Ethereum Sets All-Time High With 8.7M Smart Contracts Deployed in Q4 2025

TL;DR Ethereum recorded 8.7 million contracts in the fourth quarter of 2025, an all-time high that reflects real network usage and an expansion in on-chain development.

Ethereum, the decentralized platform created by Vitalik Buterin and its cryptocurrency Ether [ETH] is considered the second largest cryptocurrency in the world after Bitcoin and that is why news about Ethereum is one of our priorities.

It was launched on July 30, 2015 and one of the main characteristics of this cryptocurrency is the possibility of creating smart contracts, which are capable of securing, executing and enforcing agreements between two or more parties.

In this section you will have access to all the latest news related to Ethereum, improvements in the project, alliances with companies and other news that happen every day and on Crypto-Economy we want to make them arrive to you as soon as possible.

TL;DR Ethereum recorded 8.7 million contracts in the fourth quarter of 2025, an all-time high that reflects real network usage and an expansion in on-chain development.

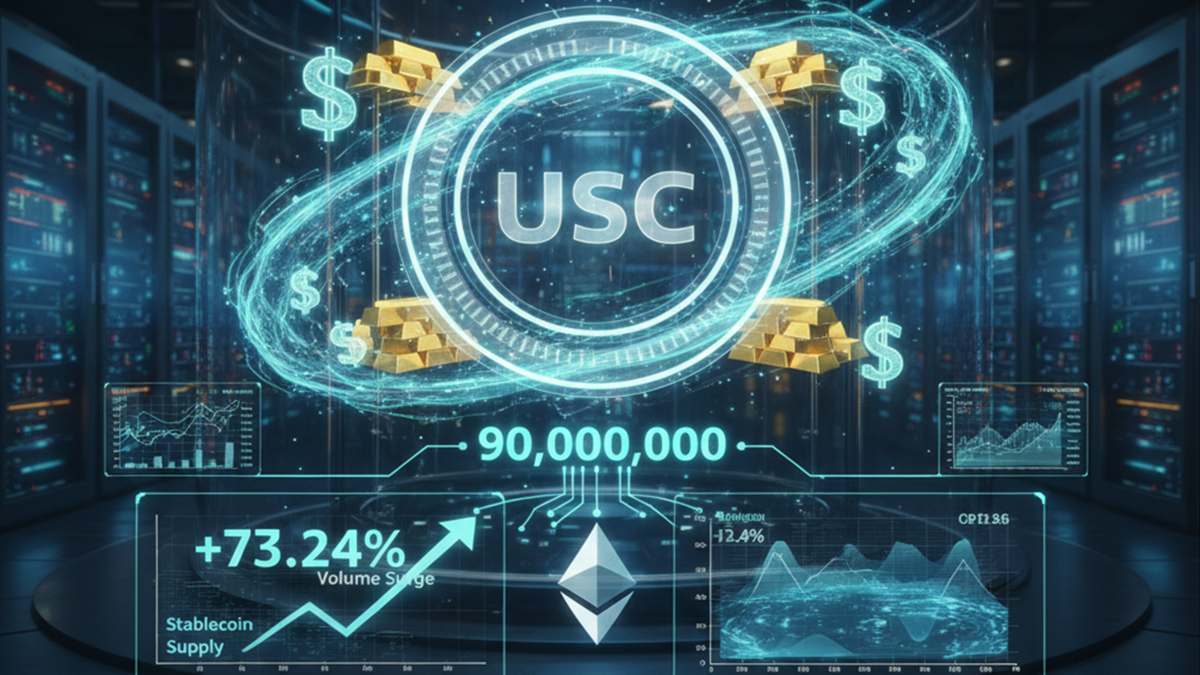

TLDR Whale Alert reported the creation of 90 million USDC, although Circle has yet to issue an official confirmation. USDC trading volume skyrocketed by 73.24% in

TLDR Benjamin Cowen suggests that a Bitcoin bear market would stall ETH’s growth. Fundstrat projects a possible Ethereum correction toward the $1,800 – $2,000 range. The

TL;DR: Over 40% of Ethereum supply is underwater; supply in profit fell from 75% to 59% as ETH traded $2,973.78. Whales diverged: Erik Voorhees moved 1,635

TL;DR: Deribit’s combined monthly, quarterly, and annual expiry totaled $28B in notional value, the biggest on record. 267,000 BTC options expired with a 0.35 put-to-call ratio,

TL;DR Ethereum hit 1,913,481 L1 transactions in one day with $0.16 average fees, showing demand can clear without pricing out users. Fusaka increased block size 33%

TL;DR Hayes shifted ETH to exchanges in December via steady on-chain transfers, rotating risk while building a sizable stablecoin buffer. Lookonchain flagged 682 ETH to Binance

TLDR Recent Dune Analytics data shows unusual spikes in full withdrawals across leading platforms such as Lido, Binance, and Frax Finance. Despite weekly volatility, the net

TL:DR: US spot Ether ETFs drew $84.6M Monday, snapping seven-day outflows after $700M left last week; cumulative net inflows sit near $12.5B. XRP products took in

TL;DR BitMine expanded its ETH treasury after watchers flagged about $88 million in flows; a filing said it bought 98,852 ETH last week. Observers tied the

Ads

Follow us on Social Networks

Crypto Tutorials

Crypto Reviews

© Crypto Economy