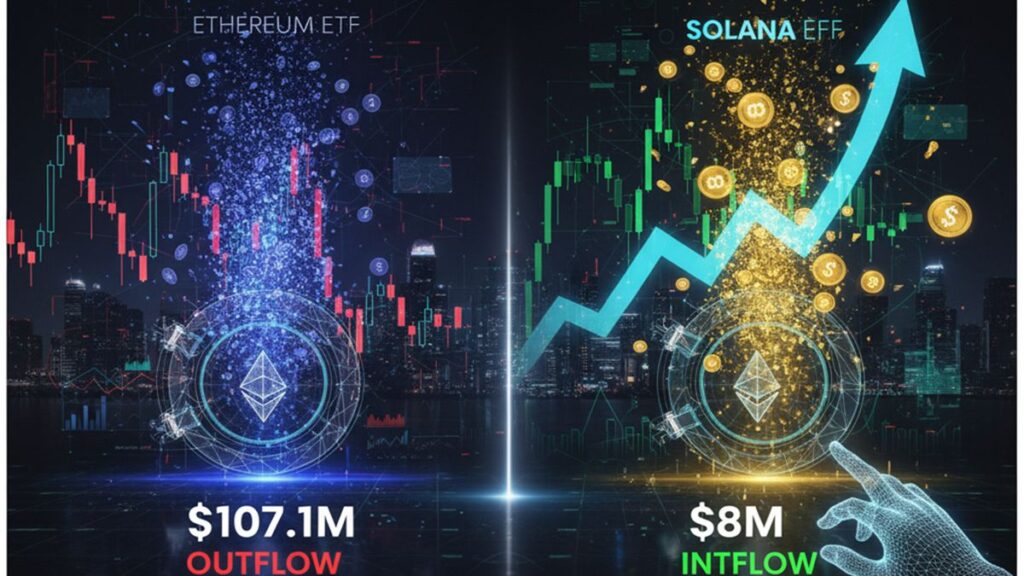

Today, the market has shown a clear institutional divergence. While on Tuesday Bitcoin exchange-traded funds (ETFs) rebounded, recording net inflows of $524 million, the highest daily amount since their all-time high reported in October. BlackRock led with $224.4 million, followed by Fidelity. However, the landscape for altcoins was different, showing a clear bifurcation: Ethereum ETFs suffered massive outflows of $107.1 million, while Solana products managed to attract an additional $8 million, with Grayscale’s fund surpassing Bitwise’s for the first time.

The renewed interest in Bitcoin comes after its worst 30-day flow period since March of this year, marked by market deleveraging. Vetle Lunde, Head of Research at K33, describes the recent selling pressure as a “temporary derisking” and anticipates a recovery in flows.In contrast, Ethereum’s red streak totals nearly $615 million in withdrawals this month, evidencing investor fatigue compared to the sustained accumulation in the new Solana funds, which now total $350.5 million since their debut.

Despite the optimism in the pioneer crypto, Timothy Misir of BRN warns that demand remains “cautious and episodic.” To break the key resistance of $108,000 – $110,000, a more consistent and broader capital flow than the current one will be necessary. Investors should watch if the accumulation trend in Solana holds up against the continued weakness of Ethereum ETFs, and if smaller cap funds like HBAR and Litecoin manage to gain traction.

Source: https://farside.co.uk/eth/

Source: https://farside.co.uk/sol/

Disclaimer: Crypto Economy Flash News is produced using official and public sources verified by our editorial team. Its purpose is to provide rapid updates on relevant events within the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendations. We recommend always verifying details through each project’s official channels before making any related decisions.