TL;DR:

- Dogecoin is trading near $0.107, facing an unusual “double death cross” configuration.

- The 23-week and 50-week moving averages threaten to cross below the 200-week exponential moving average.

- Analysts warn that failing to reclaim $0.153 could push the asset into a phase of high volatility.

The memecoin segment is experiencing a moment of high technical tension that could define its future for the remainder of 2026. Currently, the debate centers on the Dogecoin death cross and DOGE price action, following the formation of a rare bearish pattern on the weekly chart.

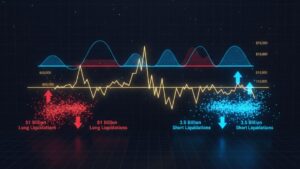

The asset is currently trading around $0.107, struggling to stay above the support levels established during October’s mass liquidations. However, the emergence of a double moving average cross suggests that selling pressure could intensify in the coming weeks.

A death cross occurs when shorter-term simple moving averages—in this case, the 23-week and 50-week—head dangerously toward a cross below the long-term 200-week exponential moving average. Given this phenomenon, technical analysts consider this configuration a warning signal that investors should not ignore.

Critical Levels and the Potential Capitulation Scenario

To avoid a major collapse, bulls must push the asset’s value above the final resistance located at $0.153. If the memecoin fails to break this barrier decisively, a period of chaotic volatility is likely to be triggered, testing the community’s patience.

Typically, a single death cross has triggered drops between 15% and 30% in previous memecoin cycles. In this regard, the proximity of a double cross near multi-month lows makes the threat much more severe for long-term holders.

In summary, the outlook for DOGE is worsened by the lack of buying volume and the absence of significant moves by “whales.” Unless an unexpected rally occurs before the end of February, the technical chart suggests that the most difficult days for the coin are yet to come.