Discussion around Ethereum has picked up this week as some market commentators revisit the $5,000 level, while some Chainlink holders are also paying attention to the newer project Remittix. The project describes itself as focused on payment and remittance use cases.

Project materials describe Remittix as a utility-focused, low-fee crypto ecosystem aimed at real-world use, with cross-chain DeFi features and a wallet release targeted for Q3. These claims have not been independently verified.

Ethereum Price: $5,000 in Sight as Liquidity Swells and Institutions Lean In

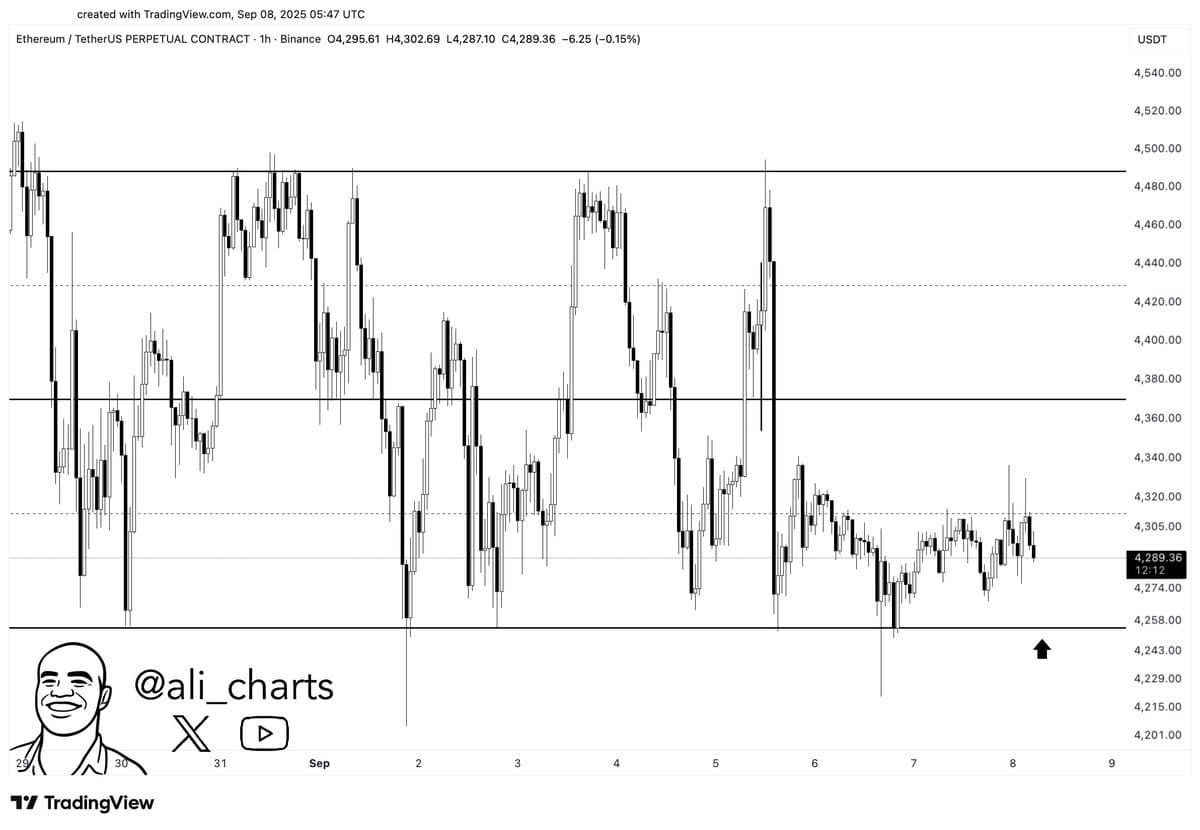

Some analysts have pointed to the $5,000 area as a potential near-term level for Ethereum, depending on market conditions. CryptoNews reported $6.7 billion in stablecoin inflows over the past week, which some traders interpret as supportive liquidity, though it does not guarantee price direction.

Commentary has also highlighted $4,250 as a support level to watch for Ethereum. Standard Chartered recently raised its year-end ETH forecast to $7,500, citing demand tied to network activity such as staking and transaction fees; forecasts are inherently uncertain.

Chainlink Stir: Community Gears Up for What’s Next

Chainlink has drawn renewed attention as some market participants point to continued demand for on-chain oracle services. Chainlink’s data feeds are widely used by DeFi applications and other smart contract systems.

Some analysts on X have suggested that a pullback toward $16 could be constructive from a technical-analysis standpoint. Separate posts have also referenced higher upside scenarios, including a move toward $100, though such targets are speculative.

Price targets for LINK vary widely. Market participants often discuss LINK alongside broader crypto market trends and the role of oracle infrastructure, but outcomes remain uncertain.

Remittix: Project Updates and Claimed Utility

Remittix has been promoted by its team as an early-stage token sale with planned product releases, including a wallet targeted for Q3 and cross-chain functionality with low fees. As with any early-stage project, readers should verify claims through primary sources and consider risks.

Key Points Cited by the Project

- A stated focus on payment and transaction-related utility

- Community growth supported by marketing incentives, according to the project

- The project says it has been audited by CertiK

- A roadmap that includes a wallet launch timeline (targeted for Q3)

These are descriptions provided by the project and should not be read as assurances of performance, adoption, or outcomes.

Alongside ongoing discussion about Ethereum and Chainlink, Remittix is one of several newer projects drawing attention in 2025. Any comparison across projects should account for differences in maturity, liquidity, and risk.

Additional Context

Remittix has also stated that it is pursuing centralized exchange listings, including BitMart and LBank. Listing timelines and availability can change and are typically subject to exchange approval.

Project links (for reference):

- Website: https://remittix.io

- Socials: https://linktr.ee/remittix

This article is for informational purposes only and does not constitute financial or investment advice.

This outlet is not affiliated with the project mentioned.