Discussion around Bitcoin possibly returning to the $120,000 level has been prominent in recent crypto market coverage. Some analysts say sentiment has shifted toward projects positioned around utility and usage, although market conditions can change quickly.

That narrative has also brought attention to PayDax Protocol (PDP), a newer network that says it is building infrastructure for DeFi lending, borrowing, and insurance-related services.

PayDax is in an early-stage token sale. Some market participants have suggested it could attract interest if it delivers the features described in project materials, but outcomes are uncertain. Below is an overview of recent Dogecoin and XRP developments, alongside PayDax’s stated plans.

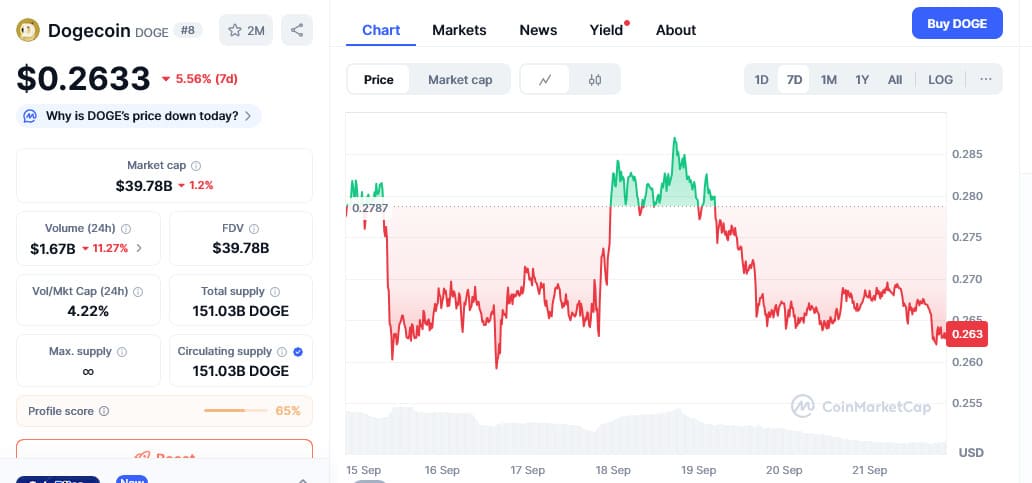

Dogecoin ETF volumes and early trading activity

The Rex-Osprey Dogecoin spot ETF has gone live. On its September 18 debut, the ETF recorded $17 million in inflows, which would place it among the higher open-day inflows reported for 2025.

Dogecoin has also seen price volatility. Dogecoin now trades at $0.264 following a 4.37% fall over the past week. Some analysts have suggested ETF-related activity could support demand over time, but any rebound remains uncertain.

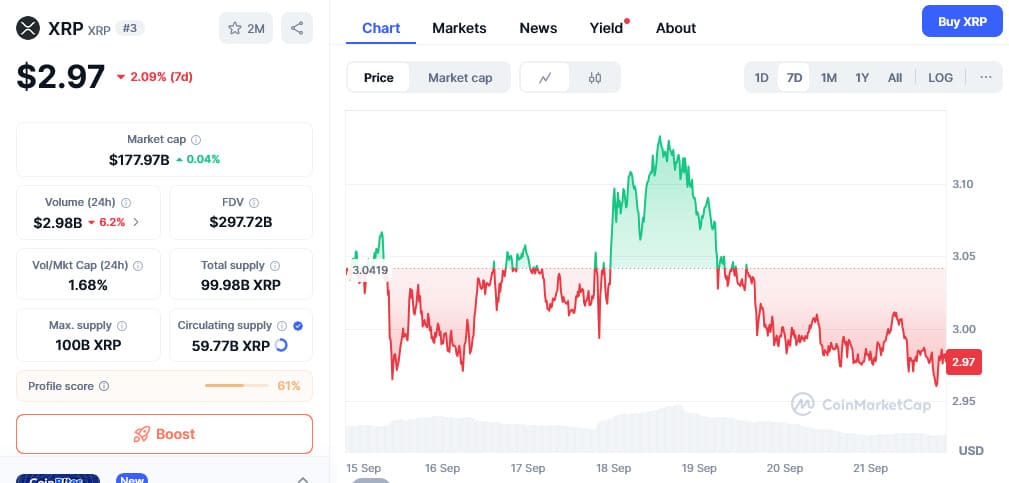

Can XRP be affected by interest rate policy?

XRP has given back some recent gains as September draws to a close. Market commentary has linked recent moves to broader macro factors, including interest rate expectations, but short-term volatility has remained a feature of the asset.

XRP now stands at $2.97 following a 2.55% drop over the past week. The 30-day XRP price chart also shows a similar fall.

Some investors believe interest rate cuts can influence risk-asset appetite, including crypto. However, whether that translates into sustained inflows or price moves for specific tokens is not predictable.

PayDax Protocol (PDP): stated DeFi lending and borrowing plans

PayDax Protocol (PDP) describes itself as a project focused on crypto-backed borrowing, lending, and related services. The project says it aims to address gaps in access to these services, though the extent to which it can do so would depend on adoption, execution, and market conditions.

According to project materials, PayDax is built on Ethereum and is intended to support peer-to-peer (P2P) lending with crypto used as collateral, including loan-to-value (LTV) settings. The project also advertises yield figures for different activities (including lending and staking), but such rates are not guaranteed and can change based on protocol design, demand, and risk events.

PayDax also describes a “Redemption pool” mechanism intended to address loan defaults. The project additionally advertises yields for staking and leveraged yield-farming features; readers should treat these figures as project-provided marketing information rather than a prediction of future returns.

PayDax Protocol (PDP) vs XRP: what is being claimed

PayDax Protocol (PDP) has promoted its infrastructure and partnerships. For example, the project states that users will have access to real-time price feeds from Chainlink and that it has partnerships involving asset custody. PayDax also links to a smart contract audit by Assure DeFi.

As with any early-stage crypto project, independent verification and ongoing security review are important. Readers should also note that XRP and newer DeFi protocols differ substantially in maturity, adoption, and risk profile, so comparisons are not straightforward.

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. The article discusses a token sale and project-provided claims; readers should do their own research and carefully consider risks before making any decisions.