TL;DR

- Elixir suspended its synthetic stablecoin deUSD after a severe liquidity shock linked to Stream Finance, which reported a $93M loss and owes approximately $68M to Elixir.

- The incident caused deUSD to drop to $0.015, placing pressure on synthetic stablecoins across DeFi.

- Despite the turmoil, industry voices highlighted that transparent, decentralized models and stronger risk controls are shaping a more resilient stablecoin sector.

Elixir suspended support for its synthetic stablecoin deUSD after the collapse of Stream Finance triggered a sharp liquidity imbalance across several decentralized lending platforms. The sudden $93M loss reported by Stream, attributed to an external asset manager, damaged deUSD’s collateral backing and sent the asset down to $0.015. Even with the setback, many crypto analysts emphasized that decentralized, overcollateralized models remain a key driver of stablecoin innovation, especially as users pursue transparent alternatives instead of opaque custodial products.

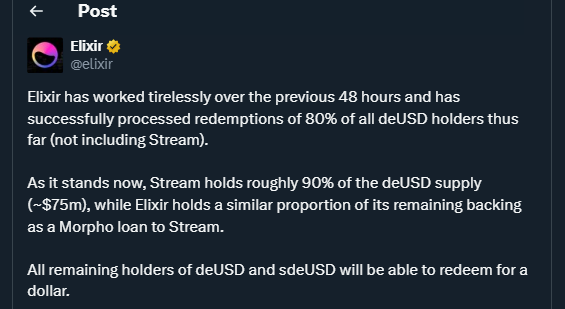

Elixir stated that it had already processed most redemptions before the depeg, limiting losses for the majority of users. However, Stream still holds close to 90% of the remaining deUSD supply, roughly valued at $75M. Elixir and several DeFi protocols are coordinating to unwind positions in an orderly manner, aiming for full repayment without triggering unnecessary liquidations.

Elixir Response And Broader DeFi Impact

Stream also relied on deUSD as part of the backing for its own stablecoin, XUSD, which plunged to $0.10 after the loss disclosure. The event placed pressure on synthetic stablecoins launched in the past year, particularly those that expanded rapidly without diversified collateral. Still, the episode did not affect major decentralized stablecoins such as DAI, USDe, or GHO, which remained stable. Some DeFi developers suggested that clearer collateral transparency dashboards and automated circuit breakers could enhance user protection without compromising decentralization.

Policy Moves Supporting Stablecoin Growth

Amid the market turbulence, US stablecoin regulation continued progressing with constructive industry input. Circle encouraged the US Treasury to maintain equal regulatory treatment for all issuers under the GENIUS Act to sustain fair competition and consumer protection. Coinbase also contributed feedback, urging flexibility that enables exchanges to offer interest-bearing stablecoin products responsibly. These proposals aim to support innovation while improving oversight, reinforcing the view that well-designed stablecoins will play a vital role in the global digital economy.