. In the immediate term, a high volume breakout mirroring those of January 20 may see ETH float easily to $2k in a bullish continuation pattern.

Conversely, if losses of the past four days form a base for sellers, any loss below $1.55k may trigger more sell-off. It will be especially so if the bar has high participation levels. In that case, ETH may contract to retest $1.35k, an opportunity for aggressive sellers to swing the sell-off.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.