TL;DR

- Long-term investors have steadily increased their realized capital beyond $20 billion, clearly indicating a strong accumulation phase.

- Binance has significantly raised its Bitcoin spot market share from 26% to 35%, firmly taking the lead in global trading volume.

- More than 20,000 BTC have exited major exchanges such as Kraken and Bitfinex within just two days, signaling that investors are actively moving their assets into cold storage.

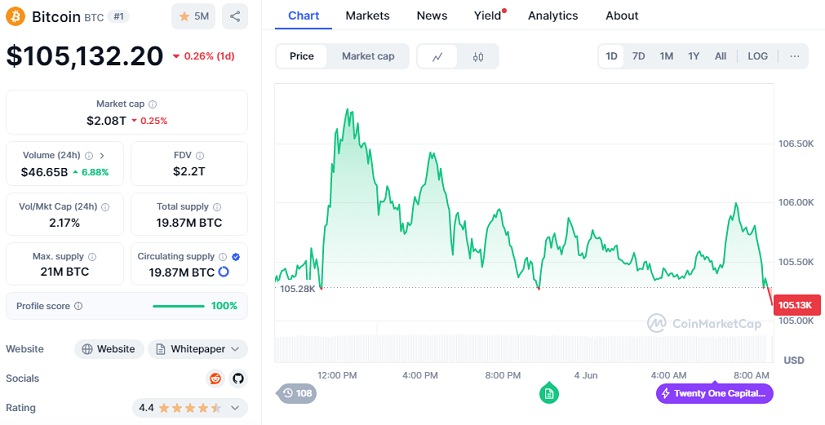

Bitcoin is currently undergoing a critical phase in its ongoing bullish trajectory, consolidating steadily around $105,132.20 with a 24-hour performance of -0.26%, according to recent market data. Despite this 6% retracement from its all-time high of $112,000, on-chain metrics reveal a quiet but consistent strengthening in its overall market structure. Its current market capitalization stands at $2.08 trillion, reaffirming its dominant status as the leading digital asset. A key focal point is Binance, which has increased its share of the BTC spot market from 26% to 35% since early June. This significant uptick in activity suggests that traders are increasingly choosing Binance to execute large volume trades, coinciding with pivotal moments of technical resistance in Bitcoin’s price movement.

Long-Term Investors Reaffirm Their Confidence

CryptoQuant data shows that the “realized cap” of long-term holders — those who have held BTC for over 155 days — has now surpassed $20 billion. This metric rises only when these participants are actively buying, not selling. Often referred to as “strong hands,” they tend to accumulate steadily during dips and hold their positions through volatile market periods. Their renewed market presence with an accumulative stance has historically been a positive signal for future price behavior.

In parallel, addresses holding between 1,000 and 10,000 BTC have added 78,000 BTC over the last 30 days. Since March 11, when Bitcoin briefly dipped below $78,000, this group has increased its total holdings by 200,000 BTC, reaching an impressive 3.5 million coins in total. These significant movements reinforce the narrative of persistent accumulation, even after new all-time highs are reached.

Exchange Outflows Strengthen the Bullish Outlook

In just two days, exchanges such as Kraken and Bitfinex have recorded net withdrawals exceeding 20,000 BTC. These outflows, likely directed to cold wallets, indicate an intent to keep the assets out of immediate sell-off circuits. When BTC reserves on exchanges decline, selling pressure diminishes and, if demand remains steady or rises, the price tends to respond with a quicker upward reaction.

The combination of reduced supply, increased accumulation by strategic holders, and a tense macroeconomic environment is creating favorable conditions for the continuation of the bullish cycle.