TL;DR

- Changpeng “CZ” Zhao, Binance’s co-founder, criticized the exchange’s token listing strategy, highlighting vulnerabilities.

- CZ pointed out the risks of the current four-hour window between listing announcements and live trading.

- To address these issues, CZ proposed a more automated listing process similar to DEXs and suggested alternative token distribution models.

Changpeng “CZ” Zhao, the co-founder and former CEO of Binance, has publicly criticized the exchange’s token listing strategy, calling it “a bit broken” due to vulnerabilities that enable market manipulation and unfair trading practices.

In a series of candid posts on X, CZ highlighted the risks posed by the current four-hour window between listing announcements and live trading, which he argues creates opportunities for price surges on DEXs before CEX trading begins.

CZ emphasized that this short gap allows advanced traders to exploit price discrepancies. “They announce, then list four hours later. The notice period is necessary, but in those four hours, token prices go high on DEXes, and then people sell on CEX,” he explained, urging traders to “beware” of such dynamics.

The TST Token Controversy: A Case Study in Market Frenzy

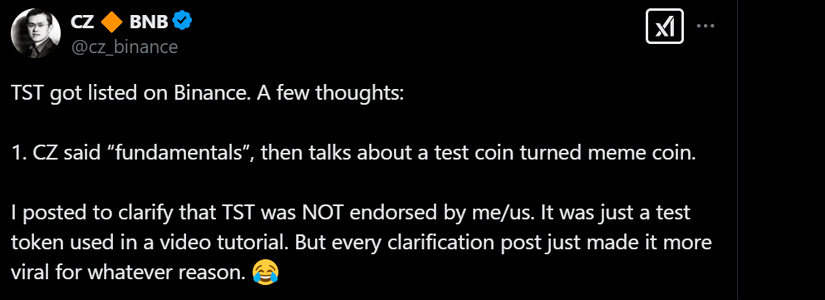

The critique follows the unexpected rise and crash of the Test Token (TST), a meme coin created purely for educational purposes in a BNB Chain tutorial video. Despite CZ clarifying that TST was “not an official token” and had “no endorsement” from Binance, the token’s brief appearance in the video triggered a speculative frenzy.

Chinese influencers amplified the hype, propelling TST’s market cap to $489 million before it plummeted over 50% within hours. CZ distanced himself from the listing decision, stating he is “entirely NOT involved” in Binance’s current operations. However, he acknowledged that his attempts to clarify TST’s purpose inadvertently fueled further speculation.

Proposed Fixes: Automation and Decentralized Fair Launches

To address these issues, CZ advocated for a more automated listing process akin to DEXs, which could reduce manual interventions and level the playing field for investors. “CEX should list (almost) everything automatically, just like DEX,” he tweeted, suggesting this approach would minimize price manipulation and improve transparency.

The discussion also turned to alternative token distribution models, such as the Hyperliquid (HYPE) project’s decentralized airdrop, which bypassed centralized exchanges entirely. Valued at $7.5 billion, HYPE’s fair launch on its own blockchain has been hailed as a potential blueprint for equitable token distribution.