TL;DR

- Changpeng “CZ” Zhao emphasized that crypto projects are not required to pay listing fees, highlighting that exchanges should list tokens based on merit.

- Decentralized platforms like Hyperliquid offer permissionless listing alternatives where only gas fees are needed.

- While Binance remains a top choice for liquidity and exposure, the debate over listing fees and token airdrops has sparked discussions about fair access and alternative trading infrastructure.

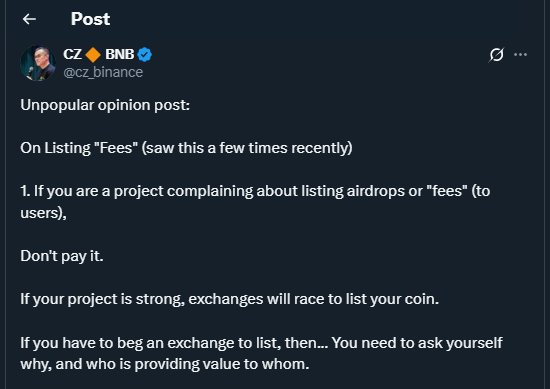

Binance founder Changpeng “CZ” Zhao recently addressed concerns about the exchange’s listing fees, clarifying that crypto projects are under no obligation to pay. The announcement comes amid growing scrutiny of Binance’s practices, with reports suggesting the exchange sometimes requests up to 10% of a token’s supply for listing. Zhao highlighted that good projects may branch out independently, as centralized exchanges evaluate tokens primarily on their potential and quality rather than mandatory payments.

Projects Pursuing Permissionless Alternatives

The debate also brought attention to decentralized platforms such as Hyperliquid, which allows projects to list tokens with no upfront fees, paying only gas costs. Hyperliquid’s system is designed to give new projects complete autonomy over trading exposure, although liquidity remains lower compared to major centralized exchanges. This approach is particularly appealing to projects seeking transparency and reduced dependency on centralized intermediaries. Several emerging projects have already started leveraging these platforms to reach niche audiences and to maintain community trust without significant financial burden.

Multiple project founders previously shared experiences where Binance requested not only listing fees but also token airdrops and additional cash guarantees. While these practices are seen as part of Binance’s business model, Zhao emphasized that alternative routes exist for projects that prefer less costly or more decentralized options.

Binance’s Position in the Market

Despite the controversy, Binance continues to be a preferred exchange due to its high liquidity and global reach. Many newly listed tokens also perform airdrops to BNB holders, offering additional exposure to existing Binance investors. Critics argue that some of these projects can experience volatility post-listing, often relying heavily on market makers to maintain price stability. In addition, Binance has continued to innovate, offering new trading pairs, advanced derivatives, and staking options that keep both retail and institutional traders engaged.

Even with these discussions, Binance’s influence remains significant in the crypto space. Listing fees and additional contributions are seen by some as standard in the industry, but the openness to alternative listing methods underscores a broader trend toward increased transparency and choice for emerging projects. Zhao’s comments reflect an evolving ecosystem where both centralized and decentralized pathways coexist, allowing developers to select the strategy best suited for their token’s growth and sustainability.