With a greater preference toward altcoins throughout this month, the trading volume of Dogecoin (DOGE) has hit a 16-week high. July 2023 belonged to altcoins as a result of the ruling in favor of Ripple in its legal battle with the SEC.

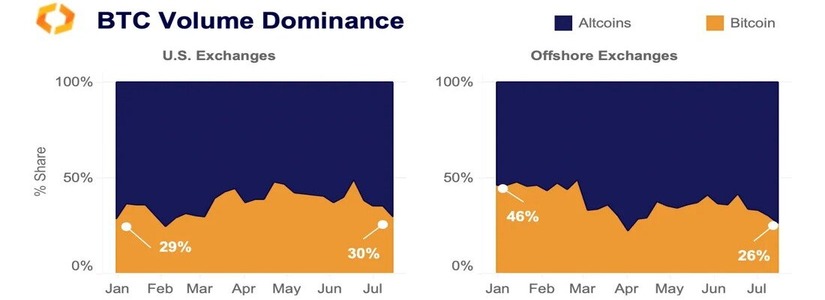

As altcoins continued to stay under the limelight, the world’s largest crypto by market cap, Bitcoin (BTC) had to suffer with a continuously dropping trading volume. Based on data shared from Kaiko, overall Bitcoin trading dominance stands at approximately 27% across the top 25 cryptocurrency exchanges. With that in mind, the token’s dominance currently stands at its lowest level since April of this year.

Investors Choose Dogecoin and Other Altcoins Over Bitcoin

Considering how investors have flocked toward altcoins throughout this past month, Dogecoin has been a hot topic lately. At the time of writing, Dogecoin (DOGE) has surged by an impressive 4.78% within the previous 24 hours. The surge has pushed the trading price up to almost $0.07713, and the market cap of Dogecoin currently stands at the $10 billion mark. The recent surge has enabled the meme coin to topple Cardano to become the seventh-largest token by market cap.

The data confirms that Dogecoin trading volumes have touched a 16-week high, and it can be assumed that investors have been displaying a greater preference for the token. As long as altcoin liquidity is concerned, it can be used to refer to the ease of buying and selling these cryptos. However, it has seen a minor increase since the beginning of this month.

Based on the ongoing situation, it is fairly easy to understand that Bitcoin-related investments have become less popular among investors. As per the data shared by Coinshares Head of Research, James Butterfill, Bitcoin investment products saw outflows totaling $13 million for the week. These outflows inevitably reversed the inflows of approximately 5 weeks.

Butterfill further stated that Ether’s investment products were the best performers last week, which led to inflows of almost $6.6 million, whereas XRP resulted in inflows of $2.6 million. Despite the change of heart of investors, Bitcoin continues to be a dominant digital asset investment product. As of now, Bitcoin is down by 2.37% in the previous 24 hours and is trading for $29,137.