TL;DR

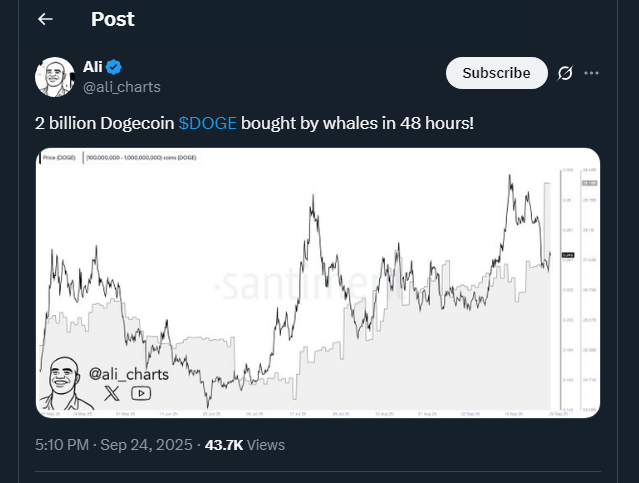

- Whales purchased 2 billion DOGE in just 48 hours, signaling significant institutional buying interest and a potential market shift.

- Thumzup Media expanded its Dogecoin holdings to 7.5 million, aligning with corporate crypto treasury strategies.

- Analysts highlight that if current accumulation trends continue, DOGE could see a short-term rise to $0.78 and possibly reach $1.30 in the long term, reflecting historic bullish cycles in meme coins.

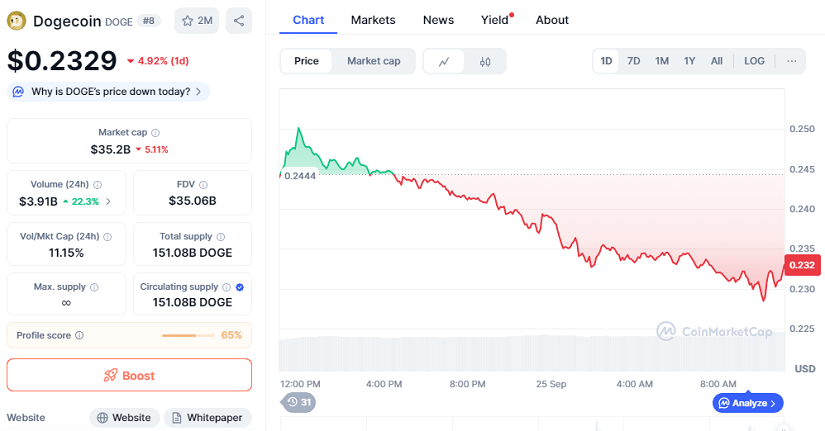

Dogecoin (DOGE), the leading meme cryptocurrency, is attracting renewed attention after whales bought a staggering 2 billion tokens within 48 hours. Despite this massive accumulation, DOGE prices fell 4% to $0.2329, reflecting a brief dip that analysts suggest could precede a strong upward move. Market observers also note increasing social engagement around Dogecoin-related projects, indicating broader retail interest complementing institutional activity.

Whales Drive $480 Million Dogecoin Surge

Crypto analyst Ali Martinez reports that wallets holding between 100 million and 1 billion DOGE were responsible for the recent buying spree, accumulating roughly $480 million worth of tokens at current prices. The purchases occurred near $0.245, a key support level, indicating that major investors are preparing for a potential rally.

Historically, whale accumulation of this scale has often preceded bullish momentum, suggesting DOGE could move higher in the coming weeks. Analysts also point out that some whales are diversifying holdings, signaling strategic planning for both short-term gains and longer-term accumulation.

Thumzup Media Boosts Corporate Crypto Holdings

In parallel, Thumzup Media is increasing its Dogecoin position, now holding approximately 7.5 million DOGE. The company is executing a $10 million share buyback program through 2026 while managing a crypto treasury that already includes Bitcoin and other assets. This approach highlights a growing trend of corporations integrating meme coins into broader Web3 finance strategies. Thumzup’s growing reserves indicate confidence in Dogecoin’s long-term potential and reflect the merging of corporate finance with crypto investments. Additionally, analysts observe that rising corporate interest may encourage new partnerships and technological adoption across the blockchain ecosystem.

Currently, DOGE trades at $0.2329 with a market capitalization of $35.2 billion and a 24-hour trading volume of $3.91 billion, up 22.3%. Analysts project that continued whale accumulation could push DOGE toward resistance levels around $0.30–$0.35. A break above this zone could open the path to $0.78 in the short term, and historical cycles suggest a potential long-term surge up to $1.30 if trends repeat. With these factors in play, Dogecoin remains a key asset to watch for both retail and institutional investors.