TL;DR

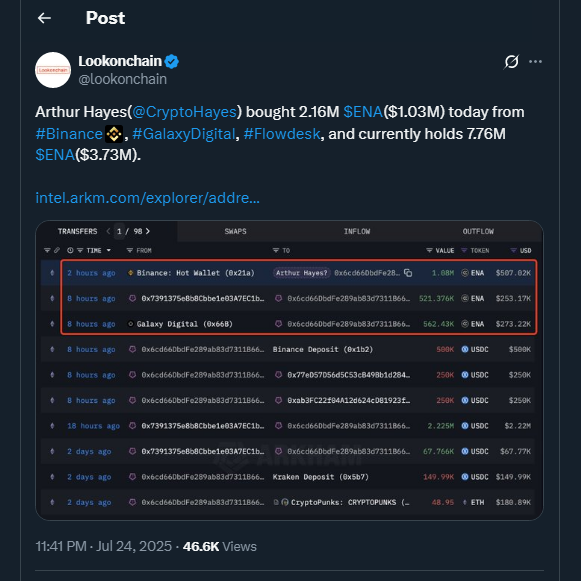

- Former BitMEX CEO Arthur Hayes has added 2.16 million ENA tokens to his portfolio, spending over $1.03 million and bringing his total ENA holdings to 7.76 million, worth around $3.73 million.

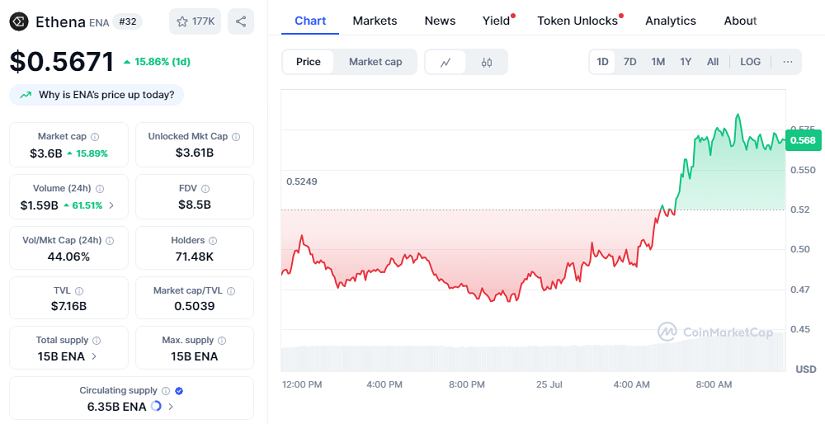

- This accumulation coincides with Ethena’s strong 15.86% daily gain and a market cap now at $3.6 billion.

- ENA’s trading volume soared to $1.59 billion in the past 24 hours, up over 61%.

Ethena has grabbed headlines by jumping nearly 16% as the broader crypto market battles heavy selling. The token’s impressive resilience is partly credited to Arthur Hayes, who spread his purchase across Binance, Flowdesk, and Galaxy Digital. Such a strategy shows his trust in ENA’s long-term potential despite sharp short-term corrections. While Bitcoin dipped around 2% to hover near $115,150, ENA rallied to $0.5671 (15.86%), showcasing strength when most digital assets faced profit-taking across multiple exchanges and wallets worldwide this week.

Hayes’ conviction is not an isolated signal. Whales and institutional investors have steadily piled into Ethena, reinforcing positive momentum for the altcoin. According to Lookonchain data, Hayes’s fresh buy comes just days after he used Flowdesk for other OTC crypto purchases, proving that he sees value when others fear more dips.

Fresh Capital And Institutional Buys Push ENA Higher

Adding fuel to the rally, StablecoinX, a new Nasdaq-listed player, recently kicked off a plan to acquire $5 million worth of ENA daily for the next six weeks. This treasury strategy will absorb about 8% of Ethena’s circulating supply by the end of the program, boosting scarcity and maintaining steady upward pressure on price.

Ethena’s DeFi footprint is growing too. Latest figures from DeFi Llama show its total value locked (TVL) has surpassed $7.19 billion, placing it among the top Ethereum-based stablecoin protocols. The project’s offering of access to DeFi yields and its synthetic USDe dollar is attracting both retail traders and large institutional allocators who seek new opportunities and steady passive income.

In the past 24 hours alone, ENA’s trading volume has rocketed 61.51% to $1.59 billion, highlighting how Hayes’s bet has reinvigorated bullish spirits. The current 1.0276 long/short ratio suggests traders lean optimistic, betting on continued recovery after ENA shed nearly a quarter of its value earlier this week.

Looking ahead, traders will watch whether ENA can sustain its momentum and reclaim levels closer to its $1.24 all-time high. For now, Hayes’s vote of confidence is sending a clear signal that major players remain keen on Ethena’s potential, even when the market tests their resolve.