TLDR:

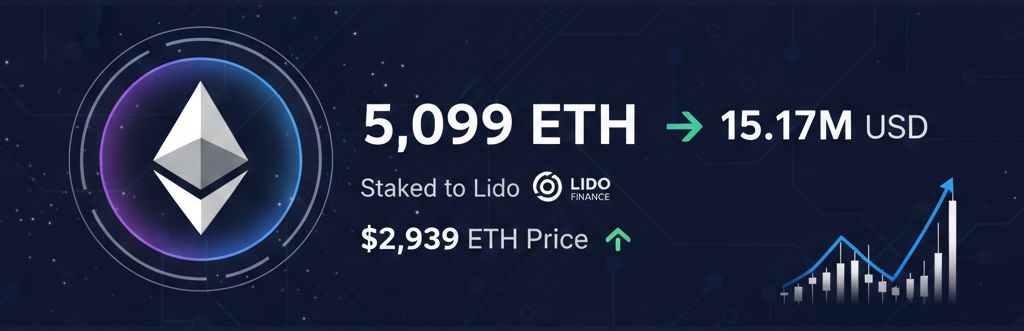

- An institutional investor withdrawn 5,099 ETH from the Kraken exchange after three months of total inactivity.

- The funds were immediately deposited into Lido Finance to be converted into staked ETH (stETH).

- The move occurred strategically near a key support level for the cryptocurrency’s price.

This Thursday, the crypto market witnessed a massive movement suggesting renewed institutional confidence. An Ethereum (ETH) whale, inactive for three months, awakened to execute a transaction worth $15.17 million.

A whale withdrew 5,099 $ETH, worth $15.14M, from #Kraken after being dormant for 3 months.

— Onchain Lens (@OnchainLens) January 22, 2026

Address: 0x761F2Ff9dB26E005fc2ea7De1C24B47C78b01b68 pic.twitter.com/0NCrfPUG6T

Arkham data reveals that the wallet “0x761F2F” made a withdrawal of 5,099 ETH from Kraken. Minutes later, the investor transferred the entirety of the assets to Lido Finance, converting immediate liquidity into liquid staking tokens (stETH).

With this action, the market witnessed the largest individual bet recorded in recent months, marking a shift from stablecoin operations toward direct exposure to the Ethereum ecosystem. Blockchain transparency shows that currently, nearly 100% of the balance is locked in staking.

Strategic Impact and Market Signals Following the ETH Withdrawal

The most striking aspect of the operation was its timing, as it coincided with a local support zone. The Ethereum (ETH) whale took advantage of the $2,939 level, a psychological barrier that served as a support during the first weeks of January.

By withdrawing funds from a centralized exchange (CEX) to deposit them into a decentralized protocol, the investor minimizes immediate selling pressure on the market. This behavior is typically interpreted as a bullish signal, as the investor prioritizes validation yields over short-term speculation.

Furthermore, using Lido to obtain stETH allows the capital to remain productive within the DeFi ecosystem while generating passive rewards. If other large holders follow this lead, we could see a new cycle of massive inflows into staking solutions in the coming weeks.

In summary, this “awakening” underscores that major capital holders view current prices as a strategic accumulation opportunity. The consolidation of over $15 million in a single move reaffirms the thesis that the network’s intrinsic value remains the primary focus for high-level investors.