Cryptocurrency prices are trading sharply higher after a beatdown for quite some time now. Bitcoin (BTC) reclaimed some of its mojos as the digital token breached $20K over the day. Ethereum (ETH) along with most altcoins noted a significant rise after the hotly anticipated Ethereum Merge.

What is the Current State of the Market?

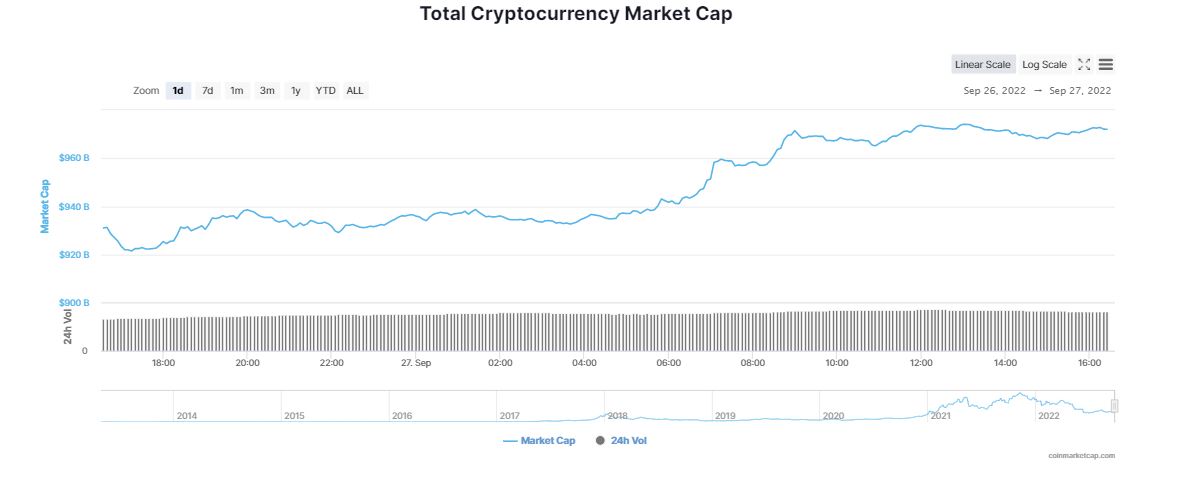

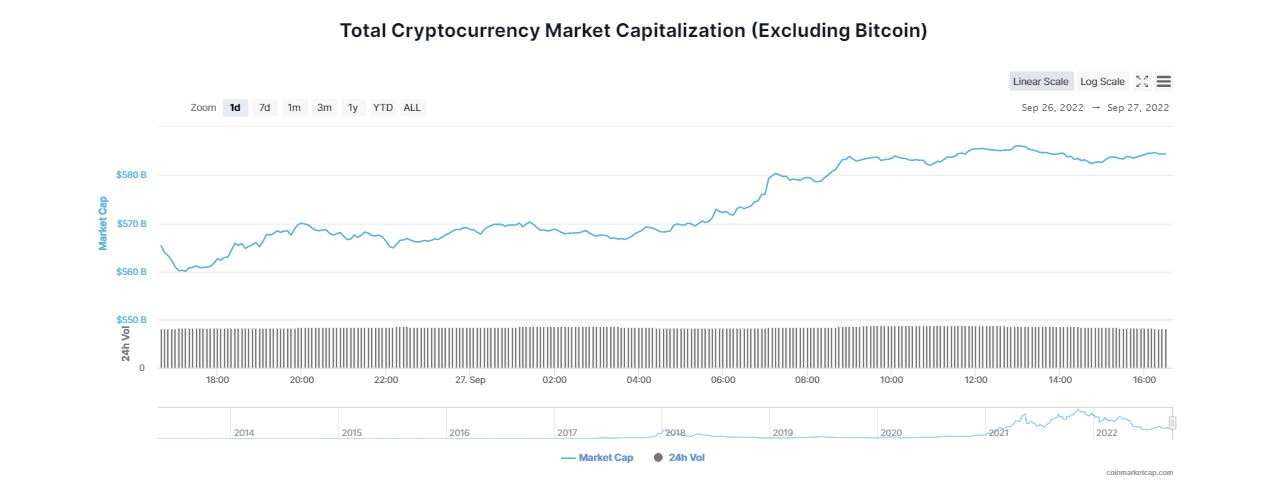

At the time of writing the global crypto market cap soared 4.19 per cent in the last 24 hours to $970.27 billion. Investors can heave a sigh of respite as most of the digital tokens have posted sharp gains. After the much-hyped Ethereum merge, the crypto market went into a free fall plunging below $1 trillion. As macroeconomic factors deteriorated, so did cryptocurrencies. In a bid to tame rising inflation, the Federal Reserve, announced another big rate increase last Wednesday.

According to CoinMarketCap, the total volume in DeFi is currently $5.67 billion, 6.85 percent of the total crypto market 24-hour volume. The volume of all stablecoins is now $76.01B, which is 91.83 percent of the total crypto market 24-hour volume. Despite the rise, the total crypto market volume decreased more than 26 percent over the last 24 hours to $82.77B.

Bitcoin Breaches $20K

Bitcoin (BTC) has finally breached the psychological level of $20K gaining 5.82 percent in the past 24 hours. The bellwether token is trading at $20,230 at print time, after creating a massive bearish engulfing candlestick, last week. BTC zoomed past over 5 percent in the last 7 days rising in tandem with the equity markets. Edul Patel, CEO at crypto platform Murudex explained,

“Most cryptocurrencies rose on Monday in counter to the equity markets. After dipping in the past week, Bitcoin rose by nearly 5% each. As buyers could fix the BTC initiative above the US$19,000 level, the next resistance would be at $20,600.”

Will ETH Return to the $1300-$1400 Level?

On the other hand, Ethereum (ETH), also surged more than 5 percent over the last 24 hours to currently hover at $1,387. There was a lot of anticipation about Ethereum’s much-awaited Merge in the crypto and blockchain industry. However, to everyone’s surprise, Merge was unable to boost the price of the leading altcoin tanking nearly 25 per cent.

However, Ether is up almost 2.37 percent over the last 7 days, regaining its psychological support at $1,300. Patel added,

“The supply of the token has increased by 8,400 ETH as it transitioned from PoW to PoS. We might likely see a mid-term growth if the price of Ethereum returns to the $1,380-$1,400 level.”

Can Cryptos Maintain the Momentum?

Meanwhile, the performance of top altcoins improved as Solana, Polygon, Avalanche, Polkadot, Litecoin, and Cardono prices were trading with gains over the last 24 hours. Within the same time range, UniSwap (UNI) exploded by more than 15 percent to trade at $6.58. Popular memcoins, Dogecoin (DOGE) and Shiba Inu (SHIB) rallied 2.16 percent and 3.79 percent, respectively.

However, analysts believe that the recovery might be short-lived amid the macroeconomic turbulence and rising fears of recession. Joshua Fernando, crypto expert, and CEO of eCarbon, a blockchain tech company suggested that aggressive rate hikes are not positive for crypto prices. He further explained investors are pulling away from risky assets in response to rising interest rates, surging inflation, and a potential recession. In a statement Fernando said,

“If the Fed signals strong rate hikes through 2023, expect more pain in the markets.”