Early-stage token sales are one way some crypto projects raise funds and distribute tokens, but outcomes vary widely and participation can involve significant risk. This article summarizes four projects referenced in the market—Based Eggman, Deepsnitch AI, AlphaPepe, and Nexchain AI—and outlines general considerations people typically review before engaging with a token sale.

Based Eggman Token Sale: Project overview

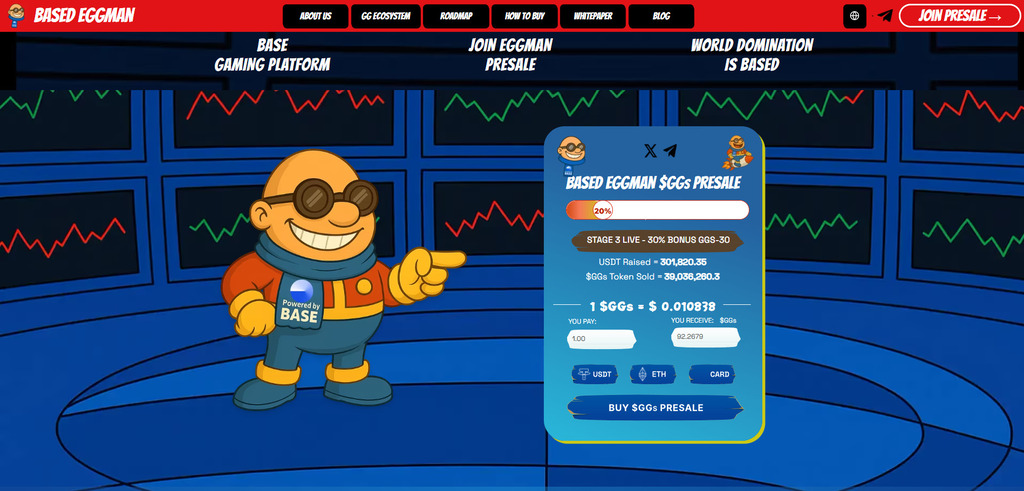

The Based Eggman token sale is presented by the project as an early-stage meme-themed token with additional utilities. As with similar offerings, independent verification of claims and security is important.

Points the project emphasizes

Network choice: The project states it is built on Base (Coinbase’s Ethereum L2), which typically has lower fees than Ethereum mainnet. Network fees and wallet support can still vary by user and time.

Security and disclosure: The project materials refer to measures such as liquidity locking, smart-contract audits, and team transparency. These claims should be checked against primary sources and third-party documentation where available. Comparisons to established assets (for example, long-running meme coins) are not a reliable indicator of future performance, given differences in scale, liquidity, and market conditions.

Nexchain AI Token Sale: The enterprise-grade AI infrastructure narrative

The Nexchain AI token sale is described as an early-stage project focused on bringing artificial intelligence services onto a blockchain environment.

Core proposition: According to project descriptions, it aims to offer decentralized AI-related services (for example, data analysis, automated trading tools, and smart-contract auditing), supported by a native token. Whether such tools are delivered, adopted, or effective is uncertain and should be evaluated independently.

Nexchain AI key features (as described by the project):

-

- B2B focus: The stated utilities are oriented toward developers, trading firms, and other blockchain projects rather than a meme-coin community.

- Target audience: Readers looking at AI-related crypto projects typically assess technical documentation, product status, security reviews, and realistic adoption pathways.

Deepsnitch AI Token Sale: Market-sentiment analytics narrative

Deepsnitch AI is positioned by its materials at the intersection of AI and meme-driven communities, with an emphasis on analytics.

- Core proposition: The project says it intends to use machine learning to analyze social media and on-chain activity to identify emerging trends.

- Key features & considerations: If delivered, such tools could be used by traders and researchers, but accuracy, data quality, and sustained user demand are uncertain. Participation in early-stage token sales can be high risk and is not suitable for everyone.

AlphaPepe Token Sale: Staking-focused meme coin narrative

AlphaPepe is described as a community-driven meme token on BNB Chain with tokenomics designed to encourage holding.

- Core proposition: The project promotes a staking mechanism available to participants and has advertised high APR figures (for example, up to 85%). Such rates are project-set, may change, and should not be treated as guaranteed returns.

- Risk considerations: High advertised rewards can increase token supply and may attract short-term participation, which can affect market dynamics. Readers typically review how rewards are funded, emissions schedules, lockups, and any independent audits.

Participating in token sales: common considerations

Token sale mechanics and eligibility vary by project and jurisdiction. The points below describe common areas people review; they are not step-by-step instructions.

- Wallet and custody: Participation often requires a Web3 wallet. Users are responsible for private-key security, phishing protection, and verifying network compatibility.

- Funding and fees: Token sales may accept different assets (for example, ETH or BNB). Transaction costs and minimums can change and may be higher during network congestion.

- Verification and due diligence: Readers typically confirm they are using the project’s official channels, check contract addresses from primary sources, and look for independent audits or security reviews where available.

- Token distribution and timelines: Projects may use different claim schedules, vesting, and token generation events. These terms should be read carefully because they affect liquidity and transferability.

- Risk and suitability: Early-stage tokens can be illiquid and volatile, and there is a risk of total loss. Legal and tax implications may also apply depending on location.

Reference links for Based Eggman (project channels)

Website: https://basedeggman.com/

X (Twitter): https://x.com/Based_Eggman

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.