TL;DR

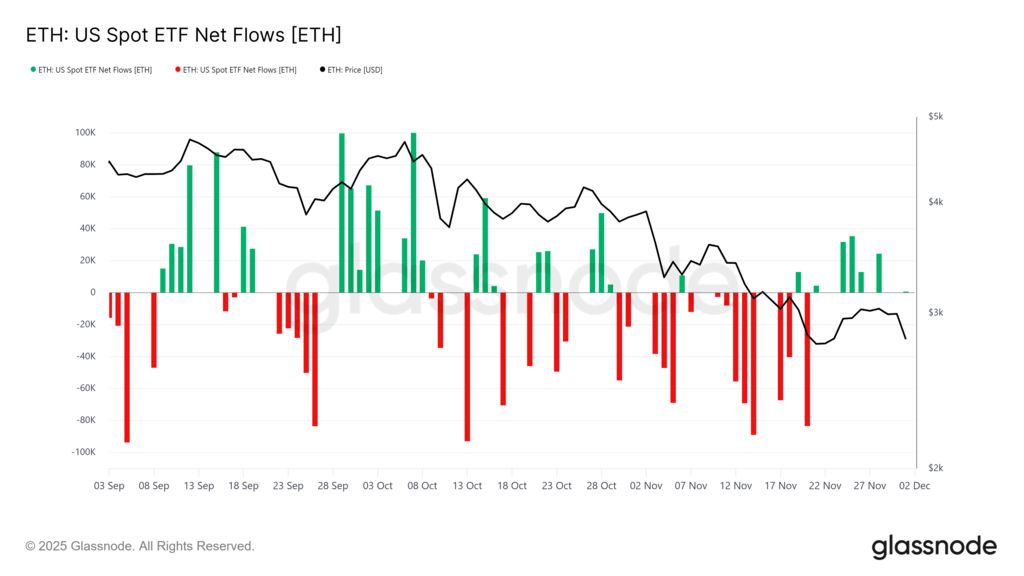

- Ethereum spot ETFs recorded net outflows of $79.057 million for the day.

- BlackRock’s ETHA ETF bucked the trend with a $26.65 million net inflow.

- Grayscale’s ETHE fund led outflows, losing $49.78 million in daily redemptions.

Ethereum spot ETFs end the latest trading day with net outflows of $79.057 million, in a session where weak flows and cautious risk appetite dominate the crypto market. The data underlines pressure on Ethereum-linked listed products, even while investor interest concentrates on a small group of issuers.

Against a soft backdrop, BlackRock’s Ethereum spot ETF, ETHA, posts the strongest performance among peers. The fund attracts $26.65 million in fresh inflows and lifts its cumulative net inflow to $13.174 billion. Market desks treat ETHA as a core instrument for institutional exposure to Ethereum, due to size, liquidity and brand recognition.

On the other side, Grayscale’s ETHE extends a prolonged phase of redemptions. The product records $49.78 million in net outflows in one day and reaches $4.982 billion in cumulative net outflows. Market analysts link ETHE selling to a rotation toward lower-fee Ethereum spot ETFs and to price volatility, prompting position cuts on short time frames.

On an aggregate basis, Ethereum spot ETFs hold $17.209 billion in net assets, a level equal to roughly 5.17% of Ethereum’s market capitalization. Despite recent selling pressure, the segment still shows $12.866 billion in cumulative net inflows, a sign of ongoing investor interest in regulated Ethereum exposure.

Market specialists underline how strong inflows over recent months support the medium-term investment case for Ethereum, even as short-term price action remains fragile. At the same time, the rapid pace of Grayscale ETHE redemptions adds selling pressure to the spot market, especially on days with lower liquidity.

Analysts expect Ethereum spot ETF flows to swing in coming sessions in line with crypto-market volatility and competition among issuers on fees and market depth, while investors monitor whether BlackRock’s ETHA can keep absorbing capital that rotates away from higher-cost products.