As the market downturn continues, readers are increasingly comparing established crypto assets with newer projects that are still early-stage. Ripple’s XRP and Solana (SOL) are among the most widely followed cryptocurrencies and rank within the top 10 by market capitalization.

However, Digitap ($TAP) is a lesser-known project that describes its product as an “omni-bank.” Supporters argue it could compete on product direction and usability, though outcomes are uncertain and depend on execution, adoption, regulation, and broader market conditions. The project’s stated focus is consumer-facing banking features alongside crypto functionality.

Digitap’s stated utility and product scope

One long-running challenge for the industry is day-to-day usability and consumer spending. Digitap says it aims to address this by offering a banking-style app that supports both fiat currencies and cryptocurrencies.

According to the project, the platform enables users to open a digital account that can hold multiple fiat currencies and cryptocurrencies. It also claims to support a Visa-branded debit card feature, though availability and terms can vary by jurisdiction and provider.

Digitap also states that users can pay with a physical card or through mobile wallet payments at participating merchants. The project describes this as involving conversion from crypto to fiat at the point of purchase, which may carry fees, slippage, and other limitations depending on the transaction and local rules.

Token supply and buyback/burn mechanics (project-reported)

Digitap is conducting a token sale for its native $TAP token. The project reports that the token’s sale price has increased over time (from $0.0125 in late summer to $0.0313 at the time of the materials referenced here) and that the sale is organized in multiple rounds with different pricing. It also reports that $2.06 million worth of $TAP has been sold.

The project has also stated that earlier rounds have sold out more quickly than earlier fundraising periods, though such trends can change and do not indicate future demand or performance.

Digitap says $TAP has a maximum supply of 2 billion tokens. For context, supply design differs widely across networks, and capped supply alone is not a guarantee of scarcity-driven price effects.

Digitap also describes a model in which 50% of platform profits would be allocated to buy back and burn $TAP and to reward stakers. These mechanisms, if implemented, depend on revenue generation, governance or team decisions, and execution; they may change over time.

XRP’s bank-focused strategy and stablecoin competition

XRP, the native token of Ripple’s payment network, is frequently discussed in the context of cross-border payments and financial-institution use cases. Ripple has announced partnerships with banks and also launched its RLUSD stablecoin to broaden potential usage.

However, competing in interbank and cross-currency transfers can be challenging, with multiple traditional and crypto-native alternatives targeting the same market.

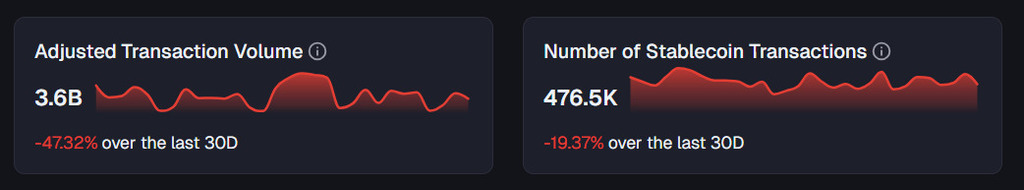

Separately, the chart referenced below cites a 19.37% decrease in stablecoin transactions over the past 30 days and a 47% drop in adjusted transaction volume, based on Artemis data shown in the graphic.

Source: Artemis

Solana’s network activity and market sensitivity

Solana is a widely used smart-contract network that has attracted activity across DeFi, NFTs, and consumer applications. Its token price has also been volatile, including a decline of nearly 50% over the period referenced here.

Some on-chain and ecosystem indicators have remained active. For example, DefiLlama shows total value locked in DeFi at $9.275 billion, up from around $6 billion in March and roughly within this year’s range. ARK Invest has also published an estimate placing Solana’s Q3 “real economic value” at $223 billion; estimates vary by methodology and should be interpreted cautiously.

Solana’s trading activity can be strongly influenced by macroeconomic uncertainty and broader risk sentiment, alongside network-specific developments.

More broadly, some market participants have shown interest in projects that emphasize consumer payments or banking-style functionality, although the success of such approaches is uncertain.

Source: DefiLlama

Comparing focus areas: payments infrastructure vs consumer banking features

XRP and Solana are established projects with different goals: XRP is commonly associated with institution-oriented payments, while Solana is known for high-throughput smart contracts supporting DeFi and applications. As more mature assets, their market behavior may be more closely tied to broader crypto conditions than to a single product narrative.

Digitap, by contrast, is positioning itself around consumer-facing banking access and retail payments, according to its own materials. Whether it can execute at scale remains uncertain, and newer projects typically carry higher risks, including operational, regulatory, liquidity, and technology risks.

Project website (for reference): https://digitap.app

Social (for reference): https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.