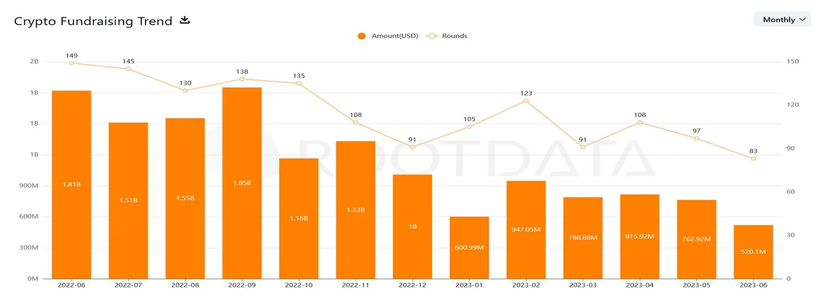

According to the data shared by RootData, it is evident that venture capital investments in crypto firms have declined considerably. The volume has declined significantly during the previous 365 days as the digital asset space received approximately $1.81 billion in funding in June 2022 but received only $520 million this year. At the same time, a total of 83 projects were reported to be registered till now in 2023.

Similarly, the information represents a downtrend for all venture capital firms interested in the cryptocurrency space, regardless of the multiple months that managed increases. When the information is analyzed, it can be assumed that September 2022 set the highest record, with a sum of $1.85 billion in funding with 138 rounds. As long as June of the same year is concerned, it had the highest number of recipients, with almost 149 rounds.

Based on the information shared by the crypto data provider, the infrastructure category still performs better than the rest, as it resulted in the influx of $213 million in funding in June from a total of 26 projects. However, this still represents a 50% decline from the previous influx of $410 million from 28 crypto projects.

Some Crypto Firms and Infrastructures had Great Funding

Centralized Finance, which features a number of companies like OPNX and Chiliz, is the second most funded category as it received a sum of $101 million and resulted in the generation of almost 20% of all financing. The gaming category established third place for itself as it resulted in the influx of $62 million, with more than half of it being flowed into Mythical Games.

Since the previous year, Ethereum had almost 1,826 of its crypto projects funded, followed by Polygon with almost 1,076 funding rounds. RootData crowns Coinbase Ventures as the most active venture investment firm, as it participated in 71 rounds since the previous year. Other firms like Hashkey Capital and Shima Capital participated in 54 and 49 crypto projects respectively.

Considering how venture capital investment in crypto has dropped considerably over a year, a number of analysts suggest that this could be a result of a number of reasons. The turmoil in the banking sector, coupled with the pitfalls of FTX and Terra might be the actors to blame the most. The increased regulatory pressure from the SEC has also prevented investors from investing in crypto projects.