Cryptocurrency and Web3 use cases continue to rise across the world, especially in the European Union (EU) and Japan, despite regulatory uncertainty in the United States. Countries are pushing digital assets adoption to offer solutions to the everyday problems, faced by individuals and businesses.

European Union Sees Prolific Growth in Crypto

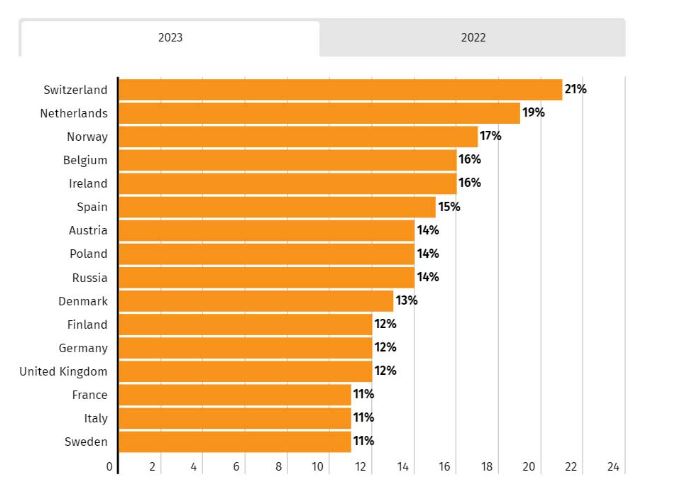

The adoption of crypto along with Web3 is increasing gradually, and Europe is no exception to this trend. Although rates vary across Europe, in most of them, between 12% and 16% of the population uses or owns digital coins. According to a recent survey, Switzerland has the highest crypto adoption rate of all European countries, reaching 21% in 2023.

Numerous factors such as a supportive regulatory framework, the growing community of blockchain enthusiasts, and state-of-the-art infrastructure have helped the EU to grow in the world of digital assets. It is expected the growing adoption of cryptocurrencies in Europe to continue this year, with more people than ever using or owning digital coins.

In the latest developments, Spanish private bank A&G launched a crypto investment fund offering to bolster crypto adoption in the country. As per a local report, A&G will launch an investment fund product after registering the fund’s brochure with the regulatory National Securities Market Commission (CNMV). It seems the fund will have exposure to both Bitcoin (BTC) and Ethereum (ETH).

According to the report, the bank said investors had expressed “great interest” in crypto investment, citing, “crypto investment can be channeled with more efficient risk management and control, via investment products that are safer and better regulated.” It seems the fund will be the first of its kind in Spain, giving investors and traders exposure to the new asset class.

Banks in EU Ramp Up Crypto Offerings

Recently, French bank Societe Generale became the first company in the county to obtain a license for crypto services. According to the website of France’s AMF market regulator, Societe Generale’s crypto unit, Forge, will offer services, including crypto custody, trading and sales.

SocGen’s blockchain unit receives the first license issued under France’s new crypto rules, ramping up the investment bank’s expansion into digital assets https://t.co/t0pPgWKkFP

— Bloomberg Crypto (@crypto) July 19, 2023

In March, Deutsche WertpapierServiceBank (Dwpbank) took an important step with the launch of its wpNex crypto trading platform, giving nearly 1,200 banks and savings banks in Germany access to the digital asset industry.

Earlier this year, Austrian-based crypto exchange Bitpanda revealed it is teaming with Coinbase (COIN) to connect the U.S.-listed exchange giant with banks in Europe who are looking to offer digital assets to their customers.

EU’s Fast Track Capital Rules for Digital Assets

Furthermore, in June 2023, the European Union reached a political agreement on new bank-capital legislation, including regulations for crypto-assets. The negotiations, chaired by Swedish finance minister Elisabeth Svantesson, centered on concerns about unbacked crypto assets entering the financial system and the need for more stringent capital adequacy rules.

EU calls for fast-track crypto capital rules for banks https://t.co/0ubMnjATBs pic.twitter.com/Tt8TXQnCSD

— Reuters (@Reuters) February 20, 2023

These developments indicate how the EU is finalizing its own capital adequacy rules for crypto to boost crypto adoption. Meanwhile, in the United States, the Securities and Exchanges Commission (SEC) is locked in several legal battles with crypto exchanges over whether crypto assets should be defined as securities.

Japan Witnesses Impressive Rise in Web3 Adoption

In another part of the world, Japan’s Prime Minister Fumio Kishida is ramping up efforts in the Web3 landscape. Speaking at the WebX a web3 conference in Tokyo, the Japanese PM said that the country’s annual broad policy outline includes measures that take user protection into account while also improving the environment for utilizing Web3 tokens and revitalizing the content industry, highlighting, “Web3 is part of the new form of capitalism.”

Japan has been dabbling with the digital assets world for a long time, now they decide to bet on web3. The land of the rising Sun has ties to the crypto and blockchain industry that date back to 2010. This was the year when one of the world’s first and largest crypto exchanges, Mt. Gox, was launched. Since then, Japan has taken giant strides to become one of the leaders in the blockchain space.

Regulatory Turbulens Continue in the US

Not just the European Union or Japan, but numerous other countries are actively pursuing the crypto dream. Many countries have been quite constructive in over-regulation, attracting attention from scores of crypto-focused companies. The regulatory turmoil in the US is pushing many companies including Coinbase to think of moving out of the country.

In a statement, Peter Smith, chief executive of London-based Blockchain.com explained how other countries were taking advantage of the void left by the US where some regulators were “openly negative about crypto”. He added,

“It has opened up opportunities for other countries. France, Portugal, the United Arab Emirates, Singapore, Hong Kong, and London increasingly and interestingly, have all been very excited to take up the slack that the US has created.”