For the first time in months, the three biggest names in crypto, Bitcoin, Ethereum, and Ripple, are moving in sync. This signals a wave of renewed optimism across the digital asset market. It has also fueled talk of an early bull-phase revival.

Bitcoin’s rebound above $109,000 has reignited interest among institutions, with Ethereum and XRP attracting new capital. However, does this mean the bull run is starting? Let’s analyze the recent rallies and see if the market is ready to rally.

Bitcoin Leads the Charge

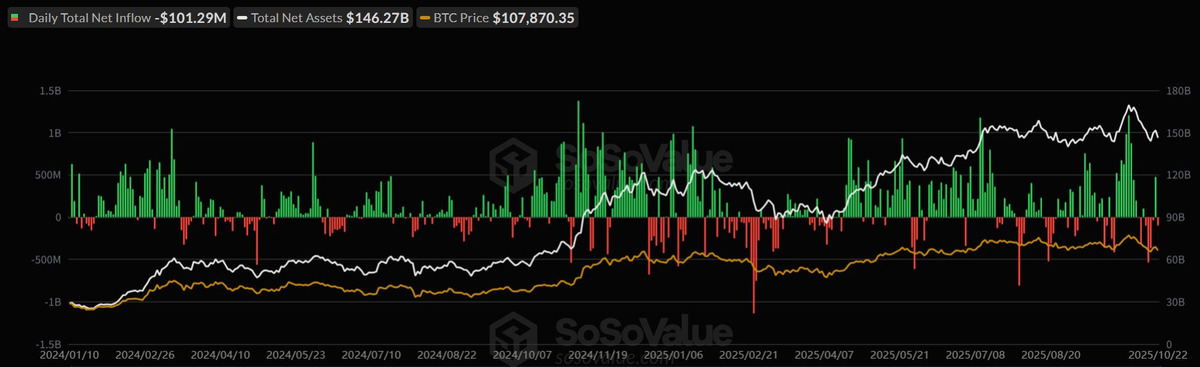

Bitcoin is grabbing the spotlight again. At press time, BTC trades around $110,000. It has recovered modestly after sliding below $107,000 earlier in the week. The recovery has been fragile, however. Spot Bitcoin ETFs saw $101 million in net outflows on October 22.

Source: Wu Blockchain on X

Technically, the $107,000–$108,000 zone is now proving to be a critical line in the sand. A break below could accelerate downside. However, If Bitcoin can sustain its footing and mount further upside, it may reclaim its leadership role in this nascent uptrend.

Ethereum’s Momentum Builds

Meanwhile, ETH is holding firm amid the wider crypto rebound. It’s trading near $3,850 today. Institutional flows are a key driver. ETH ETFs reportedly absorbed $141.7 million even during recent pullbacks, as investors bought the dip.

On-chain data support the move as major wallets continue accumulating. Power users also appear to be diversifying from BTC into ETH.

ETH Forms Bullish Flag Structure|Source: Ether Wizz on X

Technically, ETH is forming a bullish flag structure. Resistance is currently clustered at $4,100–$4,200. If it breaks above that band, momentum could accelerate.

XRP Eyes a Breakout

Similarly, XRP is quietly showing early signs of life amid the broader market uptrend. However, its move isn’t yet as pronounced as BTC or ETH. Currently, XRP sits near $2.40, after a 4% gain in several sessions.

Source: Zach Rector on X

Top XRP analyst Zach Rector has publicly predicted that the next XRP rally “will catch many off guard.” He has set ambitious targets between $5 and $12 by late 2025.

Recent developments also bolster institutional sentiment. Ripple-backed venture Evernorth is preparing to raise over $1 billion via a Nasdaq listing.

If volume holds and macro tailwinds persist, XRP may lead a secondary leg of the rally.

Is the Bull Run Starting?

Despite Bitcoin, Ethereum, and XRP all turning green, analysis suggests it’s too early to declare a confirmed bull run. The Crypto Fear & Greed Index sits at around 28. Thus, it’s firmly in Fear territory. This indicates that investors remain cautious after weeks of volatility.

Yet, CME data reveals record-high open interest across Bitcoin futures. This is a sign that institutions are quietly rebuilding positions. It suggests that early sparks may already be forming.

While BTC, ETH, and XRP rally, Remittix is Positioned for the Next Wave

As market sentiment improves, Remittix is delivering tangible real-world utility. Users can send crypto that arrives as fiat in global bank accounts within 24 hours. It’s already proving its utility through the beta wallet.

You can currently buy Remittix for $0.1166, with over 40,000 investors acquiring RTX in recent months.

With listings in sight, a $250,000 giveaway driving virality, and $27.6 million raised so far, Remittix could position itself as one of the next breakout names if the bull run truly begins.

Discover the future of PayFi with Remittix by checking out their project here:

- Website: https://remittix.io/

- Socials: https://linktr.ee/remittix

- $250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.