TL;DR

- Bloomberg experts estimate that the SEC could approve ETFs linked to Solana and crypto indexes as early as July.

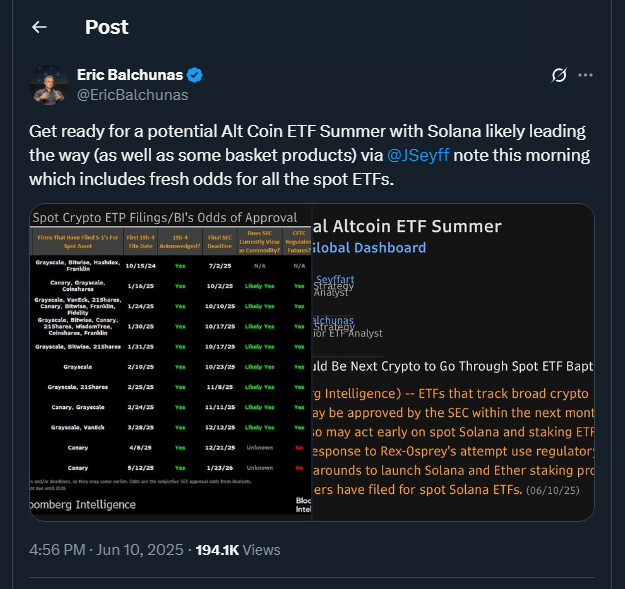

- Firms like Grayscale and Bitwise have already submitted applications.

- The inclusion of staking features in these products would mark a new stage for digital assets within regulated financial markets.

The possibility that the U.S. Securities and Exchange Commission (SEC) might authorize new exchange-traded funds (ETFs) tied to cryptocurrencies has gained traction among analysts. Bloomberg has reported that both Solana-based ETFs and those replicating broader crypto indexes could receive approval in July, opening the door to a new phase of regulated investment in digital assets across the United States.

James Seyffart, senior analyst at Bloomberg Intelligence, places a 90% likelihood on the approval of crypto index ETFs that bundle various coins, along with those based exclusively on Solana. In addition, the inclusion of staking features in some of these funds is being evaluated, which would allow investors to earn passive rewards while holding their assets in the ETF, further boosting the overall appeal of the market.

Solana May Lead This New Wave of Products

Among the issuers competing to launch the first ETFs are well-known firms such as Grayscale, Bitwise, 21Shares, and Franklin Templeton. The competition is intensifying due to Solana’s appeal, driven by its performance, network speed, and proof-of-stake model. Moreover, the SEC has already asked several issuers to update their regulatory filings to move forward with fund approval, which could arrive sooner than many expected.

This trend could lead to greater institutional adoption by offering regulated products that capture the potential of blockchain beyond Bitcoin or Ethereum. ETFs with exposure to multiple cryptocurrencies could also attract investors looking for diversification without the need to select individual tokens manually.

Staking and Diversification Drive Investor Interest

One of the most exciting aspects of this potential wave of approvals is the inclusion of staking mechanisms in Solana ETFs. This innovation would not only provide exposure to the asset’s price but also to the rewards generated by participating in network validation. While this introduces regulatory and tax challenges, it also represents a notable evolution in blockchain-based financial products.

Solana’s price has already responded positively, rising by approximately 3 to 5% following the release of this information. Analysts and fund managers view this potential approval as a prelude to greater integration between traditional markets and the crypto ecosystem, expanding access to new opportunities.