TL;DR

- The founder of Ethena stated that the issuance of USDe drives demand for USDT, since it covers 70% of the collateral in perpetual swaps.

- Young argued that in the stablecoin market it’s unfeasible to combine high liquidity with high yields, which explains the differences between both protocols.

- Ethena positioned USDe as the third-largest stablecoin by market cap, although its supply dropped 11% in a month due to its exposure to leveraged markets.

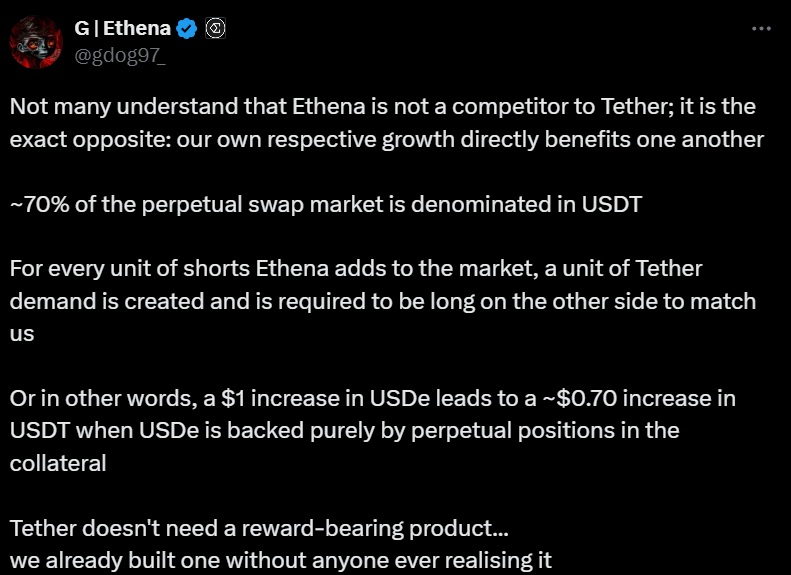

Ethena Labs founder Guy Young claimed that the expansion of his synthetic stablecoin USDe benefits the growth of Tether (USDT) and does not directly compete with it.

According to his explanation, every time Ethena increases USDe issuance backed by positions in perpetual derivatives, it generates additional demand for USDT, which acts as counterparty in those operations. This happens because 70% of the volume in perpetual swaps is currently handled with USDT as collateral.

Two Approaches for the Stablecoin Market

Young pointed out that there are two possible approaches in the stablecoin market: guaranteeing high liquidity and availability, like Tether does, or prioritizing high yields, as Ethena seeks to do. He stated that it’s unfeasible to sustainably offer both benefits. This explains why Tether doesn’t pay interest for holding USDT, since traders pay annual rates between 10% and 30% to trade in derivatives markets.

Ardoino Backs Young

The argument sparked mixed reactions. Some users noted that not all of Ethena’s positions are backed with USDT and that, in certain cases, other assets are used as collateral. However, Paolo Ardoino, Tether’s CEO, backed Young’s position by quoting his post and recommending it.

Meanwhile, Tether reached a new all-time high in its circulating supply, hitting $146 billion, consolidating its absolute market leadership. Despite regulatory issues in markets like Europe and the United States, it maintains a strong presence in emerging economies and holds a 61% dominance over the total stablecoin supply.

Ethena Surpasses DAI and USDS

Ethena, for its part, managed to position USDe as the third-largest stablecoin by market capitalization, reaching $4.766 billion and surpassing options like DAI and USDS. However, over the past month, its supply fell by more than 11%, a result of the natural volatility in products that depend on leveraged positions in futures markets.

It’s worth noting that Circle continues gaining ground with USDC, which has grown 38% so far this year, although it still lags far behind Tether in volume and global distribution.