TL;DR

- An ECB study reveals that most Europeans see no value in the digital euro and prefer traditional payment methods.

- Despite massive education attempts, citizens remain skeptical about the benefits of the digital euro.

- In the U.S., lawmakers warn that CBDCs pose a threat to privacy and emphasize the need to promote cryptocurrencies and stablecoins as decentralized alternatives.

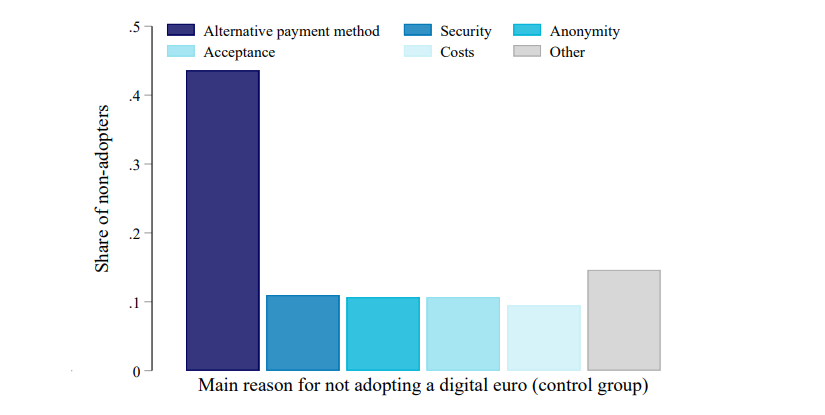

A new report from the European Central Bank (ECB) has confirmed what many already suspected: European citizens have no interest in the digital euro. The study, which surveyed 19,000 people in 11 eurozone countries, shows that the adoption of a digital euro faces serious difficulties. When asked how they would allocate a hypothetical amount of €10,000, respondents assigned only a small fraction to the digital version of the currency, favoring cash and conventional bank accounts.

The document also highlights a key problem for the ECB: citizens see no advantage in using a CBDC when multiple efficient payment methods already exist, both online and offline. In fact, researchers concluded that convincing Europeans of the need for a digital euro will be an enormous challenge.

Concerns About Privacy and Financial Control

Beyond the lack of interest, rejection of the digital euro also reflects growing concerns about state surveillance and financial control. In the United States, Congressman Tom Emmer has reintroduced the “CBDC Anti-Surveillance State Act”, a bill aimed at prohibiting the creation of a government-controlled digital dollar. According to Emmer, CBDCs go against the values of financial freedom and privacy.

Resistance is also growing in Europe. Cryptocurrency advocates warn that the digital euro would not only be unnecessary but could also become a tool for mass control. Unlike cash, a CBDC would allow the ECB to track all transactions in real time, which many see as a severe threat to citizens’ financial autonomy.

Cryptocurrencies and Stablecoins: The Real Alternative to the Digital Euro

While the ECB struggles to justify the existence of the digital euro, cryptocurrencies continue to gain ground as a solid and decentralized alternative. Bitcoin, Ethereum, and stablecoins like USDT and USDC keep expanding as reliable payment options, without the need for excessive government oversight.

The failure of the digital euro before its launch is not just a setback for the ECB but a clear sign that citizens prefer decentralized solutions free from state intervention. Instead of investing in a system no one wants, perhaps it is time for regulators to accept that the future of money is already here, and it’s called crypto.